Published 20:51 IST, July 24th 2024

Budget 2024: What new capital gains tax rates mean for your mutual funds

Hybrid funds that maintain at least 65% exposure to equity are now eligible for LTCG benefits after a holding period of over 24 months.

- Money

- 3 min read

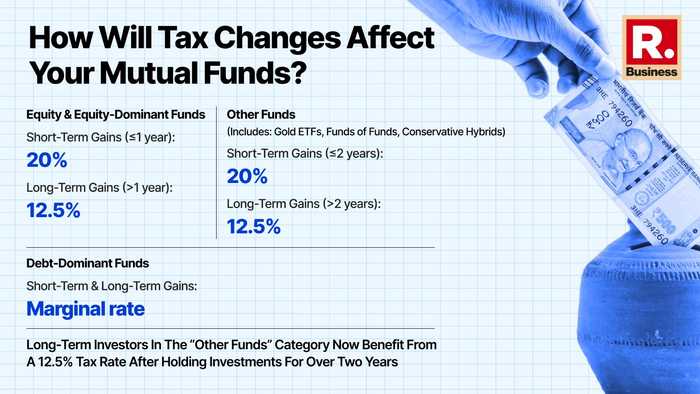

Mutual fund tax update: Finance Minister Nirmala Sitharaman's Union Budget 2024 has introduced updates to Long-Term Capital Gains (LTCG) and Short-Term Capital Gains (STCG) taxes, which will significantly impact mutual funds. The LTCG tax rate has been raised from 10% to 12.5%. For STCG, the rate on equity mutual funds has increased from 15% to 20%. Additionally, the exemption limit for LTCG has been increased to Rs 1.25 lakh per annum.

Hybrid funds and tax eligibility

Hybrid funds that maintain at least 65% exposure to equity are now eligible for LTCG benefits after a holding period of over 24 months. This change allows hybrid funds to align more closely with equity funds in terms of tax benefits. On the other hand, hybrid funds with 35-65% equity exposure will forfeit indexation benefits if held for more than three years.

Fund of funds (FoFs) tax clarifications

The treatment of Fund of Funds (FoFs) has been clarified. FoFs will now be classified as either equity funds or debt funds based on their investment composition. FoFs that predominantly invest in equity funds will qualify for LTCG benefits after a holding period of more than 24 months. Conversely, FoFs investing primarily in debt will be subject to marginal tax rates, with no distinction between short-term and long-term holdings.

Tax math

Finance Minister Nirmala Sitharaman highlighted the changes, saying, "The Finance Bill introduces simplifications in tax regimes for charities, TDS rates, reassessment provisions, and capital gains taxation."

The revised LTCG rate of 12.5 per cent implies a slight increase in tax liabilities for long-term investors. In contrast, the increase in STCG to 20 per cent will affect those investing in short-term equity mutual funds.

Each Systematic Investment Plan (SIP) contribution is considered a separate investment for tax purposes. This means that an investment of Rs 20,000 in an equity mutual fund through SIPs will be evaluated individually, affecting the holding period and corresponding tax rate for each instalment.

Assessing tax impacts

"The increase in the LTCG exemption limit to Rs 1.25 lakh is a saving grace. If you make gains of less than Rs 1.25 lakh on a listed financial asset held for over a year, you will not pay any tax. For unlisted financial assets, a minimum holding period of two years is required," Arpit Suri, CA & personal finance expert explained.

"The definition of specified mutual funds has been amended to include those investing more than 65 per cent in debt and money market instruments. This benefits mutual funds investing in gold, offshore securities, or offshore mutual funds, as redemption proceeds will no longer be deemed short-term gains," the Noida-based personal finance expert added.

The Budget 2024 tax adjustments represent a mixed impact for mutual fund investors. While the increase in STCG and LTCG rates may raise tax liabilities, the enhanced LTCG exemption limit offers some relief. Investors should assess their portfolios and tax strategies in light of these changes to optimise their tax outcomes, say experts.

Updated 14:57 IST, July 26th 2024