Updated 21:03 IST, June 22nd 2024

Tiny Singapore’s chip hub retains a big punch

Taiwan dominates high-end chip-manufacturing, Singapore has carved out a slice of the global tech supply chain.

Small but mighty. Tiny Singapore is punching above its weight in global chipmaking. NXP Semiconductors and Vanguard International Semiconductor Corporation unveiled plans this month to build a $7.8 billion factory in the city-state. It follows fresh investments from GlobalFoundries, Micron Technology and others showcasing Singapore's expertise in the industry. Retaining that edge will soon get trickier.

While Taiwan dominates high-end chip-manufacturing, Singapore has carved out a slice of the global tech supply chain making low-end chips vital to electric cars, smartphones and more. Its highly-productive workforce, well-developed research and manufacturing infrastructure, and sophisticated logistics have helped boost semiconductor manufacturing to 7% of GDP. The government also supports the industry through friendly policies and tax breaks.

Today, Singapore accounts for just over a tenth of global chip output and a fifth of semiconductor-equipment production; the city has emerged as the largest production hub outside the United States for U.S.-based firms including Applied Materials and Micron.

That makes Singapore a logical choice for NXP and Vanguard's joint venture. The new factory will produce 130 nanometer to 40 nm chips using technology TSMC developed some two decades ago. It's a commoditised market where profit margins and returns are generally low.

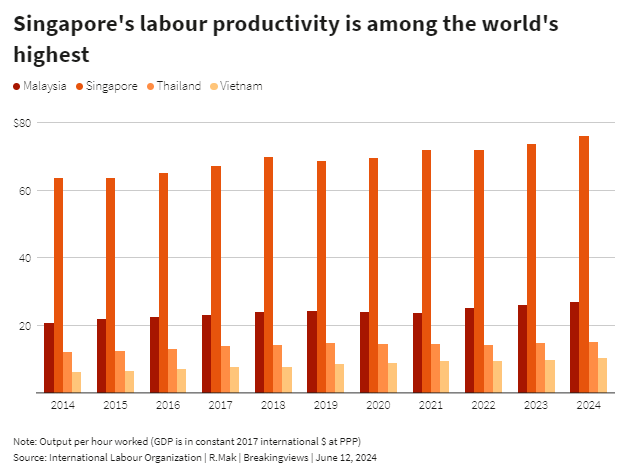

But Singapore isn't a cheap place to make stuff. The all-in cost of manufacturing goods exported to the United States, including labour costs and fuel and electricity prices, is the highest in Southeast Asia and nearly 15% more than Malaysia, it's larger neighbour, per Boston Consultant Group's Global Manufacturing Cost Competitive Index.

Malaysia's growing ambitions therefore pose a threat. It is a vital semiconductor hub for packaging, assembling and testing, and is eyeing opportunities in manufacturing, design and advanced packaging as global firms diversify Asian supply chains from China and Taiwan. The country boasts 450 times more land than Singapore and has scored some early wins: Germany's Infineon Technologies said last year it would invest 5 billion euros ($5.4 billion) to "significantly expand" its existing plant; Nvidia supplier Kinsus Interconnect Technology is, according to the Financial Times, mulling building a factory in Penang. Countries around the world are racing to build up their chipmaking capabilities. As rivals press their advantage, Singapore could soon be vulnerable.

(Co-authored by Robyn Mak)

Published 21:01 IST, June 22nd 2024