Published 21:59 IST, August 2nd 2024

BNP’s AXA deal is a logical use of spare cash

BNP Paribas on Aug. 1 said it had entered into exclusive talks to buy AXA Investment Management for 5.1 billion euros from French insurer AXA.

- Companies

- 3 min read

Ax and spend. BNP Paribas investors will be heaving a sigh of relief. Ever since the $75 billion French bank finalised its sale of U.S. arm BancWest last year, the risk has been that CEO Jean-Laurent Bonnafé gets tempted to do something silly with the proceeds. Thursday’s 5.1 billion euro swoop for AXA’s asset management arm, in contrast, looks agreeably logical.

Bonnafé’s BancWest disposal left him with 8 billion euros to spend, net of share buybacks. That raised the danger he might fritter it away on a bad lending splurge, or a rash swoop on an ill-fitting fellow bank. With BNP trading at a mere 0.65 times estimated 2024 tangible book value, as per LSEG data, investors’ first choice might be a bigger buyback of cheap shares.

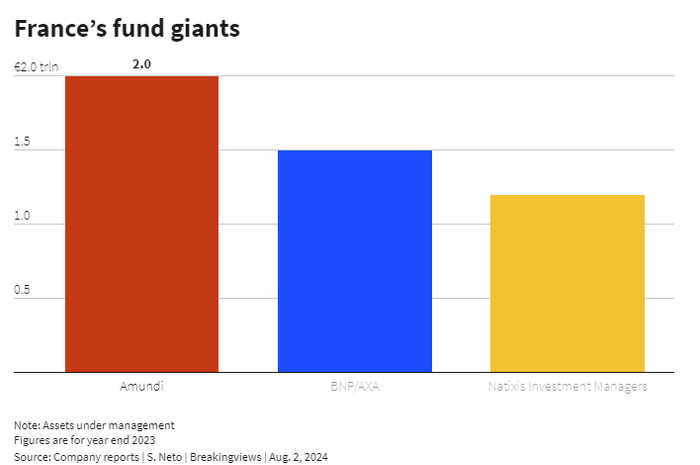

Asset management deals are far from strife-free. The integration process can see key portfolio managers leave, or consultants freeze allocations. BNP is also buying a bigger business than the one it already possesses: AXA IM’s assets under management will comprise 850 billion euros of the 1.5 trillion euro combined operation.

Still, Bonnafé is not paying too rich a price. Annualising first-half figures, BNP Paribas is forking out just shy of 13 times annual earnings. That’s more than the level at which European asset manager peers like Amundi or DWS trade, but in line with Jefferies’ average multiple for recent asset management deals of 14 times.

Moreover the deal, which allows AXA to slim down and focus capital on traditional insurance, gives BNP a much-needed leg up in asset management. The combined BNP-AXA business will have a credible presence in hot areas like credit, and scale to help compete with the likes of Amundi. Falling rates should also drive business to asset managers that can demonstrate they can make decent returns.

Better still, it’s an area that chews up less capital and is less heavily penalised than ordinary banking by regulators in stress tests. While the deal may cost over 5 billion euros, BNP estimates the new business will only consume about 25 basis points of its common equity, or around 1.8 billion euros. Barclays analysts reckon part of the difference may be down to the so-called “Danish compromise”, European capital rules which allow banks with insurance arms – like BNP – to hold less capital.

Either way, on that basis AXA’s roughly 360 million euros of earnings last year would generate a return on capital well above 15%, even before factoring in cost savings. Jefferies pegs BNP Paribas’ own return on tangible equity at about 11% this year. As such, Bonnafé could have found worse ways to flash his cash.

Context News

BNP Paribas on Aug. 1 said it had entered into exclusive talks to buy AXA Investment Management for 5.1 billion euros from French insurer AXA. BNP said it will acquire AXA IM through its Cardif insurance business, and merge it with BNP Asset Management, creating a fund group with 1.5 trillion euros of assets. The unit will also run AXA’s long-term savings business. The deal will generate an 18% return on invested capital after three years, the French bank said. In a separate statement, AXA said the deal would also comprise a further 300 million euros for the sale of fund unit Select, bringing the total outlay to 5.4 billion euros. BNP Paribas shares were trading at 60.7 euros as of 0826 GMT on Aug. 2, down 1.3%. The STOXX index of leading European stocks was off 1.4%, while AXA shares were trading at 32.4 euros, up 1.8%.

Updated 21:59 IST, August 2nd 2024