Published 15:56 IST, August 22nd 2024

China’s PwC slap may yet pack a punch

PwC China has told clients it expects to receive a six-month ban from Chinese authorities over its audit of collapsed property developer China Evergrande.

- Companies

- 3 min read

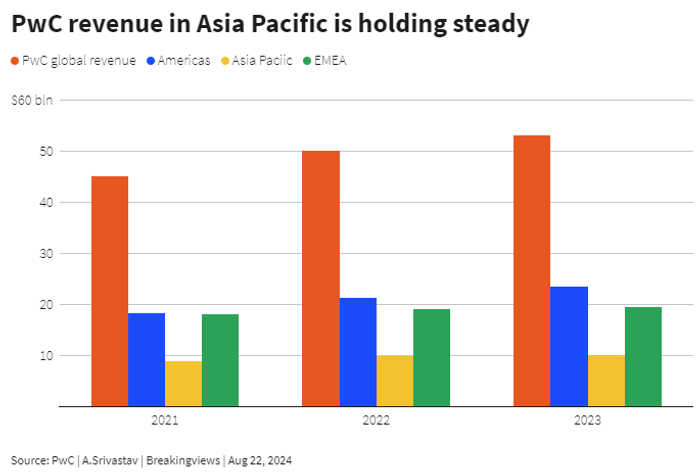

Own account. PricewaterhouseCoopers can finally start to think about putting its involvement in the China Evergrande scandal behind it. The auditor's China unit may soon be given a record fine and a six-month ban, the Financial Times reported on Thursday, citing multiple PwC clients. While that'll sting, the regulatory slap looks designed to punish rather than kill. It may yet pack more of a punch.

The sanction would bar PwC from signing off any business for half a year - worse than the three months in the sin bin the Ministry of Finance handed to Deloitte Touche Tohmatsu’s Beijing office last year. Granted, Big Four rivals EY and KPMG - and Deloitte - would be likely to try to take advantage of it by poaching customers. But PwC has assured its clients that a ban would only stop them from certifying audits, not from preparing them, per the FT. So come March 2025, it would be back to business as usual.

That may sound like Beijing is trying to ensure that sufficient competition in the accounting sector endures while also showing a lack of tolerance for wrongdoing. PwC signed off on Evergrande earnings that the China Securities Regulatory Commission determined in May overstated the property developer's revenue by $78 billion in 2019 and 2020.

Hobbling the market leader, though, doesn't stop at six months. State-owned enterprises are often not allowed to hire auditors for three years after a ban.

That'll give smaller local auditors a chance to grow. Chinese authorities have been urging state heavyweights to phase out using the Big Four on concerns over data security, Bloomberg reported in February last year, citing unidentified sources.

It won't be a quick process. Local accountants are not ready to fill the void, given China Inc’s extensive business interests overseas and the complexity of auditing Chinese firms’ offshore units. That EY and KPMG have snapped up over half of PwC’s corporate client exodus, per Reuters, indicates how difficult sidelining the Big Four currently is.

Bank of China, for instance, this week said it is ditching PwC for EY. Yet in a sign that local players are slowly making inroads, Caixin, a magazine, reported that the state bank has also appointed local firm BDO China Shu Lun Pan as a “secondary auditor”.

Chinese rules stipulate that state-owned firms should not employ the same accountant for more than eight consecutive years. The next time the auditor merry-go-round starts, the Big Four may well be facing off against the likes of BDO, too.

Context News

PwC China has told clients it expects to receive a six-month ban from Chinese authorities over its audit of collapsed property developer China Evergrande, the Financial Times reported on Aug. 22, citing multiple clients. The punishment could start as early as next month, and a record fine is also possible, the report added. Chinese authorities have urged state-owned firms to phase out using the four biggest international accounting firms, signaling concerns about data security, Bloomberg reported in February 2023, citing unidentified sources.

Updated 16:09 IST, August 22nd 2024