Published 11:37 IST, November 9th 2024

ECB will fail to get out ahead of US trade war

The European Central Bank’s Governing Council meets on Dec. 12 to decide on the level of interest rates for the euro zone.

- Economy

- 3 min read

MAGA dependent. Donald Trump’s election victory is making Europe not-so-great again. The new U.S. president’s plans for import tariffs will compound the Old Continent’s economic woes. The European Central Bank could help by slashing interest rates, starting from next month. Internal politics suggests that Frankfurt policymakers won’t do so – but they are only delaying the inevitable.

ECB President Christine Lagarde likes to say her institution is “data-dependent”, a nod to its supposed nimbleness in the face of changing circumstances. As of this week, the ECB has a new data point: Donald Trump will be the 47th president of the United States.

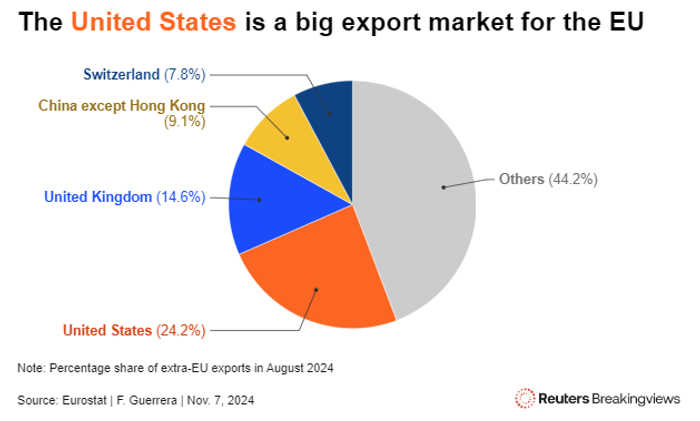

The tycoon’s return to the White House matters to the euro zone because he has promised to impose 10% tariffs on all imported goods. Since the United States is the European Union’s largest trading partner, accounting for nearly 25% of its goods exports, any levy would affect the bloc’s growth. That’s particularly true for Germany, the EU’s largest economy, which had the biggest trade surplus with the U.S. in 2023.

If Europe retaliates, a trade war and other policies of the second Trump administration could knock 0.5% from euro zone GDP , according to Goldman Sachs analysts. Most of the hit would come in 2025, reducing the bloc’s GDP growth from 1.1% to 0.8% – in line with this year’s weak performance. By contrast inflation would barely change, Goldman reckons. That’s because slower growth will offset any price pressure caused by EU tariffs on U.S. imports.

A growth shock of this magnitude calls for a strong response from monetary authorities. Lagarde could make a statement of intent on Dec. 12, when the ECB next sets interest rates. A cut of 50 basis points, bringing the benchmark deposit rate to 2.75%, would make sense – not least because euro zone inflation has hit the ECB’s 2% target.

But that’s unlikely to happen because of the sway inflation hardliners hold within the central bank. These influential voices, usually with a German accent, will point to the inflationary effects of the euro’s 1%-plus fall against the dollar since the U.S. election.

A weaker currency does make imports more expensive. But it’s unlikely to offset other disinflationary pressures caused by slow growth, moderating wages and the impact of past rate hikes. The ECB may also be worried about acting too early, given that Trump may not impose the threatened tariffs. But given the bloc’s sluggish economy and subdued inflation, markets are already betting on rates falling to 1.75% in 2025. Taking a bigger leap now to get there would help to counter any nasty side-effects of Trump’s triumph.

Context News

The European Central Bank’s Governing Council meets on Dec. 12 to decide on the level of interest rates for the euro zone. Markets believe that there is a 90% probability the ECB will cut the benchmark deposit rate from 3.25% to 3%, according to derivatives prices collected by LSEG.

Updated 11:37 IST, November 9th 2024