Published 20:04 IST, February 13th 2024

Inflation, jobs data: India marching towards 7% GDP by FY25

Softening headline inflation to 5.10 per cent must be seen as a glass half-filled.

- Economy

- 3 min read

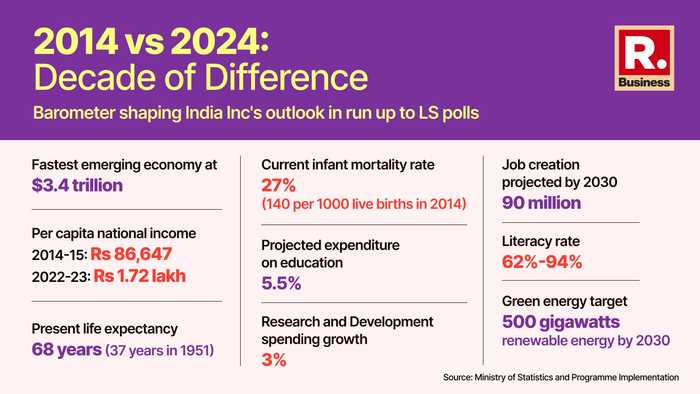

Sustainable growth: For the naysayers, the beginning of a week that is set to see the Cupid take over was not so rosy. For India, scripting its sweet success story of achieving over 7 per cent growth by FY25 end, softening headline inflation to 5.10 per cent from the earlier 5.69 per cent, must be seen as a glass half-filled.

The routine expert soundbite released Monday evening, based on trends that shaped the inflation data, had caution written all over it, with concerns of a considerably higher food inflation rate. However, a moderation in inflation reading is likely to support discretionary spending and in turn economic growth, say economists.

Going forward, inflation is likely to hover around or slightly below 5 per cent in February and March 2024 before averaging above 5 per cent in Q1 FY25. Unlike pessimists, whose armchair analysis leaves no stone unturned to downplay the self-reliance of India’s youthfulness, the world is curiously glued to India’s social schemes.

To name a few ambitious flagship schemes, are the recent interim Union Budget announcements of lighting up over two crore homes with solar energy, and expanding an existing free health insurance cover to a social strata, consisting of its frontline of “Aasha” and "Anganwadi" workers.

Exemplary economics

In the last four to four years, dominated by a tumultuous global economy, uncertain global capital markets, and the US Fed’s actions being subject to scrutiny, as its policies can have far-reaching implications, India’s economic and trade policies are seen driven by razor-sharp objectives.

The uncertainty caused by the Russia-Ukraine war, then the Israel-Hamas conflict, and more lately the armed attacks by the Yemen-backed Houthis militant group have unsettled the world economy that was in a post-COVID recovery mode. For a long-term growth-oriented economy, Monday’s fall in headline inflation to 5.10 per cent and fall in the urban unemployment rate, which now stands at 6.5 per cent, is just the tip of iceberg.

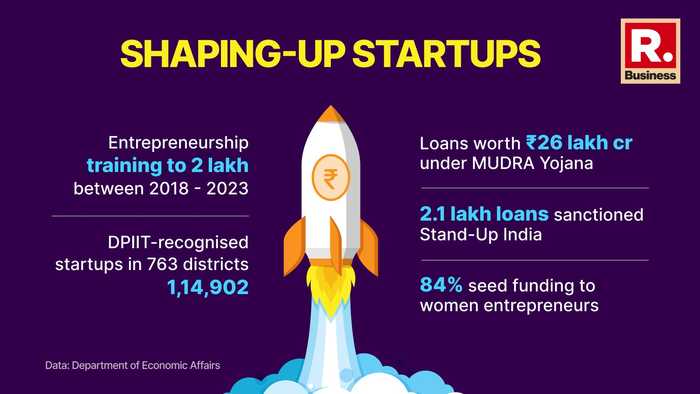

Stand-up India

In its growth story, India is betting big on its young population. In an endeavour to train 20 lakh entrepreneurs between 2018-2023, women’s empowerment remained the country's key focus. Among loans worth Rs 26 lakh crore, disbursed under MUDRA Yojana, 2.1 lakh loans were sanctioned under the “Stand-Up India” scheme. Of these, as many as 84 per cent of seed funding was extended to women entrepreneurs.

According to the quarterly Periodic Labour Force Survey data released on Monday, the female labour force participation rate in the country rose to its highest level of 25 per cent.

The creation of 10 to 5 million jobs annually, an export-driven manufacturing push, and the benefits of its predominantly young working group population are set to help India achieve its desirable goals.

India's objective to achieve over 7 per cent plus growth in FY25 has already won the global investor sentiment. The International Monetary Fund’s (IMF) revised GDP growth for India to grow by 6.7 per cent in FY24, coupled with India surpassing Japan as the third-largest auto manufacturer is a shot in the arm for the country. In a decade defined by the advent of artificial intelligence (AI), an enhanced financial economy and the use of AI to boost India’s agro-economy, will propel the country to become a developed economy.

Updated 17:07 IST, February 15th 2024