Updated 17:02 IST, June 26th 2024

Riches of Japan wealth push will be thinly spread

The number of accounts under a government tax-free investment scheme for individuals, known as NISA, topped 23 million as of end-March, up from 19 million.

Needs must. After decades of deflation, prices are rising and threaten to erode the value of Japanese savings. No wonder Prime Minister Fumio Kishida is encouraging citizens to invest and urgently promoting the country as a leading asset management center. It heralds a new wave of competition between established financial institutions and upstarts.

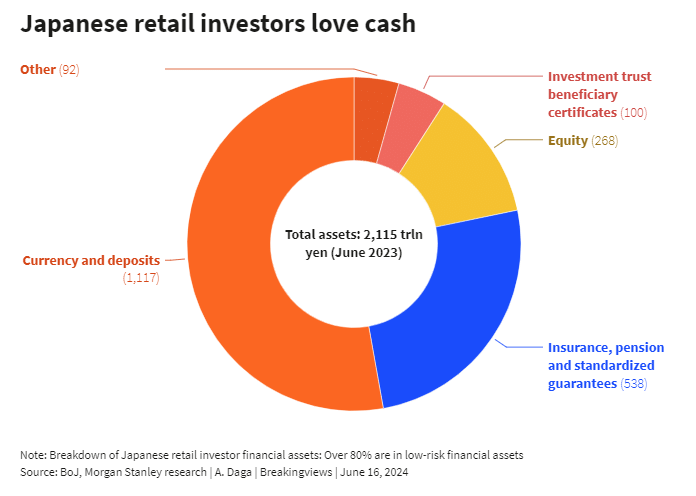

The problem is stark. Household savings amount to 2,115 trillion yen ($13.2 trillion) but more than half was held as cash and deposits at the end of June 2023, according to the Bank of Japan. For the United States and the euro area, the ratios are more like 13% and 35%. Though Japan's elderly own the bulk of financial assets, there is plenty of room to direct more wealth into investments. Kishida is aiming to double households' asset-based income.

Investment activity is rising. The number of accounts under a government tax-free investment scheme for individuals, known as NISA, topped 23 million as of end-March, up from 19 million a year ago; account openings jumped after certain allowances were increased. Almost half of new NISA investments went into Japanese stocks, per a survey. Overall, the transition of wealth to investments could translate into a 5.9 trillion yen or $37 billion revenue opportunity for financial institutions by 2030, Morgan Stanley MUFG estimates.

Japan's established financial firms are all jockeying for position. In a show of intention, Nomura and Daiwa Securities in April renamed their retail divisions both inserting the words "wealth management". The duo are trying to upgrade to serve richer customers as online brokers charging smaller fees nip at their heels. To expand its client base, Daiwa is teaming up with other companies; it picked up a stake in Aozora Bank in May, and days later unveiled a tie-up with Japan Post Insurance for asset management.

Elsewhere, Mitsubishi UFJ Financial Group, one of four megabanks, agreed in February to take a $100 million stake in WealthNavi, Japan's largest robo-adviser platform. The same month, Nomura Asset Management teamed up with KKR and Carlyle to offer funds that invest in alternative investments.

The industry is partly answering a demand by the financial regulator for banks and insurers to actively work with "emerging asset managers", and "not to exclude them simply because their business history is short". For a rich country, Japan is unusually late to develop a vibrant asset management industry. More than elsewhere, perhaps, established firms will have to share the spoils.

Context News

Japan's government on June 4 designated four regions including Tokyo and Osaka as special zones to promote new entry and expansion of domestic and foreign financial and asset management businesses to the country. The government published its "Policy Plan for Promoting Japan as a Leading Asset Management Center" in December. The plan encompasses three goals including doubling asset-based incomes and accelerating corporate governance reforms. Those first two goals were outlined in November 2022 and April 2023. The third goal aims to reform the asset management sector and asset ownership.

Published 13:24 IST, June 26th 2024