Updated 12:27 IST, July 18th 2024

HSBC makes right call on CEO, three months late

The 50-year-old Elhedery’s nearly two-decade stint at the bank means he has experience handling emerging markets in the Middle East and Africa.

Same, same. Continuity is good. That’s the message from HSBC, which on Wednesday picked frontrunner Georges Elhedery as its new chief executive. But the UK-headquartered group’s new boss inherits a series of knotty challenges, and all of them would have been easier to handle had his appointment coincided with incumbent Noel Quinn’s departure back in April.

HSBC’s Chair Mark Tucker has picked the best available candidate. The 50-year-old Elhedery’s nearly two-decade stint at the bank means he has experience handling emerging markets in the Middle East and Africa, while his 18 months as chief financial officer means investors know him and he will have a grasp of HSBC’s $3 trillion balance sheet. Even so, there are gaps: a bank that earns most of its money from Asia would ideally have appointed someone with more direct experience of the region.

China will loom large in Elhedery’s in-tray. Relations with the West will get even trickier if Donald Trump wins November’s U.S. election. Specifically, there’s the question of how to deal with activist shareholder Ping An Insurance. HSBC, which counts Hong Kong as its biggest market, last year defeated the insurer’s push to spin off its Asian business, but Ping An still has a 9% stake.

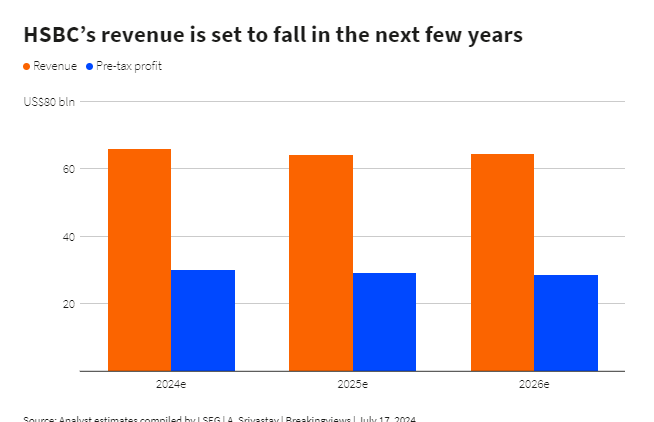

An equally tricky challenge is devising a plan to tackle slower growth as global interest rates fall. After last year’s record performance, HSBC’s pre-tax profit is forecast to edge lower until 2026, per LSEG data. While the lender earned a strong 16% return on tangible equity in the first quarter, it hasn’t set clear targets beyond this year.

If Elhedery can manage these two areas and preserve HSBC’s valuation around tangible book value, he will be doing a decent job. But two other related factors complicate matters. One is managing relations with Tucker, who has overseen three CEOs in less than seven years and who will have a big say in shaping HSBC strategy. UK corporate governance conventions imply Tucker will be off by 2026, but that’s long enough for him to strongly influence Elhedery’s big ideas.

The other issue is the circumstances of the new boss’s appointment. Given the mess HSBC has made of previous transitions, this one may look relatively smooth. But if Elhedery was the frontrunner, which he’s always seemed, then appointing him in April would have sent a stronger signal of HSBC’s confidence. Instead, the feeling persists that he was merely the best candidate who happened to be available for one of global banking’s toughest jobs.

Published 12:27 IST, July 18th 2024