Published 13:02 IST, June 10th 2024

AI drives demand for personalised insurance: InsuranceDekho Founder

Ankit Agrawal, Founder and CEO of InsuranceDekho, observed that the demand for cyber insurance is increasing due to the rising threat of cyberattacks.

- Interview

- 5 min read

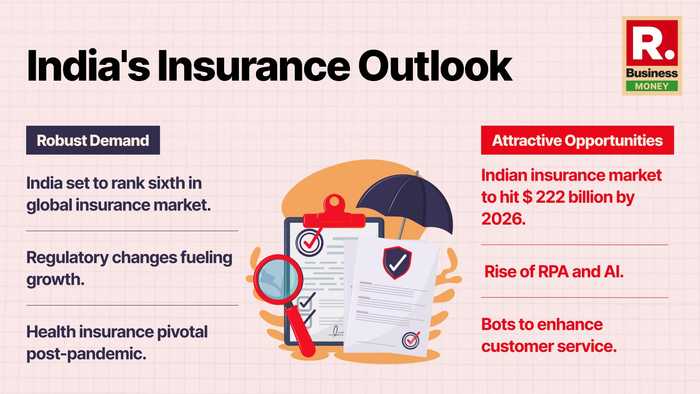

Insurance Sector Insights: India is poised to become the sixth-largest insurance market globally within a decade, as projected by the Insurance Regulatory and Development Authority of India (IRDAI).

In an exclusive interaction with Republic Business, Ankit Agrawal, the Founder and CEO of InsuranceDekho, shed light on the transformative shifts and promising opportunities shaping the insurance sector.

Modern insurance preferences

Reflecting on recent trends, Agrawal shared insights into the evolving buying behaviour of individuals seeking insurance coverage. Notably, he highlighted the surge in demand for personalised, convenient, and cost-effective insurance solutions.

"Some notable trends we have observed include personalised, convenient, and cost-effective insurance solutions. One prominent trend is the increase in demand for cyber insurance policies in the wake of the rising threat of cyberattacks," he said.

“Another emerging trend is the adoption of usage-based insurance (UBI), facilitated by Internet of Things (IoT) technology. Moreover, the insurance industry is embracing digital transformation, investing in technologies such as artificial intelligence (AI), machine learning, and data analytics to enhance the customer experience, streamline operations, and improve risk assessment and pricing models,” Agrawal added.

Additionally, embedded insurance, where insurance is bundled with products or services, is also becoming more prevalent.

Changing online buyer age

Furthermore, he stressed the pivotal role of digital transformation in transforming the industry, with investments in AI, machine learning, and data analytics enhancing customer experiences and operational efficiencies.

Discussing demographic shifts, Agrawal highlighted a major expansion in the age range of individuals purchasing insurance through online platforms.

"Initially, younger demographics, particularly millennials and Gen Z, dominated online insurance purchases due to their comfort with digital platforms. However, there has been a gradual expansion in the age range, with older demographics increasingly embracing online insurance shopping," Agrawal said.

Advice for new policyholders

Offering advice to first-time insurance buyers, Agrawal stressed the importance of assessing specific needs, conducting thorough research, and seeking guidance from experts.

"For individuals looking for insurance for the first time, it is important to approach it with careful consideration and awareness. Firstly, assess your specific insurance needs by evaluating your financial situation, lifestyle, and future goals," he said.

"Determine the types of risks you want protection against, whether it's health, life, property, or liability. Next, conduct thorough research on the different insurance options available in the market.

Compare coverage features, premiums, deductibles, and policy terms from multiple insurers to find the most suitable option.

Understand the coverage details, terms, and conditions of the policies. Seek advice from insurance agents, brokers, or financial advisors who can provide personalised guidance based on your requirements," Agrawal explained.

Tackling unclaimed policies

Addressing the challenge of unclaimed policies, Agrawal highlighted the importance of proactive measures such as maintaining detailed records, understanding policy terms, and utilising digital platforms for managing accounts and filing claims.

"Consumers should take proactive steps to ensure proper utilisation of insurance policies when needed. This includes maintaining detailed records of all policies, including policy numbers, coverage details, premium payments, and contact information for insurance providers," he said.

"Carefully read and understand the terms and conditions of each insurance policy. Periodically review insurance policies to ensure that they still meet your current needs. Maintain open communication with insurance providers and utilise online portals or mobile apps for managing accounts, accessing policy documents, and filing claims," he added.

Tomorrow's insurance landscape

Looking ahead, Agrawal envisioned future trends characterised by a growing demand for personalised and flexible insurance solutions, driven by evolving risks and consumer preferences.

"Consumers are likely to seek more transparent and simplified insurance products with customisable coverage options and pricing models. Climate change concerns will drive demand for coverage against natural disasters and sustainability-focused products. Insurers must innovate, enhance digital capabilities, and prioritise customer-centric approaches to adapt to these evolving trends," he said.

Is AI changing the game ?

Delving into the integration of AI technologies, Agrawal stressed its impact on traditional business models within the insurance industry.

"In the next decade, AI integration will significantly impact insurance. It will revolutionise underwriting, claims processing, and risk assessment, enhancing efficiency and personalisation. With continuous learning, AI will streamline workflows, improve risk management, and deliver greater value to insurers and policyholders," he said.

By analysing customer data and behaviour patterns, AI is helping insurers offer personalised recommendations and tailored product offerings.

With the assistance of AI, insurers can analyse vast amounts of data, including customer information, historical claims data, and external factors, to assess risk more accurately and efficiently than traditional methods.

"InsuranceDekho has introduced an AI-based self-inspection platform for vehicles. This platform allows customers to self-inspect their vehicles using AI-powered image recognition and analysis techniques. The platform can automatically capture vehicle details, reducing the turnaround time for inspections from 24-48 hours to just 25 minutes," he added.

Disrupting insurance practices

AI and the Internet of Things (IoT) will facilitate the widespread adoption of usage-based insurance models, where premiums are calculated based on actual usage or behaviour rather than predictions.

AI-powered computer and machine learning algorithms will enable insurers to automate various stages of the claims process, from initial filing to damage assessment and fraud detection.

AI-powered virtual assistants and chatbots will become more prevalent in the insurance industry, providing customers with 24/7 support, answering queries, guiding them through the purchasing process, and assisting with claim filing.

Highlighting the robust demand and attractive opportunities in the Indian insurance market, Agrawal underscored the sector's substantial growth potential.

The insurance market in India is projected to reach $222 billion by 2026, presenting growth opportunities. Robotic Process Automation (RPA) and Artificial Intelligence (AI) are expected to play prominent roles, driven by advancements in data processing capabilities and the utilisation of newer data channels.

Updated 15:38 IST, June 11th 2024