Published 21:34 IST, August 28th 2024

Carry trade chaos charts outlines of next selloff

Yen-denominated loans to financial market players other than banks hit $250 billion in March, researchers at the Bank for International Settlements said.

- Markets

- 3 min read

Margin of error. The sharpest recent market routs came from a dizzying array of sources: pandemic, war, UK pension funds, and most recently the combination of a poor U.S. jobs report and the unwinding of a popular Japanese-yen focused investment strategy. Underlying all of them, however, was a common trend of highly levered market players like hedge funds struggling to meet margin calls. There’s every reason to think it will keep happening.

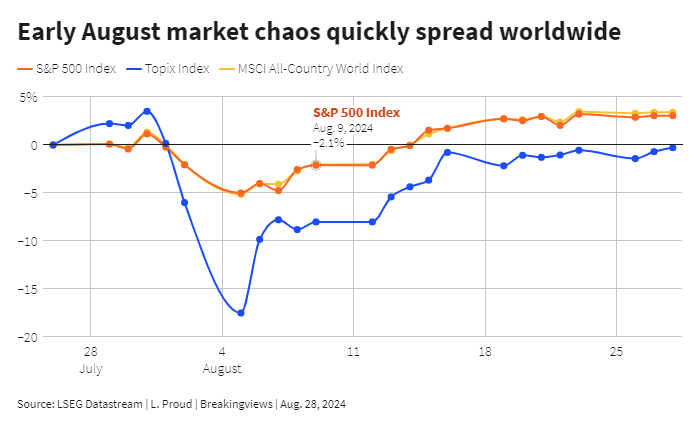

Researchers at the Bank for International Settlements have repeatedly drawn attention to the worrying frequency of what they call “procyclical deleveraging”. On Tuesday, they released a first account of the Aug. 5 flash crash. The triggers, they note, were seemingly minor: a U.S. labour report on Aug. 2 that was bad but not disastrous, and the wider context of a well-flagged hawkish turn by the Bank of Japan. Somehow, that turned into a global selloff that sent the Japanese Topix Index down by more than a tenth and wiped $1 trillion off the valuation of previously popular artificial intelligence and technology stocks.

The backdrop explains the moves. For starters, hedge funds were highly leveraged: one indicator of U.S. hedge funds’ indebtedness had soared to its pre-pandemic heights. Meanwhile, investors increased their use of a strategy known as the carry trade, which involves borrowing in a currency with low rates like the yen to invest in assets denominated in high-rate ones like the Mexican peso. The BIS researchers make several stabs at trying to quantify this trade, landing on a “rough middle ballpark” estimate of $250 billion before the selloff. They think this itself is probably a lowball.

Hedge funds and other investors often execute this strategy through derivatives. When the positions lose money, or when market volatility rises, dealers and clearinghouses will typically ask the investors for higher margin levels, reducing risk. The hedge funds and other market players thus tend to need cash in the middle of a panic, forcing them to sell unrelated positions just to meet margin calls on the losing bets. That explains how a currency-linked trade and U.S. stocks became entangled. A little volatility led to margin calls, which led to broader asset sales and further volatility. In March 2020 and September 2022, a similar self-reinforcing cycle affected U.S. and UK government borrowing markets, forcing central banks to limit the price collapse by buying assets.

Regulators are alert to the recurring problem, which relates to a post-2008 effort to move risk away from banks and into markets. A triumvirate of the Basel Committee on Banking Supervision, Committee on Payments and Market Infrastructures and Board of the International Organization of Securities Commissions in January recommended various measures to make clearinghouses’ margin calls more predictable. Transparency is helpful, but it’s hard to see how it would change the fundamental dynamic. Margin calls keep blowing up markets, and there’s no end in sight.

Context News

Yen-denominated loans to financial-market players other than banks hit $250 billion in March, researchers at the Bank for International Settlements said in a bulletin published on Aug. 27. The figure is a rough proxy for the size of the popular yen carry trade, which involves borrowing in the low-yielding currency to invest in a high-yielding one. A collapse in the trade contributed to market chaos on Aug. 5, when Japanese and worldwide stock markets slid. The BIS researchers concluded that cascading margin calls helped to propagate the problem, as investors sold whatever they could to meet the new higher margin requirements.

Updated 21:34 IST, August 28th 2024