Published 17:09 IST, July 20th 2024

China’s EU-made EVs are in pole position – for now

Volvo Cars, controlled by China’s Geely group, said on July 18 its net income grew 60% to 5.7 billion crowns ($540 million) in April to June.

- Economy

- 3 min read

Travel budget. Chinese electric-car makers like BYD and Chery are charging up production in the European Union to dodge tariffs. On paper, they have an edge, but how long they keep their pole position will hinge on Brussels.

Some home advantages don’t travel well. Labour costs add around $500 per car if BYD’s pure-electric Seal sedan is made in Eastern Europe, UBS calculated last year. A factory in Germany would more than quadruple that figure. Additional energy costs are harder to measure, and could be even higher. Using international suppliers costs a further $4000 for this specific model.

But what’s under the bonnet counts. China Inc’s early push into electric vehicles means it can make an EV’s chassis and electronics more cheaply. Some players, like BYD, develop batteries and components as well. It helps that research dollars go far further in the Middle Kingdom: Both Geely Auto and BYD launched multiple models last year, when they invested 4.4% and 6.6% of revenue in R&D respectively, while Tesla spent 5.1% of the top line but christened just one entirely new model in 2023.

Taking all of that into account, UBS analyst Paul Gong estimates that today it would cost BYD roughly 25,000 euros to produce a car in Europe, some 25% more than in China. That is still about 10,000 euros cheaper than similar models put out by European peers. Seal sedans exported from China to Europe sell for around 45,000 euros. That implies BYD would still earn a handsome profit per car, and also has scope to undercut EU rivals on price while remaining competitive.

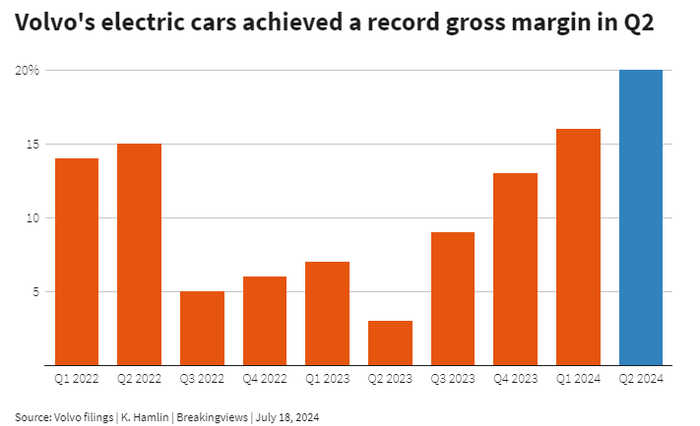

There are no real-world examples to confirm the thesis, as China Inc has yet to start up its first European production lines. Nor do carmakers typically break out specific financials that quantify the value of engineering. But Sweden-based, Chinese-owned Volvo Cars’ disclosures give a hint. The recently launched EX30, its first electric car to use an underlying body developed by parent Geely for Zeekr and Polestar EVs, can achieve a gross margin of 15% to 20%, the company says. That helped nudge Volvo to its highest-ever gross margin for battery-powered vehicles in second-quarter results on Thursday.

However, even careful sums could still be upset by any nasty surprises from Brussels. The bloc could threaten fresh probes, tariffs and rules, especially if Chinese marques made in Europe fuel member states’ concerns for their legacy automakers. Evoking new regulations on sourcing and foreign subsidies would disrupt supplies of batteries or other parts, for instance. China’s upstarts are formidable rivals, but they still need to test their speed limit on European roads.

Context News

Volvo Cars, controlled by China’s Geely group, said on July 18 its net income grew 60% to 5.7 billion crowns ($540 million) in April to June, compared with a year earlier, as sales fell 1% to 102 billion crowns. The company added that its gross margin for battery-electric vehicles increased to a record high 20% compared with 3% a year earlier. Volvo’s new EX30, a pure electric sports utility vehicle, can achieve gross margins of 15-20%, the company said in February. The European Union is imposing provisional tariffs of between 17.4% to 37.6% on imports of electric vehicles made in China, in addition to an existing 10% duty, the bloc confirmed on July 4.

Updated 17:09 IST, July 20th 2024