Published 15:10 IST, September 20th 2024

Axel Springer split gives M&A freedom to news unit

CEO Döpfner walks away with the media unit he built, which includes German tabloid Bild and Politico – as well as a strong hand for future M&A.

- Opinion

- 2 min read

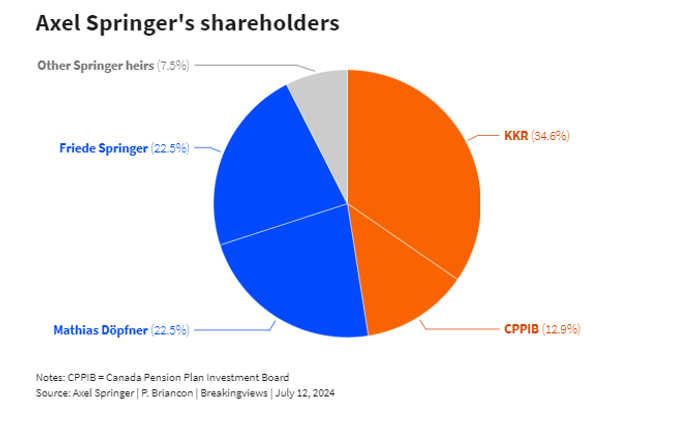

Turning the page. Mathias Döpfner and KKR have agreed on their conscious uncoupling. The co-owners of Axel Springer are parting ways in a 13.5-billion-euro breakup, after taking the German media group private five years ago for 8 billion euros including debt. KKR keeps the flourishing classified advertising business. CEO Döpfner walks away with the media unit he built, which includes German tabloid Bild and Politico – as well as a strong hand for future M&A.

The split seems based on a healthy valuation. The ads businesses, including jobs portal Stepstone, is valued at some 10 billion euros according to a person familiar with the matter, or 18 to 20 times expected 2024 EBITDA. That is way above listed peers such as German property-listing site Scout24, and in line with the valuation multiple of British car-sales group Auto Trader.

The media division, whose brands also include Business Insider and Die Welt, is valued at around 3.5 billion euros, or 12 to 14 times this year’s EBITDA, according to a person familiar with the matter. That is well below the 19 times 2024 EBITDA the New York Times is trading at, but above the 11 times valuation multiple of Rupert Murdoch’s News Corp, which suffers from a governance discount.

KKR and its partner CPP Investments will control the most valuable part of the empire. Classifieds businesses are generally amenable to private-equity ownership because of their high margins and free cash flow. The investors are also walking away from controversies like a scandal involving Bild’s former editor in chief, or distractions like Döpfner’s offer two years ago to manage the social network once known as Twitter for Elon Musk.

Meanwhile the media unit will be nearly debt-free. And to make up for the valuation gap to the KKR-controlled unit, Döpfner and his associates, who own just over 50% of Springer, will also get minority stakes in the classifieds websites. These stakes can be monetised at a later stage, serving as M&A firepower. Former music critic Döpfner is counting on the global English-language news market, notably the United States, to make up for declining growth in ageing Germany. After trying in vain to buy the Financial Times in 2015, he went on to buy Politico. The Wall Street Journal looks like a possible future target, if Rupert Murdoch is willing to sell it. Döpfner gets a shrunken Springer, but regains freedom to grow.

Updated 15:10 IST, September 20th 2024