Published 16:30 IST, November 17th 2024

China developers’ survival fight gets litmus test

Sunac China said on Nov. 14 it has proposed a debt restructuring plan for onshore bondholders.

- Industry

- 3 min read

Round 2: Fight. A year after a landmark deal to restructure $9 billion of offshore bonds, Sunac China is hoping to cut leverage further and get a vote of confidence from onshore creditors, too. The $3.1 billion Chinese property developer on Thursday said it will offer them four options for repaying its domestic paper, totalling 16 billion yuan ($2.1 billion) according to Reuters, including buying back some at an 82% haircut and a debt-for-equity swap. How creditors vote will shed light on their views about not just the Hong Kong-listed firm’s chances of survival, but also Beijing’s latest attempts to end the property slump.

The offshore restructuring Sunac pulled off in November last year also involved an equity conversion and a lengthy extension for repaying debt, but effectively no haircut. The process bought time, but staying afloat has remained an uphill battle. Sunac has received financing lifelines from state-backed firms, for instance, but only after selling them majority interests in some valuable projects. It also relocated its headquarters from Beijing to Tianjin, Chair Sun Hongbin’s hometown, for bigger support from the local government.

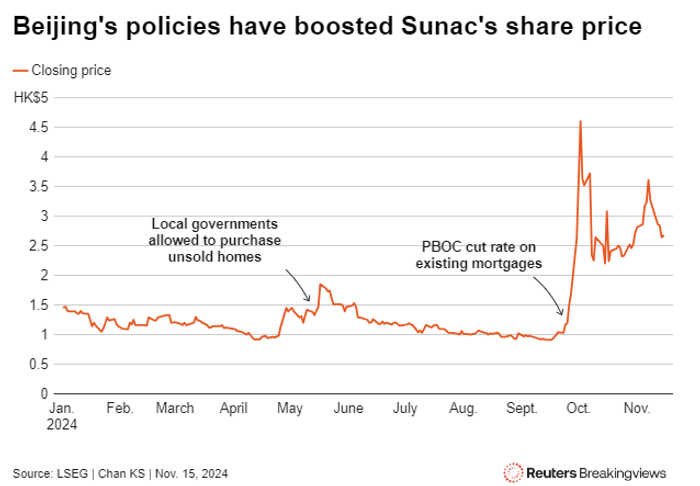

Sunac's share price has rebounded nearly 80% this year, and the company was able to raise $155 million last month in the first share placement by a Chinese developer since 2022. That's thanks partly to its own overhaul, but also to Beijing's recent policies to shore up the housing market.

Riding on the improving mood, Sun is putting his firm to test again. The more creditors opt to swap their bonds for equity, for example, the more bullish the signal it'll send. The company proposed to accept up to 3 billion yuan of bonds under this option, which, according to sources cited by Reuters, would be priced at a 167% premium to where its stock closed on Nov. 5.

Of course, bondholders can walk away now with 18% of their principal, though the maximum amount repayable under this option will be 4.4 billion yuan. Otherwise, they can also choose between repayments backed up by receivables in real estate projects, or owning new notes carrying a 1% coupon and maturing almost 10 years later than current bonds.

Investors in debt restructuring talks with the likes of Country Garden will keenly watch how round two of Sunac's restructuring plays out.

Context News

Sunac China said on Nov. 14 it has proposed a debt restructuring plan for onshore bondholders. In one of the four options, the Chinese developer is proposing to buy back up to 4.4 billion yuan worth of bonds at 18% of their nominal value. It also proposes a swap scheme to convert up to 3 billion yuan worth of bonds into its Hong Kong-listed shares.

Updated 16:30 IST, November 17th 2024