Published 18:40 IST, June 27th 2024

Ola sets a mileage test for India’s EV market

Investors from SoftBank Group to Tiger Global to Singapore's Temasek have backed the scooter maker.

- Companies

- 2 min read

Power up. India's top EV startup inspired rivals to catch up. That might explain why investors are resisting a mooted target valuation of $7 billion for Ola Electric as it promotes its upcoming initial public offering.

Investors from SoftBank Group to Tiger Global to Singapore's Temasek have backed the scooter maker to lead the EV transition in a country where two-wheelers vastly outnumber four-wheelers; 17 million scooters and motorbikes were sold in the financial year ended March, nearly five times the number of cars. Yet fewer than 5% of scooters are battery-run.

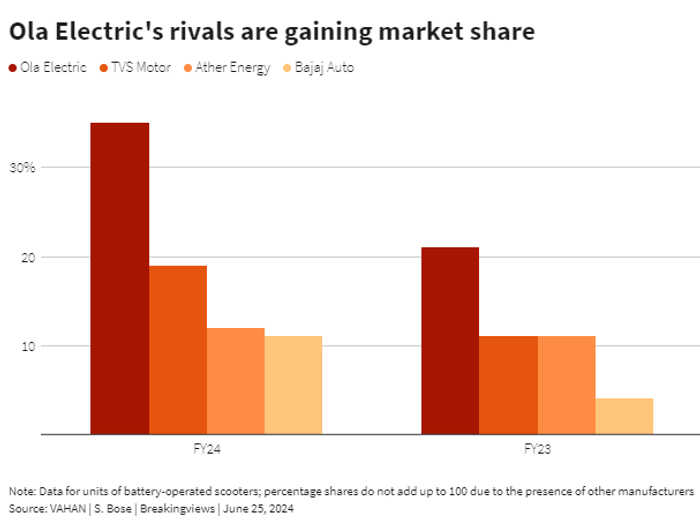

The company, 45%-owned by founder and chairman Bhavish Aggarwal and his related entities, started delivering electric scooters to customers in 2021 and continues to build market share, accounting for more than a third of all unit sales during the year ended March, according to official data.

Ola's quest to lock in a valuation 30% higher than the figure it achieved in an October fundraise will focus minds on how fast its rivals can gain ground. The $32 billion Bajaj Auto more than doubled its share of the market to 11% during the year to March. TVS Motor expects EVs will account for a quarter of the scooters it sells by 2027.

As a pure-EV company, loss-making Ola is not directly comparable. However, its rivals offer investors cheaper exposure to a fast-growing market and they are profitable too. Ola will generate $614 million revenue in the current financial year based on the annualised result for the first quarter. At $7 billion, the enterprise would be valued at 11 times its sales, nearly twice the multiple for Bajaj Auto and three times that of TVS.

Ola's pure electric focus also makes it sensitive to sudden changes in a fast-evolving market. For instance, it cut prices of its cheapest scooter model in April to support demand after New Delhi reduced incentives for buyers. Meanwhile, its large peers are active in the $100 billion market for India-made motorbikes and scooter exports across Africa, Latin America and Southeast Asia that Ola is targeting.

Aggarwal's startup will get a premium valuation but a string of Indian startups are trading below their IPO prices, and he would be wise to leave enough value on the table to distinguish Ola from that crowd.

Updated 19:26 IST, June 27th 2024