Published 13:11 IST, November 8th 2024

German government meltdown has a silver lining

German Chancellor Olaf Scholz on Nov. 6 sacked his Finance Minister Christian Lindner, calling an end to the three-party coalition government he formed in 2021.

- Economy

- 3 min read

Braking free. On the face of it, Olaf Scholz has an odd sense of timing. The German chancellor cancelled his own government on the day Donald Trump’s re-election as U.S. president underlined Europe’s need for strong and decisive governments. But after months of bitter disagreements in Berlin’s ruling three-party coalition, the latest crisis also gives Germany the opportunity to debate and hopefully amend its infamous “debt brake” – the needlessly rigid fiscal rule that is shackling its ailing economy.

Finance Minister Christian Lindner was fired before he had the time to resign after a months-old, acrimonious debate on the 2025 budget. Social-democratic party leader Scholz and his Green allies in the coalition wanted to allocate more funds to cap energy costs for industry, help support the country’s automotive sector, and keep assisting Ukraine’s war with Russia. To do this they advocated a suspension of the debt brake, voted into the Constitution in 2009, which limits budget deficits to 0.35% of GDP . The rule allows merely small variations in bad times, and can be suspended only in case of national emergencies.

The brake never made much sense to begin with. It had to be suspended in 2020 after the Covid-19 crisis. Scholz argues that war with Russia on Europe’s eastern front is another of these emergencies. He shouldn’t even need to use that excuse: the German economy has shrunk for two years in a row. And the economy’s problems didn’t start with Covid or the energy crisis that followed the Ukraine invasion: industrial production has been declining since 2017.

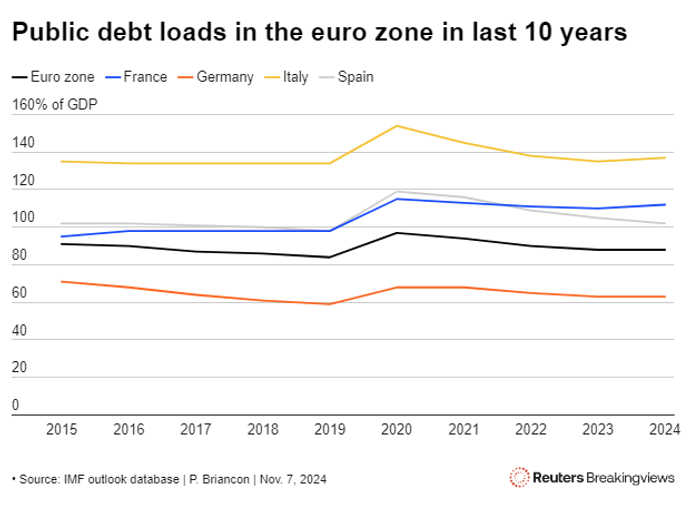

Germany could have taken on more debt in the six years, from 2016 to 2021, when it could mostly borrow at negative rates. Instead, its debt load remained stuck at around 67% of GDP, way below the euro zone’s 89%-of-GDP average throughout these years. And to the list of spending priorities he gave this week, Scholz could also have added the need to make up for the decade-long dearth of public investment.

Scholz is unlikely to survive the snap election – likely to be held in late March – that will follow the vote of confidence he has called on Jan. 15. He has invited his probable successor, conservative leader Friedrich Merz, for talks on how to keep supporting Ukraine and take the economy out of its funk. If the upcoming electoral campaign provides an opportunity for a serious debate on the debt brake and more generally on government spending, this political crisis will not be wasted.

Context News

German Chancellor Olaf Scholz on Nov. 6 sacked his Finance Minister Christian Lindner, calling an end to the three-party coalition government he formed in 2021, and paving the way for a snap election that would take place next spring.

Scholz accused Lindner, the leader of the liberal FDP party, of refusing to suspend the country’s constitutional “debt brake” limiting the fiscal deficit, a step the German leader deems necessary, notably to support Ukraine and help the country’s ailing economy.

Scholz scheduled a vote of confidence for Jan. 15. He will lead a minority government until then, but said he would consult with Friedrich Merz, leader of the conservative opposition party CDU, to try in the meantime to “work together constructively” on the economy and on defence.

Updated 13:11 IST, November 8th 2024