Published 13:14 IST, September 4th 2024

Clouds gather over China’s needed solar mergers

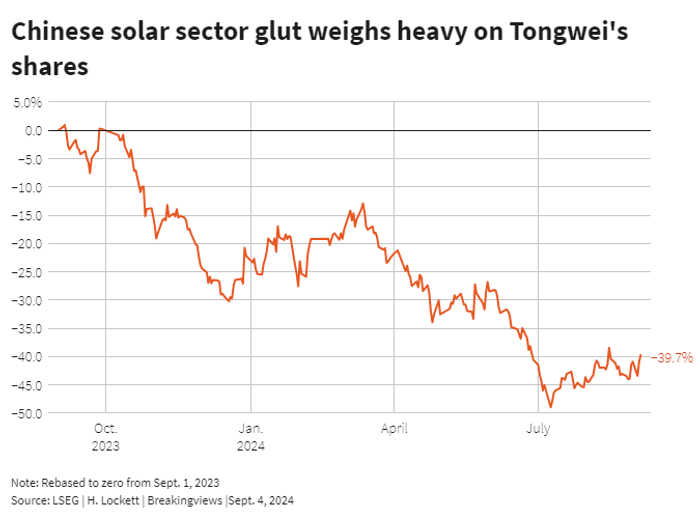

Tongwei, whose shares have fallen about 40% over the past year, announced plans to acquire controlling stake in smaller rival Runergy for up to 5 billion yuan.

- Industry

- 3 min read

Overcast forecast. When $12 billion Tongwei, one of the world’s largest polysilicon and solar panel makers, announced plans last month to spend about $700 million to take control of its smaller rival, Runergy, it sparked hopes that much-needed consolidation in China’s badly oversupplied solar sector might finally be kicking off.

The urgency became clearer on Friday, when Tongwei reported a net loss of 2.3 billion yuan ($323.5 million) in the second quarter and gross profit margin at a 13-year low of 5%, per LSEG data, thanks to tumbling prices. The war chest it built up during the solar sector’s boom years also shrank, with cash and cash equivalents dropping to 18.9 billion yuan, down from more than 33 billion yuan a year ago. Shares in the company have plunged 40% over the same period.

But Tongwei’s plan to boost its stake in privately-held Runergy does not appear to be a sure sign that China’s biggest solar groups are keen to snap up the sector’s struggling small fry.

For a start, the target has plants in the United States, Thailand and Vietnam. One Shanghai-based industry analyst granted that while Runergy did have some onshore facilities that Tongwei could upgrade for a reasonable cost, the company’s “crown jewel assets” were offshore. The U.S. solar industry is more profitable, and Runergy planned to take advantage of the Inflation Reduction Act subsidies for clean energy manufacturers.

What's more, it may be politically fraught to shut down Chinese factories. Some of Runergy’s biggest shareholders are government investment funds with ties to Yancheng, the city in Jiangsu province where it is based. That could make it difficult to extract the obvious benefits of consolidation.

The debate on how to solve China's solar problem is heating up. The China Photovoltaic Industry Association warns local governments ploughing money into solar panel factories to boost employment are wasting money on unsustainable businesses. The association has called on Beijing to limit investment in the sector, and in July, China’s industry ministry published draft rules to that effect. But the ministry also said those rules, which could change before final publication, were not binding. For China’s solar sector, it’s still cloudy days ahead.

Context News

Chinese solar company Tongwei on Aug. 30 reported a second-quarter net loss of 2.3 billion yuan ($323.5 million). Its gross profit margin fell to a 13-year low of 5% due to tumbling prices across the industry. Tongwei, whose shares have fallen about 40% over the past year, on Aug. 13 announced plans to acquire a controlling stake in smaller rival Runergy for up to 5 billion yuan.

Updated 13:14 IST, September 4th 2024