Published 19:44 IST, August 27th 2024

China steel woes will recast miners’ M&A desires

The People's Republic accounts for around half of the two billion tons of the metal produced globally each year.

- Industry

- 3 min read

Winter is coming. Mike Henry sure likes to downplay his acquisitive tendencies. While unveiling results for the year to the end of June on Tuesday, the BHP boss declared that his $47 billion tilt for Anglo American earlier this year "wasn't Plan A for us". Instead, organic growth is. That may just be sour grapes after his overtures to his rival failed. But the growing steel crisis in China makes such deals ever-more appealing.

The People's Republic accounts for around half of the two billion tons of the metal produced globally each year. And it buys most of the iron ore, a key ingredient, dug up in Australia by BHP, Rio Tinto and Fortescue.

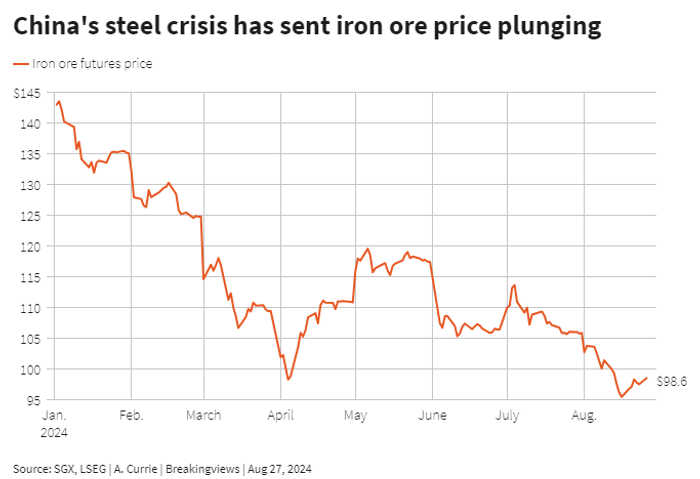

Now overcapacity, wrought in part by the property market slump in the world's second-largest economy, is pushing its steel industry into what Hu Wangming, chair of top producer China Baowu Steel Group, calls a "harsh winter". At least 75% of the country's steel mills are not turning a profit, per Macquarie; a survey by consultancy Mysteel puts than number at 95%. As a result, the iron ore price has fallen some 30% this year to just below $100 a ton.

That's painful for miners Down Under. Rio relies on iron ore for 73% of its EBITDA, while Fortescue is almost entirely dependent on it. At BHP, the figure is lower at 65%, but that's thanks in part to its purchase last year of local copper miner Oz Minerals for $6.4 billion - a quarry Henry dubbed "nice to have, not a must-have" after his approach was initially rebuffed.

Had his proposal to buy Anglo succeeded, iron ore's share of BHP's EBITDA would have dropped below 60%, Breakingviews calculates using both companies' most recent annual results. That would have provided a quick jolt to Henry's longer-term plans to diversify BHP's income by developing its existing copper and potash assets; he's also snapping up undeveloped and early-stage projects, spending $2.1 billion on Latin American copper mines last month.

Aussie miners have a decent buffer against China's woes: all-in iron ore costs are $40 a ton at BHP, rising to $60 at Fortescue, per UBS. And Henry is showing some balance sheet caution, cutting the annual dividend, increasing capital expenditure, and reducing net debt.

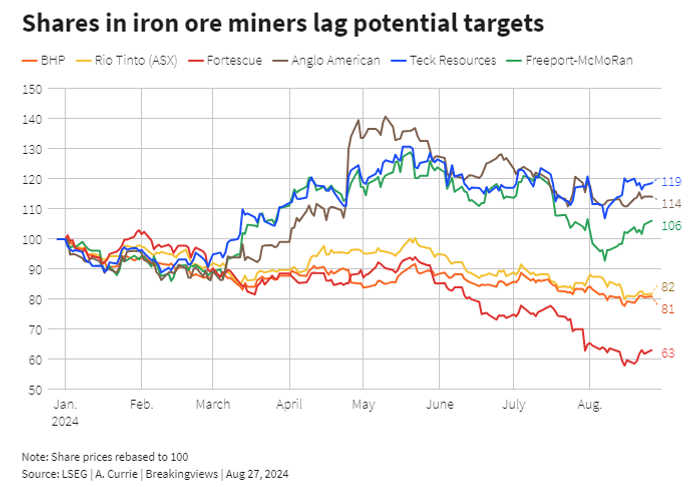

Trouble is, shares in BHP - and Rio - are down by almost a fifth this year, while potential targets like Freeport-McMoRan, Anglo and Teck Resources are up by as much as the same amount. That makes diversification via M&A all the more expensive.

Context News

BHP on Aug. 27 reported attributable profit of $7.9 billion for its 2024 financial year to the end of June, 39% lower than the previous 12 months. Excluding $5.8 billion of impairments and other charges announced in February, attributable profit would have been $13.7 billion. The Australian company is paying total dividends for the financial year of $7.4 billion, 15% lower than in 2023. Capital expenditure is expected to rise around $500 million to $10 billion in the 12 months to next June. China's Ministry of Industry and Information Technology on Aug. 23 said it was suspending its system for approving new steel plants and would develop a new one. The country's steel industry is suffering from excess supply. Hu Wangming, chair of China Baowu Steel Group, the world's largest producer of the metal, recently told staff the industry is facing a "harsh winter" that will be "longer, colder and more difficult to endure than we expected", Bloomberg reported on Aug. 14. Iron ore futures on the Singapore Stock Exchange closed on Aug. 26 at $98.60 a ton, down some 30% since the start of the year.

Updated 19:44 IST, August 27th 2024