Published 08:52 IST, September 17th 2024

For global firms, India IPOs are a honey trap

South Korea’s Hyundai Motor is gearing up for a $3 billion initial public offering of its Indian operations.

- Opinion

- 2 min read

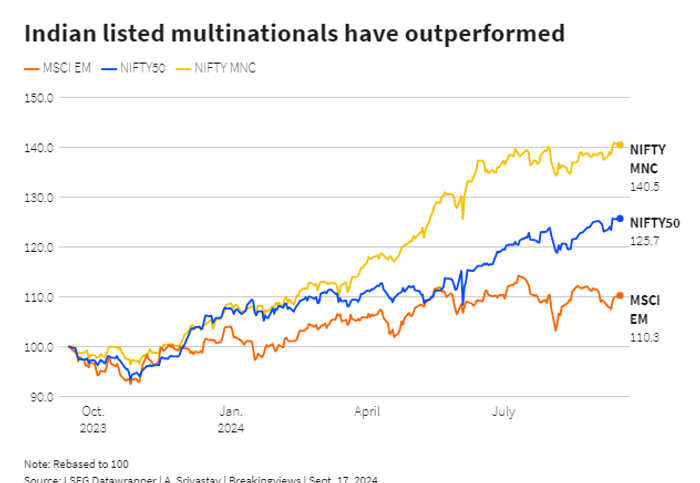

Sweet and sticky. It rarely makes sense for a company to maintain more than one stock market listing. Tell that to the growing list of multinational firms rushing to float their local subsidiaries on Mumbai bourses. They are shrugging off the additional costs and compliance burdens to tap higher valuation multiples. They are also running into a honey trap of sorts.

South Korea’s Hyundai Motor is gearing up for a $3 billion initial public offering of its Indian operations, and its compatriot LG Electronics has hired banks for a similar deal to raise up to $1.5 billion, Bloomberg reported on Friday citing unnamed sources.

Success would allow global companies to crystallise the worth of their fast-growing Indian operations, often at a higher valuation than the parent company: MSCI India is trading at 24 times forward one-year earnings, above its 10-year average of 19 times, LSEG data shows. A listing would also hand them richly valued stock they could use to strike onshore deals. Still, there are risks.

For one, emerging markets can quickly fall out of favour. Consider the experience of global firms that rushed more than a decade ago to list in Hong Kong to tap Chinese capital. Names including luggage maker Samsonite, luxury powerhouse Prada and skincare group L’Occitane are now either weighing going private or adding a listing closer to home as global investors slash exposure to the People’s Republic on worsening Sino-U.S. relations.

At least those companies have the option to retreat. In India, going private is harder. Companies use a reverse book-building process where minority owners can force exorbitant premiums. The securities regulator introduced an alternative method in June but it remains prescriptive on how companies should be valued.

Hyundai and others also may find their Indian subsidiaries complicate future decision-making. British energy company Cairn floated its India unit in 2007 after discovering oil in the state of Rajasthan. The parent was later slapped with a capital gains bill after it transferred the Indian assets as part of an internal reorganisation; a roughly $1 billion tussle with Indian authorities lasted until 2022.

Though the publicly traded Indian subsidiaries of Unilever, Nestle , Suzuki Motor and Pfizer are successful, they are legacy structures and largely inherited. Global companies that rush to list in the South Asian country may rue the decision.

Updated 08:52 IST, September 17th 2024