Published 10:03 IST, August 19th 2024

China’s ammo export curb is more a green defence

Among other uses, antimony is a key ingredient for military and defence purposes, from nuclear weapons to night-vision goggles.

- Opinion

- 2 min read

Swords and ploughshares. Beijing's latest choice of critical mineral to put under export limits may at first blush appear to be old-school Realpolitik. Among other uses, antimony is a key ingredient for military and defence purposes, from nuclear weapons to night-vision goggles, as well as for more traditional uses like hardening bullets and tanks. China cited national security and non-proliferation obligations as reasons for the move, but climate change is at least as big a driver, too.

That's because silver-grey metalloid is also used in photovoltaic glass to improve the performance of solar panels. Production capacity in China for these renewable energy generators grew to 1,000 gigawatts last year.

Much of that is for domestic use, with solar power output increasing 47% year-on-year in the first half of this year, per the country's National Energy Administration, following a record 2023. As a result, the People's Republic is about to hit the goal it set four years ago of installing 1,200 gigawatts of renewable energy by 2030. China also dominates solar panels globally, accounting for some 80% of the market.

Granted, there are concerns about overcapacity. But even at a less breakneck pace of solar panel production, the demand for antimony for photovoltaic glass will be high; Kang Dongsheng, chair of major state-owned miner Twinkling Star, last year predicted the sector would replace fire-retardant products as the biggest user, Fastmarkets reported.

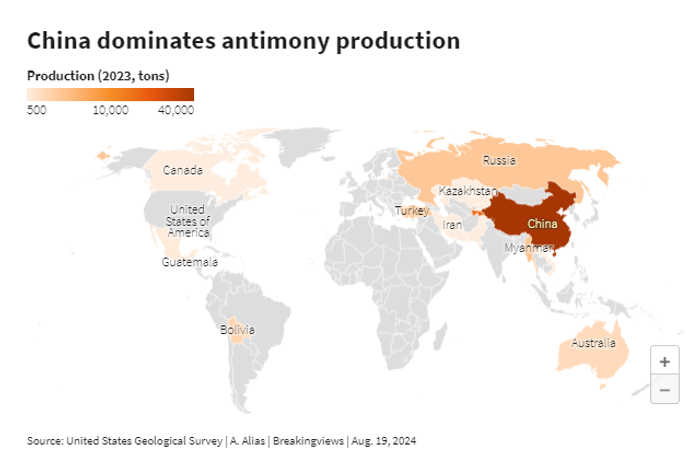

Trouble is, antimony supply has been shrinking. The People's Republic is the largest producer, accounting for almost half the element dug up last year, per the U.S. Geological Survey. That 40,000 tons, though, is 55% less than China mined four years earlier - and almost 80% less than it extracted in 2008.

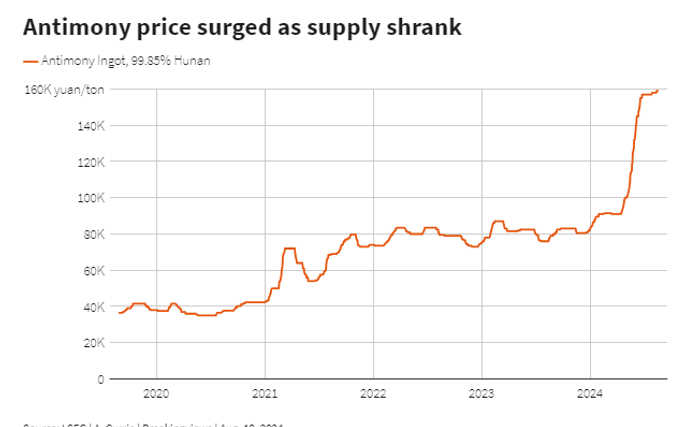

Tajikistan and, until recently, Russia, picked up some of the slack. But global production is half what it was in 2019. The price of antimony has quintupled since then, doubling this year alone. New supply looks a way off: U.S.-listed Perpetua Resources, for example, has a new mine planned for 2028.

The restrictions, which require exporters to apply for licences to sell to buyers that may have dual military and civilian uses for the product, will probably reduce Chinese exports overall. That will stoke fears that Beijing is using its market heft to retaliate against what it sees as unfair trade practices on the country. But the latest move is very much a way to defend China's green offensive.

Updated 10:03 IST, August 19th 2024