Published 19:08 IST, November 4th 2024

German M&A flurry is powered by lasting tailwinds

With interest rates falling, buyout firms and blue chips alike will find deal financing easier to come by.

- Companies

- 3 min read

Fee for all. The titans of German industry are shedding their old clothes in favour of new ones. Whether that helps the country’s ailing economy is up for debate. But it certainly bodes well for dealmaking.

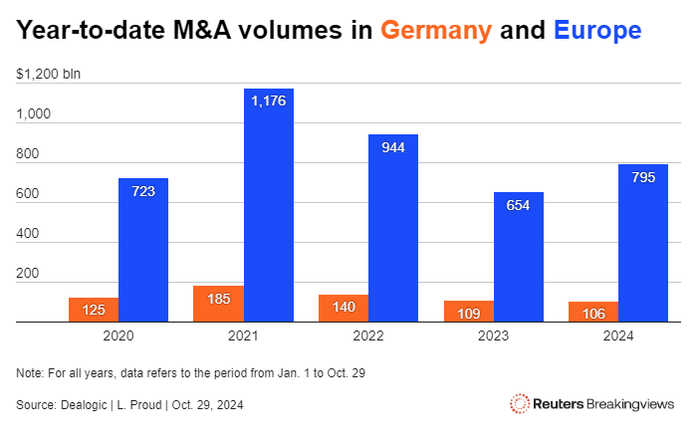

Admittedly, the volume of mergers and acquisitions involving domestic companies has slumped in Germany, as in most countries. The total during the first 10 months of the year was about $106 billion, according to Dealogic data – down 3% from the same period in 2023, and barely half the equivalent year-to-date peak of $185 billion in 2021.

A recent flurry of announced megadeals, however, suggests things may be changing. State-owned railway operator Deutsche Bahn in mid-September agreed to sell its Schenker logistics arm to Denmark’s DSV for $15 billion. In early October, Abu Dhabi National Oil Company sealed a deal for German chemicals producer Covestro at a $16 billion enterprise value. Underlying the nascent trend is a radical reshaping of the business model for Germany AG, which still has a long way to go.

In the last two years, the country’s largest industrial companies have struggled to adjust to the loss of two historic growth boosters – cheap Russian energy, and what once appeared like an endless Chinese appetite for German manufacturing products. The lifeless economy, which shrank in 2023 and is stagnating this year, reflects the scale of the problem.

The response requires massive investments in new products, factories and geographies to boost revenue and hedge the risks of ongoing trade wars. Private conglomerate Bosch, for example, made a play for U.S. growth with its $8.1 billion July purchase of Johnson Controls International’s residential heating and air conditioning operations. Carmaker Volkswagen is trying to keep pace with technological change, announcing a $5 billion investment in U.S. electric vehicle maker Rivian Automotive this summer. Merck KGaA, the $73 billion technology and pharmaceuticals group, intends to grow its life sciences division through acquisitions.

Germany AG is also shedding peripheral businesses to mobilise resources. BASF, the $44 billion chemicals powerhouse, plans to list its agriculture arm and sell its Brazilian unit. And buyout firms look increasingly like plausible buyers for unwanted assets. CVC Capital Partners failed in its pursuit of Schenker but won union support, which would have been inconceivable a few years ago. In that context, German hostility to UniCredit’s Commerzbank overtures looks like an exception.

With interest rates falling, buyout firms and blue chips alike will find deal financing easier to come by. What remains to be seen is whether an M&A wave will help stop or slow the gradual shrinkage of Germany’s industrial base. Busy investment bankers can ignore that question for now.

Updated 19:08 IST, November 4th 2024