Published 22:13 IST, November 29th 2024

India’s GDP Dips To 5.4%- Factors That Led To Steep Decline

The moderation was already expected on the back of weak consumption leading to slowed manufacturing.

- Economy

- 4 min read

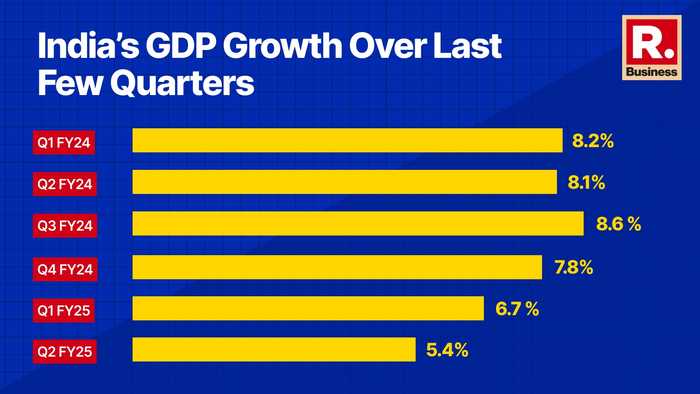

India’s growth numbers in Q2 sent a shocker across the various parts of the economy. Well, the moderation in the growth print was already factored in by the economy watchers, but it was not the moderation that shocked everyone, it was the steep fall and growth rate of 5.4 per cent which was far below the projected GDP numbers as put together by pollsters and economists.

All polls forecast put together, hovered in the range of 6.3 to 6.6 per cent, the most bullish projection was from the apex bank at 7 per cent. The GDP number fell to a 7-quarter low and raised concern about whether this is the beginning of stagflation or the beginning of low growth numbers going forward.

“India’s second-quarter GDP growth at 5.4 per cent has come as a big negative surprise. While the GDP growth was expected to moderate as indicated by some of the high-frequency macroeconomic indicators and weaker corporate performance, the quantum of deceleration is much sharper than expected,” Rajani Sinha, Chief Economist, CareEdge said.

Concerns Galore

According to India’s Chief Economic Advisor, V Anantha Nageswaran, the GDP print in the second quarter of FY25 is disappointing but not an alarm bell considering many bright spots in the economy. Shrugging all the concerns floating around, he dubbed the 5.4 per cent shocking and below expectation GDP print as a one-off event.

“We should expect to see growth in the second half of the current financial year… We need to be aware that the global context is not the same as it was in the first decade, when there was synchronized global growth, resulting in capital formation growth,” Nageswaran said. The concern was not only about the beginning of a larger trend of low growth rate but was also about achieving the projected GDP growth of 7 per cent in the current fiscal year.

Drivers of Decline

The moderation was already expected on the back of weak consumption leading to slowed manufacturing. But the main villain was rainfall which disrupted the mining, and quarrying, and also led to low electricity consumption demand. And today’s print exactly falls in line as far as drivers of decline are concerned. The manufacturing sector grew by only 2.2 per cent in Q2 of FY25 which is in sharp contrast to the robust growth of 14.3 per cent growth seen in the same quarter last year.

“A prolonged monsoon this year impacted the mining sector in Q2 FY25. Additionally, the contraction in public capex further slowed construction activities. The manufacturing growth witnessed a steep slowdown in growth, growing at 2.2 per cent YoY in Q2, much lower than the 7 per cent YoY growth in the previous quarter. The slowdown in the manufacturing sector was on the expected line, reflecting the moderation seen in IIP data and corporate profitability. However, the quantum of slowdown was higher than expected, “ the report by rating agency CareEdge showed on Friday. So, it was the larger-than-expected quantum of slowdown that dragged the growth down.

Another drag on the growth is the gross fixed capital formation (GFCF), a proxy for investments in the economy. As far as the second quarter is concerned, GFCF dipped to 5.4 per cent from 7.5 per cent in Q1.

“There has also been a sharp moderation in investments. The government’s capex which had been supporting growth so far, saw a moderation, with the Centre and consolidated State capex falling by 15 per cent and 11 per cent respectively in H1. However, the positive aspect is that consumption growth has remained healthy at around 6 per cent in Q2,” Sinha of CareEdge opined.

On the flip side, the agriculture sector stood out as a star performer, with a strong rebound of 3.5 per cent after having a stagnant growth rate for many quarters. It's not only agriculture that is a comforter but other sectors such as construction also provided much-needed relief to the growth metrics.

“Agriculture sector showed a promising rebound of 3.5 per cent after sluggish growth last year, giving some much-needed relief to the rural sector. The construction sector remained a standout performer, driven by robust domestic consumption of finished steel, which powered 7.7 per cent growth in Q2 and an impressive 9.1 per cent in H1FY25. Meanwhile, the tertiary sector sustained strong growth at 7.1 per cent in Q2FY25, buoyed by trade, hotels, transport, and communication,” Suman Chowdhury, Executive Director & Chief Economist, Acuité Ratings said.

Updated 22:13 IST, November 29th 2024