Published 15:50 IST, January 12th 2025

Constellation Mega-Deal Delicately Orbits AI Sun

Constellation Energy is acquiring Calpine for $27 billion, capitalizing on AI-driven electricity demand.

- Opinion

- 2 min read

Reverse polarity is flowing into the electricity business. Exelon spun off Constellation Energy back in 2022 when prospects for nuclear power were dim, but artificial intelligence brightened them again. With such demand surging, Constellation has agreed to buy gas-fueled rival Calpine for $27 billion, including debt, with a deal structure that should help prevent any sort of future shock.

Calpine is a case study in the difficulty of predicting power usage. The company overbuilt gas-fired plants around the turn of the century using borrowed money and was wrong-footed by Enron’s price manipulations and collapse. Calpine emerged from its own bankruptcy in 2008, before being acquired almost a decade later for $17 billion by a private equity consortium led by Energy Capital Partners, a buyout shop started by Goldman Sachs alum Doug Kimmelman.

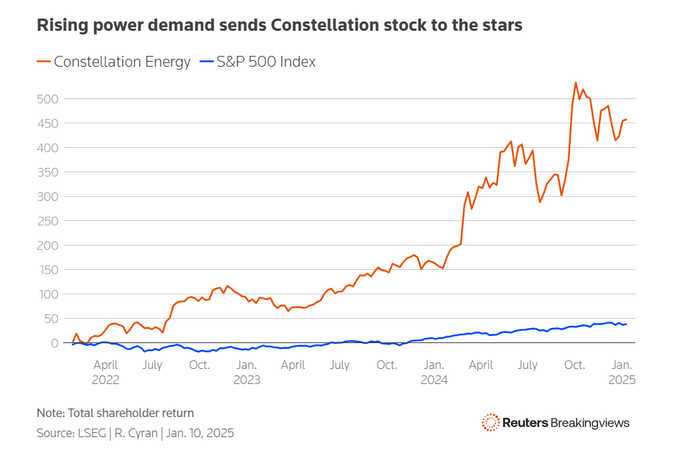

Both Constellation and Calpine have benefited from rising electricity needs. Constellation’s nuclear plants essentially produce power no matter the demand, while Calpine’s fleet can buy natural gas cheap and sell electricity dear. Since separating from Exelon, Constellation’s share price has jumped more than 450%.

Uniting with Calpine has several benefits. Its concentration in Western states provides geographic diversification and taps into growing demand in places like Texas. Size also helps, and the worldwide rush for power means it would take a lot of time and money to build equivalent projects. The biggest attraction, however, is the price.

Constellation, run by Chief Executive Joseph Dominguez, is paying about 8 times Calpine’s projected 2026 EBITDA. Rival Vistra trades at 11 times, according to LSEG, which means that rather than paying a premium for control, the valuation amounts to an implied $10 billion discount. Private equity sellers are rarely accused of leaving money on the table. And yet a sale is cleaner than an initial public offering.

Nevertheless, some AI hype plugged into the deal. After Constellation unveiled it on Friday, the company added as much as $19 billion to its market value, more than the $16 billion equity component of the acquisition. While machine-learning demand seems insatiable, alongside U.S. manufacturing growth and energy-transition pursuits, the bullish outlook easily could fall short. Using its own high-flying stock as part of the currency provides a useful, albeit limited, hedge, in case the currents flip again.

Updated 15:51 IST, January 12th 2025