Published 14:32 IST, December 6th 2024

RBI MPC Meeting: Can Growth Continue and Inflation Come Down? Das & Co Answer

However, Governor Das and his team assured that the economic slowdown had ‘bottomed out’ in Q2, providing much-needed clarity on the growth outlook.

- Economy

- 4 min read

The Fifth RBI Monetary Policy Committee (MPC) meeting for the fiscal year 2024-2025, in line with expectations, decided to keep the repo rate steady at 6.5 per cent. This was the 11th consecutive meeting in which RBI governor Das applied caution and kept it unchanged.

However, as anticipated, considering the tight liquidity conditions going forward and the need to spur growth, the Reserve Bank of India (RBI) reduced the Cash Reserve Ratio (CRR) by 50 basis points to 4 per cent. The CRR cut was referred to by RBI Governor Shaktikanta Das as a ‘normalising’ exercise.

As far as the final MPC meeting of 2024 is concerned, the dominant themes were maintaining the status quo and exercising caution, under Governor Das’s leadership, whose tenure is set to expire on December 10.

“We need more credible evidence to believe that things are unfolding as we expect,” RBI Governor Shaktikanta Das stated during the post-MPC press conference. According to Das, the decision to maintain the status quo was made because it offers flexibility to monitor and assess the outlook for inflation and growth and take appropriate actions as necessary.

Economy watchers know that within the gap between two MPC meetings, growth dynamics shifted drastically, posing a formidable challenge for the RBI. The GDP growth fell short of expectations, registering only 5.4 per cent, while inflation remained persistently high in September and October.

RBI Outlook: Growth Down, Inflation Up

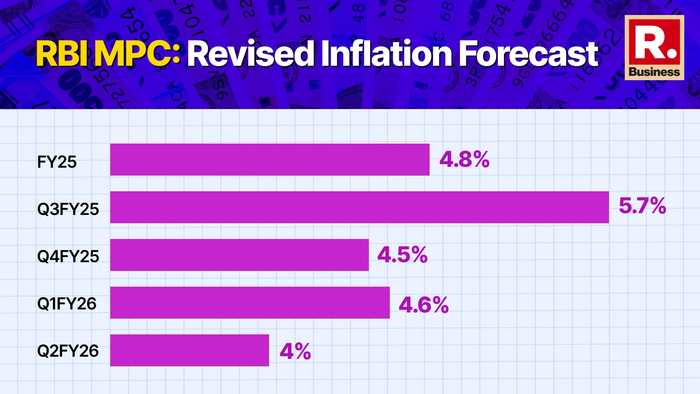

Governor Das acknowledged the evolving growth-inflation dynamics, stating, “Last time, we said the growth-inflation balance looked well poised for this and the next quarter. Now, inflation has been slightly higher than we expected, so the growth-inflation balance has been somewhat unsettled.”

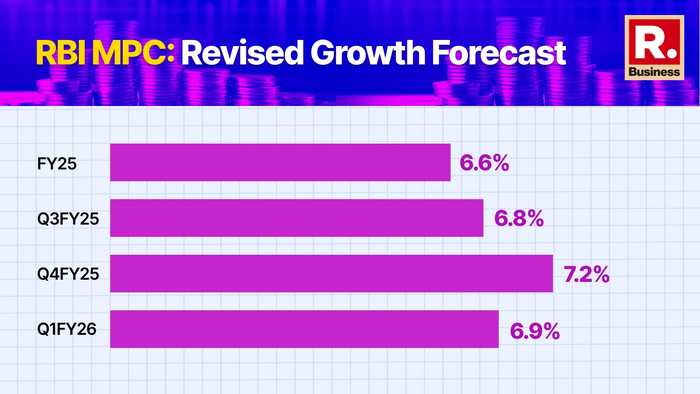

Against this backdrop, the growth and inflation projections were revised. The growth outlook for FY25 has been lowered to 6.6 percent, from the earlier projection of 7.2 percent. On the other hand, inflation has been revised upwards, from 4.5 percent to 4.8 percent.

The discrepancy between the RBI’s earlier growth projection for the July-September quarter (7 percent) and the actual 5.4 percent raised questions about the accuracy of the RBI's forecast. This was addressed in the post-MPC press conference, where Deputy Governor Michael Patra explained, “If you look at the demand side, the main issue is investments. On the supply side, the main problem is manufacturing. These two are intertwined. In manufacturing, the biggest issue is the slump in sales growth. When sales growth slows, companies are reluctant to invest in expansion or new capacity creation, which results in reduced investments. Thus, the underlying reason for the slowdown is inflation.”

However, Governor Das and his team assured that the economic slowdown had ‘bottomed out’ in Q2, providing much-needed clarity on the growth outlook.

Devoid of Analogies

This MPC meeting was notably devoid of the colourful analogies used in previous meetings, such as comparing inflation to an elephant or a horse. In the last MPC, Governor Das compared inflation to an elephant, which he said was walking toward the forest. “Now we want the elephant to stay in the forest on a durable basis.” In the October MPC, he compared inflation to a horse brought into a stable, saying, “Now we have to be cautious when opening the gate, as the horse may bolt again.”

This time, however, Governor Das stated, “The horse has made a very valiant effort to bolt, but our effort is to keep it on a tight leash.”

Trend Growth Below 7 Percent

With growth dipping to 5.4 percent, the revised growth projection for the full fiscal year is now pegged at 6.6 percent. When asked if India’s trend growth had fallen from 7-8 percent to 6.5 percent, Deputy Governor Michael Patra responded, “It’s not appropriate to comment on trend growth based on just one data set. What was expressed as 8 percent was not a trend; in fact, it was an average growth rate from 2024-2026. In the second half of this year, there is a reversion to the upper growth rate of 6.9-7.3 percent, which we hope will continue through 2026. We are optimistic that we will return to that growth level.”

Updated 14:32 IST, December 6th 2024