Published 10:10 IST, August 2nd 2024

Can you start investing with just Rs 100? Explore top SIPs for small budgets

Here are some mutual fund SIPs with minimum investments ranging from Rs 100 to Rs 500.

- Money

- 4 min read

SIP for small budget: Thinking about investing but worried about high entry costs? Systematic Investment Plans (SIPs) offer a viable solution. With an initial investment starting as low as Rs 500, SIPs provide access to a range of mutual fund options, according to data from Groww.

These funds cover a spectrum of small-cap and large-cap equities, each with distinct risk profiles and potential returns. Investors can select from various schemes that align with their financial goals and risk tolerance. Below are some mutual fund SIPs with minimum investments ranging from Rs 100 to Rs 500.

Axis Small Cap Fund Direct-Growth

- Type: Equity (Small Cap)

- Risk: Very High

- 3-Year Annualised Return: 24.78 per cent

- Current NAV: Rs 118.90

- Fund Size: Rs 22,262.42 Crore

- Minimum SIP: Rs 100

- Overview: Launched on September 4, 2009, this fund employs a bottom-up approach to select promising small-cap stocks with long-term growth potential. Suitable for investors with a high-risk appetite seeking capital appreciation through equity investments.

ICICI Prudential Small Cap Fund Direct-Growth

- Type: Equity (Small Cap)

- Risk: Very High

- 3-Year Annualised Return: 25.29 per cent

- Current NAV: Rs 101.26

- Fund Size: Rs 8,438.19 Crore

- Minimum SIP: Rs 100

- Overview: This fund focuses on investing in small-cap companies with significant growth potential. Ideal for investors looking for high returns and willing to take on high risk.

SBI Small Cap Fund Direct-Growth

- Type: Equity (Small Cap)

- Risk: Very High

- 3-Year Annualised Return: 25.33 per cent

- Current NAV: Rs 207.84

- Fund Size: Rs 30,835.87 Crore

- Minimum SIP: Rs 500

- Overview: Available since June 29, 1987, this fund aims for long-term capital growth by investing in a diversified portfolio of small-cap stocks. Suitable for investors with a moderately high-risk appetite.

ICICI Prudential Bluechip Fund Direct-Growth

- Type: Equity (Large Cap)

- Risk: Very High

- 3-Year Annualised Return: 23.27 per cent

- Current NAV: Rs 118.79

- Fund Size: Rs 59,364.40 Crore

- Minimum SIP: Rs 100

- Overview: Launched on October 12, 1993, this fund targets long-term capital appreciation by investing in large-cap companies known for their strong financials and stable growth.

Tata Large & Mid Cap Fund Direct Plan-Growth

- Type: Equity (Large & Mid Cap)

- Risk: Very High

- 3-Year Annualised Return: 22.05 per cent

- Minimum SIP Amount: Rs 150

- Fund Size: Rs 7,967.53 Crore

- Overview: Since June 30, 1995, this fund aims to offer capital appreciation by investing in a mix of mid-cap and large-cap companies with strong growth prospects.

"These funds span various market segments, and each presents an opportunity for investors with a long-term horizon. Whether you are looking to build wealth, save for a specific goal, or plan for your retirement, the key to a successful SIP journey lies in understanding your financial goals and risk tolerance," said Aastha Gupta, CEO, Share India FinCap.

Diversify your investments across mutual fund categories to align with your objectives. "For instance, if your aim is to secure your child's education fund over the next 15 years, an equity mutual fund might offer the potential for substantial returns over the long term," she added.

Once you have a clear understanding of your financial goals, determine the SIP amount that suits your budget. This is a critical step as you should choose an amount that you can commit to for the long haul.

Most SIPs offer a monthly investment frequency, but some also allow quarterly and weekly contributions. Select the frequency that aligns with your financial situation and investment plan.

Selecting the right mutual fund scheme is crucial, and consulting with a financial advisor or conducting thorough research can help you make an informed decision.

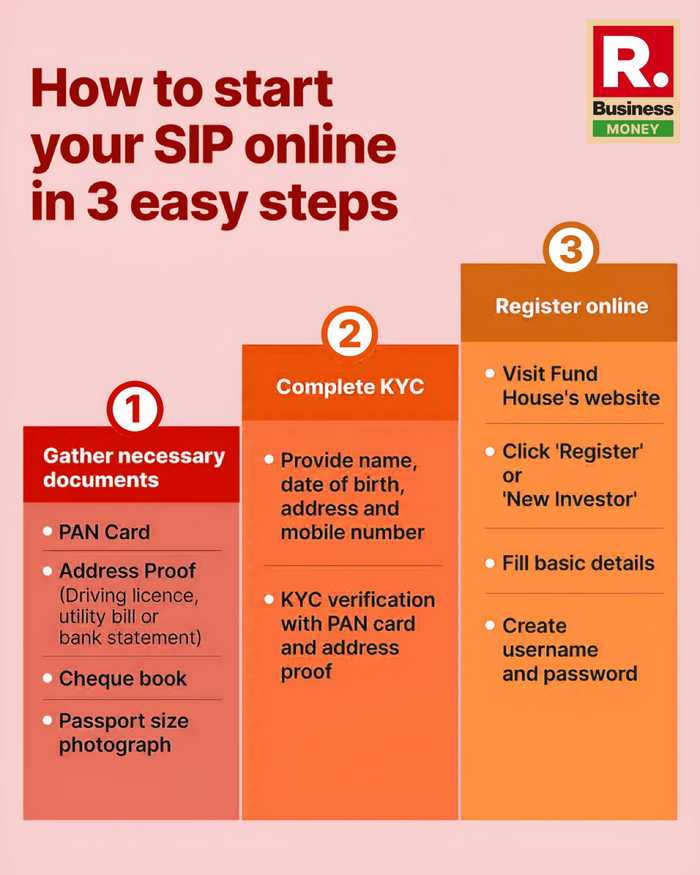

Registration for a SIP can be done online via the fund house's website or through your demat account. Alternatively, you can visit the fund house's office or an authorised distributor to get started.

"Remember to regularly review your investments, ideally at least once a year, to ensure they remain on track with your financial goals. This periodic assessment will help you gauge your progress toward your objectives," said Amit Gupta, MD, SAG Infotech.

"SIP investments are designed for the long term and offer benefits such as rupee cost averaging and the ability to withstand market fluctuations. As a beginner, starting with a small investment and gradually increasing your SIP amount can be a prudent approach," he added.

In addition to these steps, experts advise to seek the guidance of a financial advisor, stay informed about market conditions, and stay focused on your financial goals. Over time, your SIP investments can grow into a substantial corpus, allowing you to achieve your aspirations and secure your financial future.

Updated 13:13 IST, August 2nd 2024