Published 14:31 IST, October 27th 2024

Biden trustbusters get free rein to accessorize

Judge Jennifer Rochon of the Southern District of New York issued a preliminary injunction blocking the acquisition of handbag maker Capri by rival Tapestry.

- Companies

- 3 min read

All sewn up. U.S. trustbuster Lina Khan’s biggest victory hasn’t come in David vs. Goliath challenges against the likes of Amazon.com. Instead, it might be Thursday’s court win against the acquisition of Michael Kors owner Capri by Kate Spade owner Tapestry, which lopped $2 billion off the seller’s shares. While the deal is relatively small, the heft it adds to the Biden administration’s antitrust crusade might be enormous.

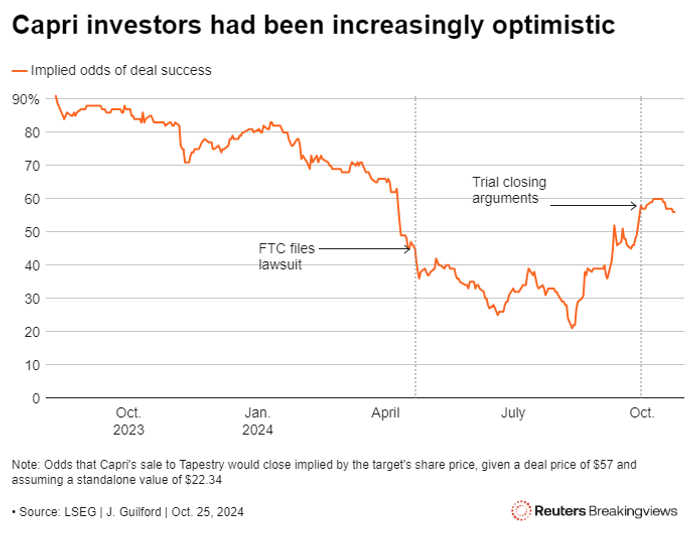

Judge Jennifer Rochon’s 163-page opinion backs the Khan-led Federal Trade Commission’s request to halt the $8.5 billion tie-up. The agency’s lawsuit argued that, despite the vast proliferation of handbag brands, Tapestry and Capri dominate a category dubbed “affordable luxury.” It might seem a stretch: the definition relies on specific materials and the bags’ Asian manufacturing provenance. Hedge funds didn’t quite buy it - target Capri’s shares rose steadily heading into closing arguments.

Khan has taken lumps for losing cases on far-flung theories before. Merger hawks argue that shots on goal matter: despite failing to stop, say, Facebook owner Meta Platforms from acquiring virtual reality startup Within, a lawsuit can nudge the way judges think about deals even in a losing opinion, building to later victories. And Biden’s trustbusters need judges on-side, having proposed shake-ups in merger review that require the courts’ endorsement to stick.

That’s what makes Judge Rochon’s opinion so important. Indeed, she approvingly cited cases - like Meta/Within - that the FTC lost, as offering support. More importantly, she implicitly backed one of the biggest proposed overhauls in how deals are adjudicated.

Ordinarily, companies and the government bicker over defining a “relevant market”, such as a sub-slice of the economy, like “affordable luxury”, and proceed with their analysis from there. Failing to narrow this definition enough can stymie a lawsuit. Though the FTC also followed this traditional method, it argued that the deal is illegal regardless, since Capri and Tapestry are direct competitors that provably respond to each other’s pricing.

Rochon effectively endorsed this head-to-head analysis. Not only that, she agreed that Tapestry and Capri’s troves of consumer data hobbles less-endowed competitors, a decision with implications for technology deals. A bevy of other new merger guidelines earned judicial nods.

The only consolation for M&A bankers everywhere is that the victory was so comprehensive that Rochon didn’t even weigh in on more radical arguments, such as mergers harming the labor market by consolidating employers. The two companies said they have appealed the decision, so the trustbuster’s victory isn’t final. Nonetheless, Khan stands to make one of her biggest marks yet. Competition cops are getting more license to try on aggressive, merger-hostile arguments.

Context News

Judge Jennifer Rochon of the United States District Court for the Southern District of New York on Oct. 24 issued a preliminary injunction blocking the acquisition of handbag maker Capri by rival Tapestry. The Federal Trade Commission had sued to block the tie-up, which would have united brands including Kate Spade and Michael Kors. Capri shares opened down 46% on Oct. 25.

Updated 14:31 IST, October 27th 2024