Published 18:41 IST, August 22nd 2024

Shipping rates yet to signal a calmer Middle East

Like the price of oil, shipping costs are an imperfect barometer of Middle East strife.

- Industry

- 4 min read

Sails bump. Investors are once again hoping for a calmer Middle East. U.S. Secretary of State Antony Blinken is pushing hard for an Israel-Hamas ceasefire deal. Yet one rough gauge of regional tensions – the cost of shipping cargoes around the world – doesn’t inspire much confidence.

Prior to Israel’s war last October, an oversupply of ships looked set to depress freight rates, and thus the bottom lines of Denmark’s $25 billion Maersk and Germany’s $30 billion Hapag-Lloyd. But since then Houthi militants aligned with Israel’s foe Iran have repeatedly attacked container ships passing through the Red Sea, blocking the key Suez Canal conduit. As ships reroute around Africa, the need to maintain trade at previous speeds has eaten through the glut and started to hike rates.

All freight companies have benefitted. Just before Hamas attacked Israel on Oct. 7, the cost of shipping a 40-foot container from China to the U.S. west coast, for example, was around $1,600, according to an index compiled by freight booking platform Freightos. That rose to around $5,000 when detours around Africa became more widespread in February. Recently, amid peak shipping season in the run-up to Thanksgiving and Christmas, rates hit $8,000.

Like the price of oil, shipping costs are an imperfect barometer of Middle East strife. Rates have also spiked due to companies’ desire to frontload cargoes ahead of tariffs announced by U.S. President Joe Biden on $18 billion of Chinese goods – a dynamic that may intensify if Donald Trump replaces him. Still, Red Sea blockages are correlated to the war.

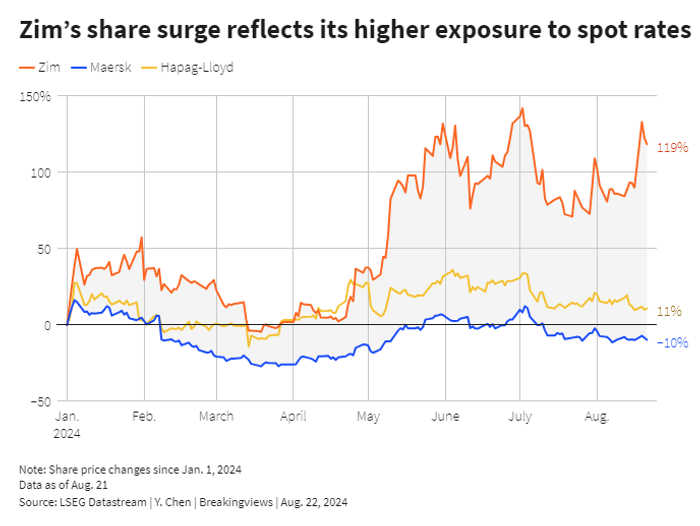

The best placed freight groups are those with shorter-term contracts that benefit from the higher prices. Ironically, that includes $2.6 billion Haifa-based Zim Integrated Shipping, in which the Israeli government holds a golden share. One industry expert estimates 70% of its contracts are the more lucrative flexible spot ones. So far this year, Zim’s U.S.-listed shares have risen about 120% while those of Hapag-Lloyd and Maersk – which have more longer-term contracts – are up 11% and down 10% respectively.

Zim and Maersk executives don’t see a rapid end to elevated rates. On Monday, Zim reported a 50% increase in revenue in the March-June quarter year-on-year, and guided its 2024 operating profit outlook higher. Importantly, the Israeli group reckons the only risk to that forecast is that the Red Sea crisis concludes and Suez traffic resumes, a scenario it sees in the short term as “less likely”.

Blinken’s efforts notwithstanding, Israel and Hamas have struggled to find common ground for over 10 months. Even if a peace deal is reached, the fear of Houthi attacks will persist. Either way, investors may be better served focusing on shipping forecasts, rather than political ones.

Context News

A Greek-flagged oil tanker was adrift in the Red Sea on Aug. 21 after repeated attacks that started a fire on the vessel and caused the ship to lose power, the UK maritime agency said. No group has yet said it was behind the attacks, which Greece’s minister of maritime affairs condemned as a flagrant violation of international law, according to the BBC. U.S. Secretary of State Antony Blinken departed from the Middle East after a trip to the region to inject urgency into efforts to broker a Gaza ceasefire deal, Reuters reported on Aug. 20. After meeting with Prime Minister Benjamin Netanyahu on Aug. 19, Blinken said Israel had accepted the proposal and urged Hamas to do the same. The Palestinian group has not explicitly rejected it, but says it overturns previously agreed terms. The details of the so-called bridging proposal have not been made public. Iran has threatened to retaliate against Israel after the assassination of Hamas leader Ismail Haniyeh in Tehran on July 31.

Updated 18:41 IST, August 22nd 2024