Published 12:23 IST, October 2nd 2024

Bain jets towards first-class lounge Down Under

A sale at that level, assuming Australian authorities approve the Qatar deal, would mark just the latest stop on a lucrative journey.

- Industry

- 3 min read

Highflyer. Bain Capital may be on the verge of achieving what financial-market lore would hold is a rarity: making a fortune betting on an airline. The U.S. private equity firm on Tuesday said it had agreed to sell 25% of Virgin Australia to Gulf carrier Qatar Airways. Neither side disclosed the terms, but chances are that Bain is jetting to some first-class returns.

The Boston-based money manager spent A$731 million ($506 million) in 2020 to buy the Down Under airline out of its pandemic-induced bankruptcy. Virgin Australia returned to profitability in the 12 months to the end of June 2023, with revenue more than doubling year-on-year to A$5 billion. The top line grew 12% in the following six months. And the company and market leader Qantas now enjoy an effective domestic duopoly after two smaller carriers, Regional Express and Bonza Aviation, collapsed in recent months.

That’s all fuel for Bain’s journey. Assume Virgin Australia maintained the 12% rate of growth for the second half of the financial year to June 2024. For the current fiscal year, imagine that revenue increases by 7%, roughly in line with what analysts expect for Qantas, according to LSEG. On that basis, Virgin’s revenue for the 12 months ending in June 2025 would be A$6 billion.

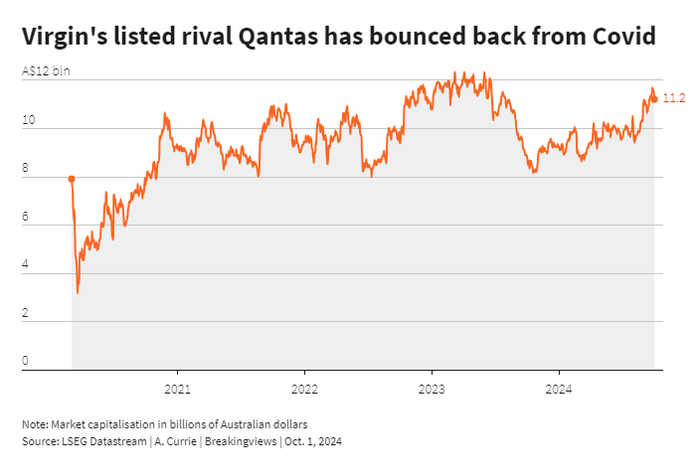

On a 6% net margin, a tad lower than the consensus figure for Qantas, that’d put Virgin’s forward earnings at A$360 million. Multiply that by 6.5, a discount to Qantas’ equivalent price-earnings multiple of almost 8, and a fair equity value for Virgin might be A$2.3 billion.

A sale at that level, assuming Australian authorities approve the Qatar deal, would mark just the latest stop on a lucrative journey. In 2021, Bain sold 5% of the company to Richard Branson’s Virgin Group and another 2% to the airline’s home state of Queensland at a A$1 billion valuation. Then in May last year it took its share of a A$730 million dividend payment.

Fold it all together, and the numbers imply that Bain is sitting on a 47% internal rate of return so far, according to Breakingviews calculations. Of course, that’s on paper only, as the buyout shop would still own two-thirds of Virgin Australia if the Qatari deal closes. And Sydney-based partner Mike Murphy has made it clear Bain will retain a decent stake even after a much-delayed initial public offering that might now take place in the coming months. If Murphy and Bain realise the paper valuation in a float next year, for example, the return would be 41% instead.

Regardless, the buyout shop will already have recouped almost double the firm’s investment assuming Tuesday’s sale goes through. That will make it a lot easier to stomach any ensuing turbulence.

Context News

Bain Capital has agreed to sell 25% of Virgin Australia to Qatar Airways, the companies said on Oct. 1, without disclosing the financial details of the deal. The U.S. private equity group bought the airline out of bankruptcy in 2020. A year later it sold 5% to Virgin Group and 2% to the Australian state of Queensland in deals that valued the company at A$1 billion ($691 million), the Australian Financial Review reported at the time. In May last year, Virgin Australia paid its shareholders a A$730 million dividend.

Updated 12:23 IST, October 2nd 2024