Published 11:01 IST, December 26th 2024

SoftBank’s $100 Bln US Pledge Is Doubly Fanciful

The Japanese company could offload private holdings which it values at $56.7 billion, but these are harder to sell quickly.

- Companies

- 3 min read

Soft sell. Masayoshi Son’s new $100 billion investment target for the United States sums up the Japanese tycoon: it’s attention-grabbing, probably exaggerated, and almost certainly a poor use of his shareholders’ money. The SoftBank founder’s pledge, which he unveiled on Monday alongside Donald Trump at the U.S. President-elect’s Mar-a-Lago estate, is double the commitment he made after Trump’s first victory in 2016. Unfortunately, Son’s cards look weaker this time around.

Back in December 2016, the entrepreneur pledged to invest $50 billion in American companies and create 50,000 jobs after a meeting with Trump. SoftBank had just created the Vision Fund, a $100 billion vehicle for investing in technology companies worldwide, half of which came from sovereign wealth funds in the Gulf. In one sense, Son was true to his word: SoftBank has since invested over $70 billion in the United States. But much of that was squandered on misplaced bets. Failed office-sharing start-up WeWork sucked up $16 billion. Zume, which used robots to make pizza, was also a flop.

Though Son has doubled down, he has less cash to throw around this time. SoftBank’s net debt at the end of September was equivalent to 12.5% of the value of its equity holdings. If the company increases that to the 25% level the company sees as its internal limit, it can borrow about an extra $28 billion, according to Breakingviews calculations. That’s little more than a quarter of what Son has pledged to put to work in the next four years.

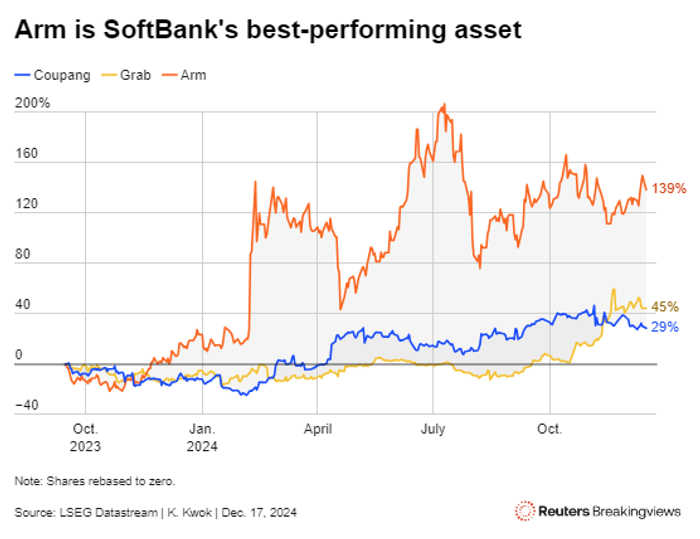

Raising cash elsewhere could be tricky: investors in the first Vision Fund received a humdrum return, and Son largely funded the second vehicle himself. SoftBank could offload stakes in publicly listed companies worth about $25 billion as of September 2024. Shares of Korean e-commerce platform Coupang and Southeast Asian ride hailing company Grab, for example, are up 29% and 45%, respectively, since September 2023. But Son would need to distribute some of those gains to external investors like Saudi Arabia’s Public Investment Fund.

The Japanese company could offload private holdings which it values at $56.7 billion, but these are harder to sell quickly. That leaves SoftBank’s 90% stake in chip designer Arm, currently worth $130 billion. But selling shares would weigh on the company’s stock price and undermine SoftBank’s asset value.

Even if Son somehow raises the cash, for example by borrowing against his Arm shares, he will still face the question of where to spend the money. Artificial intelligence data centres and large-language models consume a huge amount of capital. And though the Japanese tycoon has been talking about the potential for super-intelligent computers for years, he has largely missed the current AI craze. SoftBank investors will be hoping that Son’s new pledge is more fanciful than the last.

Context News

SoftBank Group CEO Masayoshi Son on Dec. 16 announced that the Japanese group would invest $100 billion in the United States over the next four years at a joint appearance with President-elect Donald Trump. Trump said in his joint appearance with Son that the investment would create 100,000 jobs focused on artificial intelligence and related infrastructure, with the money to be deployed before the end of Trump’s term. The announcement echoes a similar pledge Son made with then-President-elect Trump in December 2016, when Son said he would spend $50 billion and create 50,000 jobs. It is unclear how SoftBank plans to fund the investment promise. As of Sept. 30 the company had $27 billion in cash on its balance sheet. The company’s Vision Fund 2 has $3 billion left to deploy. SoftBank shares rose 4.4% on Dec. 17.

Updated 11:01 IST, December 26th 2024