Published 14:35 IST, August 4th 2024

Exxon’s dominance may not be good for Exxon

Chevron said on Aug. 2 that revenue for the second quarter was $51.2 billion, an increase of 5% from the same period last year.

- Industry

- 3 min read

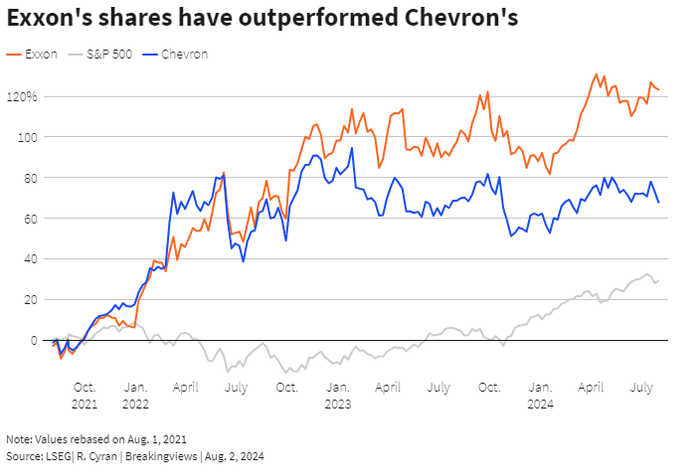

More oil, more problems. Exxon Mobil is barging ahead of rival Chevron. Second-quarter figures reported on Friday showed the $520 billion oil giant churned out $9.2 billion of profit, thanks to the benefits of its $60 billion deal for Pioneer Natural Resources and record production in oil fields in Texas and offshore South America. The company run by Darren Woods is growing its dominance, but that has risks, too. It could use friends at home and abroad, and it’s punishing its biggest potential ally.

The company’s production has two gems. Output from the Permian Basin in Texas and New Mexico is now 1.2 million barrels of oil equivalent a day, or over three times as much as it produced three years ago, thanks to higher production from legacy acreage, and output added from its deal, which closed in May. Exxon also said cost cuts, previously estimated at $2 billion a year, were exceeding expectations. Likewise, production from the nation of Guyana exceeded 630,000 barrels per day, roughly five times as much as three years ago.

Chevron is both smaller, pumping 1.1 million fewer barrels per day, and posted slower growth than Exxon. While rising production in Texas helped, problems in Australia didn’t. The bigger snag is its $53 billion deal for Hess. Chevron, which is moving its headquarters from California to Texas, is gunning for a stake in the same Guyana oilfield as Exxon. But that deal is in arbitration thanks to an arrangement Exxon claims gives it the right of first refusal. The resolution of that dispute is set to drag into the spring of 2025, at the earliest, giving Chevron’s biggest rival another year to make its life difficult, while also getting ahead.

While growing dominance in the rapidly consolidating U.S. oil industry sounds appealing, parts of that could work against Exxon’s long-term interest. Oil’s popularity is already limited in Washington, and while that could change in November if Republican nominee Donald Trump is elected, views on antitrust are still nuanced. The more Exxon is seen as the goliath, the less sympathy it may glean.

Plus U.S. oil companies compete against the Organization of the Petroleum Exporting Countries, where jurisdictions work together. A bigger Exxon is still a minnow compared to OPEC producers like Saudi Aramco, which pumps out twice as much daily. In any global showdown, a strong U.S. rival is probably a useful Exxon ally.

Context News

Chevron said on Aug. 2 that revenue for the second quarter was $51.2 billion, an increase of 5% from the same period last year. The oil company’s earnings fell 26% to $4.4 billion. The same day, Exxon Mobil said revenue was $93.1 billion, an increase of 12% from the same quarter a year ago. The company’s earnings rose 17% to $9.2 billion. Chevron said on July 31 that an arbitration meeting over Hess’ Guyana assets has been pushed back until May 2025. Chevron agreed to buy Hess in October in a $53 billion deal. Exxon and CNOOC challenged that deal, saying they had a right of first refusal to Hess’ 30% stake in an offshore Guyana oilfield under a joint-operating agreement. Chevron and Hess say this is not the case. Under the current agreement, Exxon owns a 45% stake and China’s CNOOC 25%. “This matter is too important to rush through – all relevant facts and circumstances must be taken into consideration, and this will take time," said an Exxon spokesperson.

Updated 14:35 IST, August 4th 2024