Published 16:47 IST, July 12th 2024

Victorian rail mania has lessons for AI investors

Railway promoters simply did not appreciate the potential demand for high-speed travel.

- Technology

- 5 min read

Off the rails. The excitement about artificial intelligence is matched only by the technology’s voracious investment needs. Total investment in AI is set to top $1 trillion by 2027, Leopold Aschenbrenner predicts in a much-cited recent paper. The former OpenAI executive says there are historical precedents for such spending, citing the massive investment in British railways in the 1840s. Yet this earlier technology boom — which produced large and largely foreseeable losses — provides a salutary warning for today’s hyped-up investors.

The first railway to use steam locomotives, the Stockton and Darlington Railway, opened in 1825 and was designed to carry coal, not passengers. Railway promoters simply did not appreciate the potential demand for high-speed travel. The successful launch of the Liverpool and Manchester Railway in 1830, however, demonstrated the commercial viability of passenger travel. By the early 1840s, Britain’s railway network stretched to more than 2,000 miles. Railway companies were delivering acceptable, if not spectacular, returns for investors.

Then railway fever suddenly gripped the nation. Enthusiasts touted rail transport not just for its economic benefits, but for its benign effects on human civilisation. One journal envisaged a day when the “whole world will have become one great family speaking one language, governed in unity by like laws, and adoring one God”. In the two years after 1843, the index of rail stocks doubled.

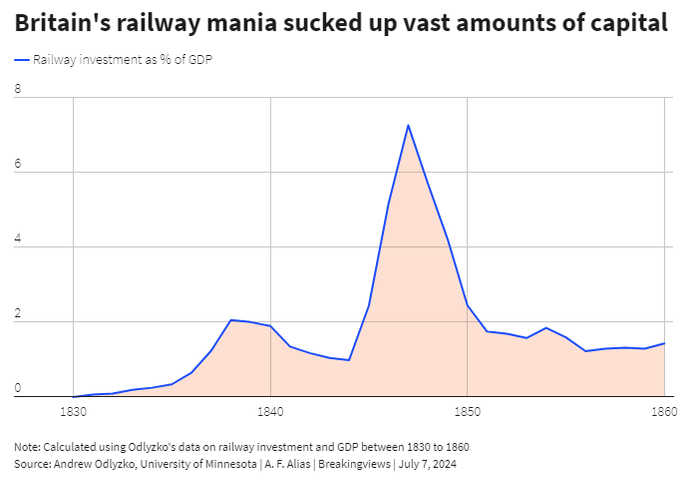

Hundreds of new railways were proposed. Investment peaked at about 40 million pounds in 1846 and 1847, equivalent to around 7% of Britain’s national income, according to Andrew Odlyzko of the University of Minnesota. Railway enthusiasts predicted that rail would soon replace all the country’s roads and that “horse and foot transit shall be nearly extinct.”

Some prominent sceptics raised doubts. The Times asked in July 1845: “whence is to come all the money for construction of the projected railways?” The newspaper later pointed out: “there does not exist the capital, the labour, or even the material, for more than a certain amount of railway production”. The Economist likewise fretted that investing huge sums in railways would exhaust the nation’s savings, and divert capital from other uses.

A well-regarded science writer, Dionysius Lardner, calculated that the new lines in aggregate would inevitably be unprofitable. In 1845, Britain’s railways carried nearly 34 million passengers and earned gross revenue of 6 million pounds. If the 8,000 miles of newly authorised railways were to deliver their expected 10% return, then the industry’s total revenue and passenger traffic would have to climb fivefold or more — all within the space of just five years. “This should have alarmed observers by itself,” writes Odlyzko. “But they were deluded by the collective psychology of the Mania, and distracted by concerns about the immediate problems of funding railway construction.”

In 1847 a severe financial crisis broke out, induced in part by the diversion of large amounts of capital into unprofitable railway schemes. It turned out that the revenue projections provided by so-called “traffic takers” were wildly overoptimistic. Railway engineers underestimated costs. The vogue for constructing direct lines between large urban centres proved mistaken, as most traffic turned out to be local. As a result, Britain’s rail network was plagued with overcapacity. There were three separate lines connecting Liverpool with Leeds and London with Peterborough. Railway companies cut dividends as returns on invested capital fell to 3%. By the end of the decade, the index of railway stocks was down 65% from its 1845 peak.

In “Engines that Move Markets: Technology Investing from Railroads to the Internet and Beyond”, Alasdair Nairn writes that tech bubbles are characterised by the emergence of a technology about which extravagant claims can be made with apparent justification. New publications uncritically promote the invention. Entrepreneurs create new companies to meet demand from investors, who suspend normal valuation criteria. The technology is often immature. There follows a huge over-commitment of capital, forcing down potential rates of return.

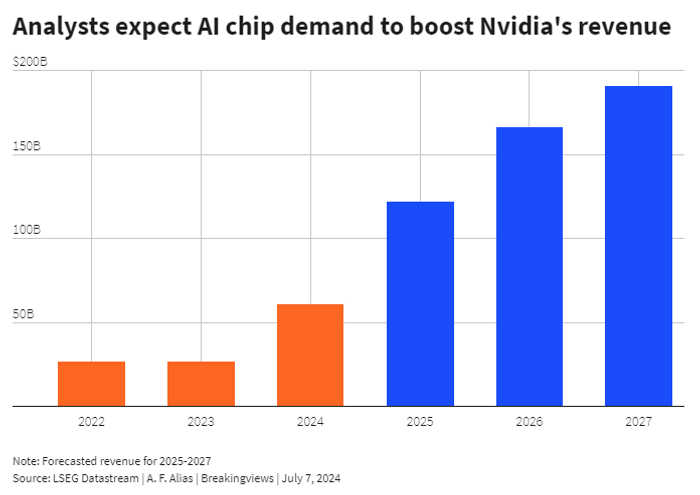

Britain’s railway mania fits Nairn’s description. So does the current AI boom. The main difference is that by 1840s railways were firmly established, whereas AI is in its infancy. The hype over self-teaching computers is as extravagant as anything encountered during in Britain almost two centuries ago. Aschenbrenner predicts that by the end of the decade, we will have “superintelligence in the true sense of the word.” Yet many observers question whether computers will ever replicate the full capabilities of the human mind. The investment costs required to train and operate large language models are staggering and many of these investments appear duplicative.

“AI technology is exceptionally expensive,” says Jim Covello, head of global equity research at Goldman Sachs. “And to justify those costs, the technology must be able to solve complex problems, which it isn’t designed to do.” Covello doubts whether AI will substantially augment or replace human interactions. Eighteen months after the introduction of generative AI, he says, “not one truly transformative – let alone cost effective – application has been found.” For Covello, “the crucial question is: what $1 trillion problem will AI solve?”

David Cahn, a partner at Sequoia Capital, calculates the required return to pay for the ongoing AI investment. By his back-of-the-envelope reckoning, spending on Nvidia graphics chips and the cost of data centres required to operate them can only be justified if AI generates annual revenue of at least $600 billion. Yet the current sales of OpenAI, which dominates the market, are just $3.4 billion. As Lardner wrote in his 1846 survey of the lacklustre prospective profitability of railway investments: “This subject opens up many curious and interesting views.”

Nairn suggests it is easier to identify the losers from technology bubbles than the winners, whose success usually only becomes apparent after several years. In the current AI frenzy, however, everyone is seen as a winner. There are no obvious losers. When sanity returns to the market, this order could be reversed. There is another common feature of tech bubbles, such as the 1840s railway mania: As long as stock prices keep rising, no one pays any attention to the sceptics.

Updated 16:47 IST, July 12th 2024