Published 21:14 IST, June 27th 2024

A South Korean EV reversal would inspire copycats

South Korea's SK Group might go the other way and merge its loss-making battery unit with another division.

- Companies

- 2 min read

Spin doctors. Splitting out assets to capitalise on an electric-car boom was once a way to charge up valuations for brands from Renault to Geely. But South Korea's SK Group might go the other way and merge its loss-making battery unit with another division as part of a broader shakeup. As growth in the industry slows, standalone EV businesses face a tough slog.

South Korea's second-largest conglomerate is mulling a major overhaul of its sprawling empire that spans over 200 companies in chips, chemicals, hotels and more. One key question is what the conglomerate will do with its struggling battery business. Three years ago, the $8 billion SK Innovation, which operates the country's largest oil refiner, split out its batteries division into a standalone company, SK On. At the time, EV mania had taken over global markets: Tesla's stock rose nearly eightfold between the beginning of 2020 and September 2021 when SK investors approved the plan.

One mooted idea as reported by local media is to combine SK On, which has made a cumulative operating loss of about $1.7 billion, with a financially stronger business such as the conglomerate's energy utility. SK Innovation has said it is considering different strategic measures including mergers to strengthen its competitiveness, but nothing has been decided.

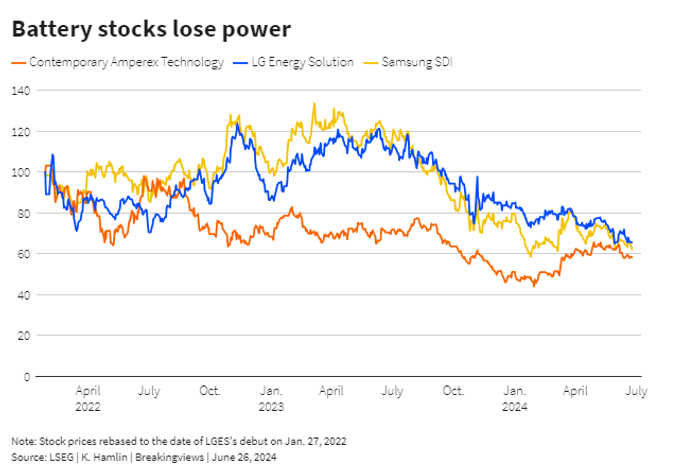

Any deal will be a wake-up call for global automakers and their suppliers. Renault separated EVs into its Ampere unit last year; China's Geely has listed multiple EV brands including Zeekr, while compatriot Great Wall Motor spun out its battery arm SVOLT. In 2022, South Korea's LG spun out its battery unit, LG Energy Solution, in an $11 billion initial public offering; the stock, alongside local rival Samsung SDI's, is down by nearly a third since the debut.

As with SK On, those pure-play EV businesses now face an uncertain future as global demand in electric cars slow. Revenue at the South Korean battery-maker roughly halved year-on-year to 1.7 trillion won ($1.2 billion) in the first quarter of this year. Car companies including SK client Ford Motor have reconsidered or pushed back planned EV investments.

Combining a stalling battery business into a larger entity won't solve a growth slowdown. But it might give executives more flexibility to shore up its finances, including by paying down debt. If SK makes a U-turn, it will be closely studied.

Updated 21:14 IST, June 27th 2024