Published 13:48 IST, August 30th 2024

Reliance can afford to sit out India’s IPO boom

The annual shareholder meeting of $245 billion Reliance Industries was an unusually low-key affair.

- Opinion

- 3 min read

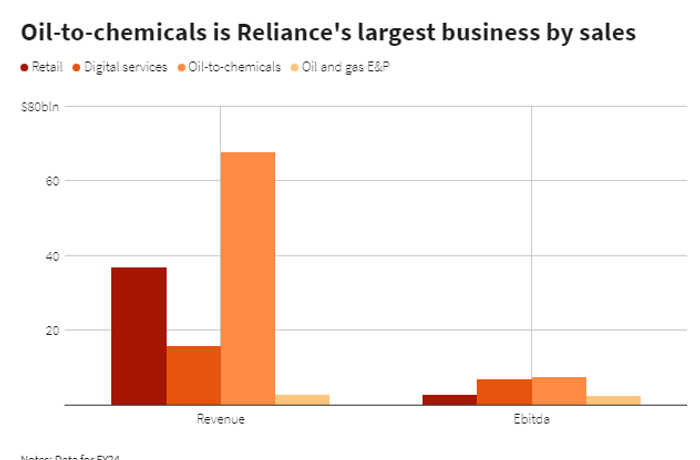

Wait for it. India’s largest company is biding its time. The annual shareholder meeting of $245 billion Reliance Industries was an unusually low-key affair. Chair Mukesh Ambani seems in no hurry to list his two consumer-facing businesses as promised to their 2020 backers including KKR, Silver Lake and Meta. A slim conglomerate discount at least makes the wait for everyone easier.

Grand pledges from the oil-to-data group at the meeting failed to stir the market. The stock closed up just 1.6%. Ambani envisions Reliance will soon be one of the world’s 30 most valuable companies. There was some 61 mentions of artificial intelligence. It announced production of solar photovoltaic modules by the end of the year and a battery gigafactory by 2026. Ambani says the Jio telecoms and the retail operations that will eventually yield IPOs aim to double their topline and EBITDA over the next four years.

To jump from 50 into the top 30 listed firms, Reliance would need to match semiconductor equipment maker ASML's market capitalisation at around $366 billion, LSEG data shows. Chunky IPOs from a sprawling conglomerate ought to help unlock some value. What's more, India's capital markets are firing up, valuations are rich, and it's a good time for robust businesses to go public.

Yet it's unclear if Reliance's spinoffs will deliver a big boost. Qatar Investment Authority last year took a 1% stake in Reliance Retail, valuing it at $100 billion. Analysts at brokerage Ambit are more sanguine and peg its equity worth as little as half that amount. They cite slowing growth: revenue for the three months to June grew at less than half the pace reported a year ago. The company blamed it on an overall slowdown in India’s discretionary consumption.

Meanwhile Jio's topline growth is steady but it can sweat its 490 million customers more. Tariff hikes of up to 25% in July were the first in nearly three years. The launch of cloud subscriptions are cheaply priced for now and could eventually boost average revenue per user that's languishing at 182 rupees ($2.2).

Bankers say the value of the businesses may be obscured by all the others Reliance houses, and their worth will only become clear when the deals finally happen. For now, the company's shares are trading only around 3% lower than the average sum of the parts-based price target of five brokerages after the annual meeting. Apart from keeping investors happy, there may be little benefit to rushing any stock market listings.

Updated 13:48 IST, August 30th 2024