Published 16:01 IST, July 3rd 2024

Salesforce signals CEO pay is easy come, easy go

A majority of Salesforce shareholders voted against a compensation plan for its CEO Marc Benioff and other top executives, according to a regulatory filing.

- Companies

- 3 min read

Easy come, easy go. Sometimes shareholders are asleep at the switch. Other times, they’re quick to pull the trigger. With $246 billion Salesforce and its leader Marc Benioff, they seem to be getting antsy. After a year of strong outperformance and then a middling six months, investors have rejected Benioff’s compensation plan. Generosity has limits, even with executive pay.

Though U.S. corporate leaders are often known for outsized paychecks, Benioff’s is high by even those standards. Proxy advisory firm Institutional Shareholder Services puts the total package at $43 million, with the large majority of the compensation coming from incentives, stock, and option grants. That is 65% higher than the average CEO pay in a group of peers.

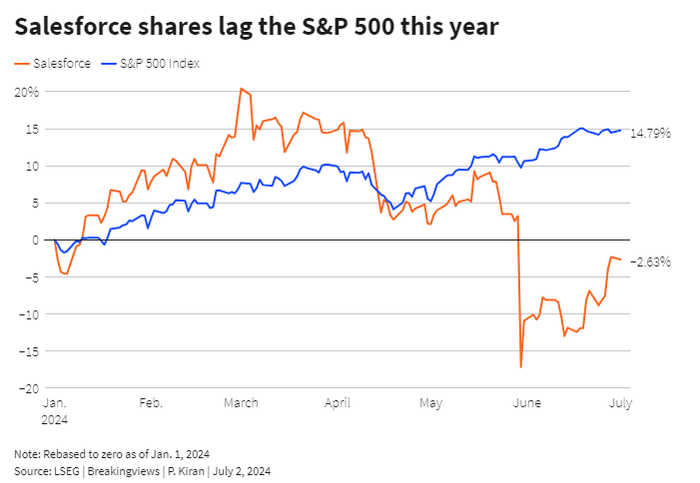

Such generosity might have been easier to justify last year when Salesforce shares returned 4 times the S&P 500. But the stock price lags the index year-to-date. Cloud markets are maturing after more than a decade of fast-paced growth. Benioff will need clients to spend more on Salesforce’s products, but customers’ budgets are pre-occupied on things like data centers and chips related to artificial intelligence.

Benioff can turn things around. Adobe and Oracle – companies that are older than Salesforce – saw their shares surge last month after tapping into AI-related demand. But it’s a harder shift for business software firms like Salesforce which are habituated to the so-called “seat model” which involves selling clients subscriptions based on a set number of users rather than how much of the product they consume.

Salesforce’s troubles are reminiscent of Oracle in the early 2010s. Then, Larry Ellison’s firm and Benioff’s own alma mater struggled to boost growth as clients moved their tech into the cloud and away from data centers. For six straight years, shareholders rejected Oracle executives’ compensation plan. Only in 2023, after years of chunky share buybacks, did Ellison start gaining favor for remaining as chairman.

Ellison stepped down as CEO at Oracle in 2014 and let his deputies lead. In the last 10 years, the company’s shares have more than tripled, far outpacing the returns of the S&P 500 Index. Benioff may have more time to show shareholders he can pivot in a world geared towards AI. He just might have to fight to be paid for his efforts in the process.

Context News

A majority of Salesforce shareholders voted against a compensation plan for its CEO Marc Benioff and other top executives, according to a regulatory filing on July 1. The resolution to approve the compensation received 339.3 million votes in favor versus 404.8 million against, the filing said. Advisory firms Glass Lewis and Institutional Shareholder Services both recommended that investors vote down the measure.

Updated 16:01 IST, July 3rd 2024