Published 16:25 IST, November 2nd 2024

Saudi’s Davos is no longer such a desert

Saudi Arabia’s Future Investment Initiative took place in Riyadh between Oct. 29 and Oct. 31.

- Industry

- 3 min read

Shifting sands. Saudi Arabia’s big shindig is getting bigger. About 4,000 delegates showed up for the desert kingdom’s first Future Investment Initiative in 2017. This year’s gathering attracted twice that number, suggesting that the country’s Vision 2030 project to shed its historical dependence on oil has gained some traction.

The conflab often known as “Davos in the desert” has a turbulent history. In 2018, the top bosses of Western blue chips like Blackstone, JPMorgan and BlackRock stayed away following the murder of journalist Jamal Khashoggi by Saudi agents. So did SoftBank boss Masayoshi Son, who the previous year had shared a stage with Crown Prince Mohammed bin Salman after the Saudi state contributed $45 billion to his tech-focused Vision Fund.

This year, the corporate titans were very much back in force at the King Abdulaziz International Conference Center, though they still chose their talking points with care. Attendees like BlackRock’s Larry Fink, Blackstone’s Steve Schwarzman, Ken Griffin of Citadel, and Ruth Porat, president of Google owner Alphabet, spent relatively little time discussing the war raging in Israel, Gaza and Lebanon a mere 800 miles away.

Participants were much more eager to expound on the dominant investment topic of the moment: artificial intelligence. Son, despite recording underwhelming returns on his Vision Fund and dumping a 5% stake in chipmaker Nvidia long before it became a $3.4 trillion company, predicted that AI could be worth $9 trillion a year and that machines would become 10,000 times more intelligent than humans by 2035. Tesla boss Elon Musk beamed in by video link to assert that AI would surpass the collective intelligence of all humans before the end of the decade.

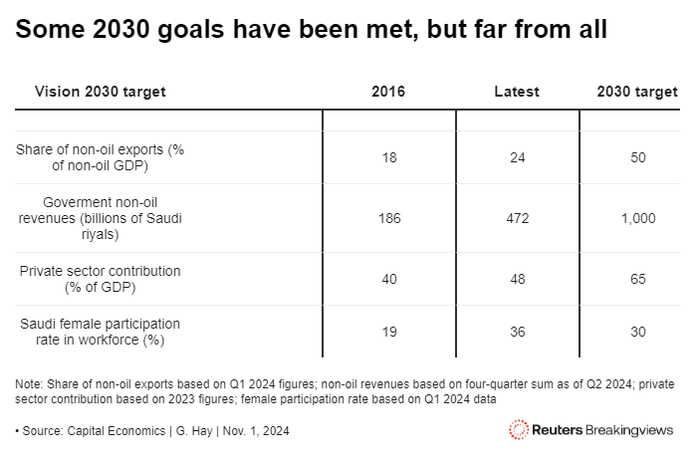

The likes of Fink and Schwarzman are more or less obliged to attend, as Saudi has invested billions of dollars in their funds and deals. But the balance has shifted. While the country is still way short of some key Vision 2030 targets, such as lifting the share of non-oil exports and increasing the private sector’s share of GDP , it has scored some successes. The proportion of Saudi women in the workforce, for example, has reached almost 36%, nearly double the figure in 2016, and well ahead of the original 30% target.

A tangible rise in leisure activities is also making Saudi a less forbidding place to live and work. Apart from the non-alcoholic drinks, a rooftop reception for Gulf venture capital types at the Huqqa bar on Wednesday evening offered a vibe little different to that of a high-end establishment in London.

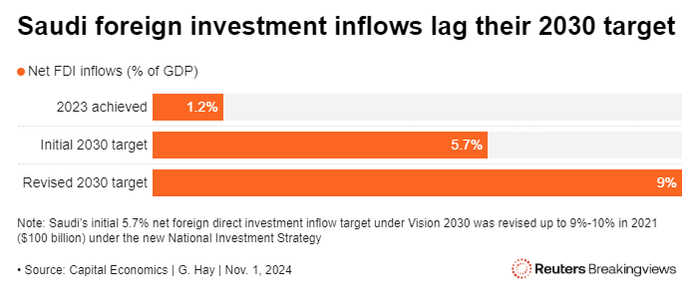

The test for Saudi’s overhaul remains foreign direct investment. Despite its oil riches, Riyadh wants its investment conflab to be a forum where Western companies unveil local acquisitions, factories and headquarters. That hasn’t shown up in the data. In 2023 direct investment inflows amounted to only 1.2% of GDP, according to Capital Economics – way off Saudi’s initial target for 2030 of 5.7%.

There are some signs of progress. Canadian investor Brookfield Asset Management and Saudi’s $950 billion Public Investment Fund on Wednesday announced the creation of a $2 billion private equity fund which will aim to invest half its capital in the kingdom. The country needs lots more of these types of deals. The latest gathering in Riyadh at least suggests that is less unlikely than it once seemed.

Context News

Saudi Arabia’s Future Investment Initiative took place in Riyadh between Oct. 29 and Oct. 31.

Updated 16:25 IST, November 2nd 2024