Published 13:25 IST, October 25th 2024

Why stablecoins will entrench dollar’s supremacy

Russia’s BRICS Bridge would enable the settlement of trade and finance between Brazil, China, India and other members of the group, using their own CBDCs.

Bridge too far. Uncle Sam can rest easy for now. A Russian plan to break the grip of the U.S. dollar through a new international payments network met a cool reception at the BRICS summit in Kazan this week, with the emerging market club’s official declaration failing to mention the “BRICS Bridge” initiative by name. Rather than slipping, in fact, the greenback’s supremacy may be strengthening because of an entirely different monetary innovation: dollar-backed stablecoins.

Russia’s BRICS Bridge would enable the settlement of trade and finance between Brazil, China, India and other members of the group, using their own central bank digital currencies (CBDCs). A mooted second would introduce a new international currency backed in part by gold. That could threaten not just the reach, but also the value, of the U.S. dollar. The yellow metal would rally, and the greenback wilt, if use of the new monetary unit were to take off. With the gold price touching an all-time-high of nearly $2,750 per ounce on the summit’s first day, there was speculation that traders were already front-running the rout. In the end, however, the meeting’s official statement gestured only vaguely towards the project that Moscow bills as a major reorientation of the international monetary system.

Instead, the most important monetary announcement of the week took place in California. On Monday, San Francisco-based U.S. payments firm Stripe announced the acquisition of a little-known crypto startup for $1.1 billion. Its target – called, coincidentally, Bridge – is a specialist in stablecoins: private, digital currencies pegged to a fiat currency such as the dollar. This Stripe-Bridge stablecoin tie-up is more likely to define the future world monetary order than the BRICS Bridge CBDC one. It is also likely to strengthen, not weaken, the role of the greenback – and perhaps its value too.

Underlying both initiatives are three trends of the last fifteen years. The first is the spread of mobile telephony. That democratised digital payments and made them possible on the move. The second is the steep decline in the cost of computing power and internet bandwidth. That opened up digital settlement in the cloud. The third was innovation in cryptography. That enabled the development of secure, decentralised digital ledgers such as blockchains, and the cryptocurrencies that can operate on them.

Private, digital currencies like bitcoin were the first to emerge from this revolutionary mix. Two advantages over bank-based currencies make them in principle a killer app. The first is the intrinsically international nature of the internet, which makes web-based cryptocurrencies global in scope. There is no need for cumbersome national intermediaries: money can flow freely around the world. To the communications miracle of VOIP, voice over internet protocol, can be added the financial miracle of MOIP, or money over internet protocol. The second advantage lies in functionality. Traditional currencies, even in virtual form, can only settle payments. Cryptocurrencies are programmable: they can automate other financial services too. A technology which economises on bankers and lawyers is always a popular idea.

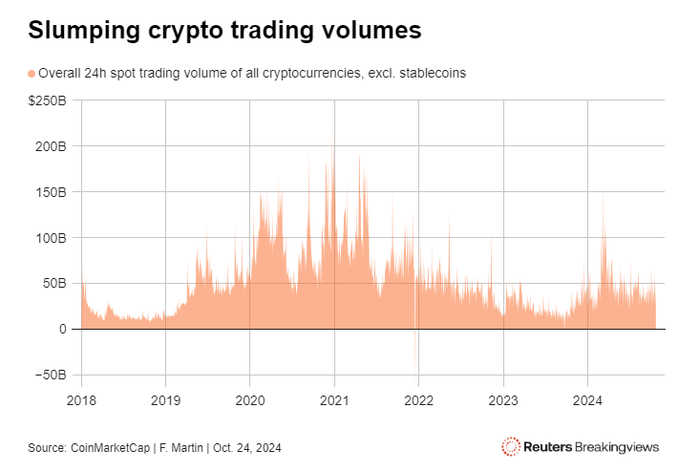

Unfortunately, the first generation of private, digital currencies were hobbled by a key design flaw. Following bitcoin’s lead, most adopted their own standard units, untethered from existing currencies. That rendered their market value nebulous, which in turn led to epic speculative booms and busts. It also implied competition with existing national currencies, and so provoked a ferocious regulatory backlash. The result is that as of today, transactions in own-standard cryptocurrencies have tumbled from their 2021 peak.

The digital revolution, however, is now beginning to birth public, digital currencies like CBDCs too. CBDCs share the plus of programmability with their private, digital counterparts. But as virtual representations of existing fiat currencies, they swerve the speculative volatility and regulatory exposure that caused own-standard cryptocurrencies to come unstuck.

Yet while CBDCs are an advance on private cryptocurrencies in these respects, in others they take a step back. By definition, they are designed to settle payments under a particular central bank, not as part of a seamless global network. That’s why add-ons like BRICS Bridge are necessary to allow them to facilitate cross-border trade and finance. Then there is the awkward detail that they pose an existential threat to traditional banking systems. If money-users can transact directly using risk-free central bank money, why would they continue to hold deposits at risky commercial banks? To ask the question is to answer it – and to keep bank treasurers up at night.

Stablecoins, the latest innovation in digital currency, are a hybrid of the private and public models and claim to deliver the best of both their worlds. Like private cryptocurrencies, they offer a real-time, global payments platform – without the need for any BRICS Bridge. Like CBDCs, they offer digital tokens collateralised by traditional national money – rather than free-standing monetary units at the mercy of speculative whims. In short, they promise the functionality of a global, decentralised blockchain combined with the familiarity, and regulatory acceptance, of the fiat regime.

Stripe CEO Patrick Collison dubs the resulting combination “room-temperature superconductors for financial services” – an analogy with the Holy Grail of electrical engineering that would permit near-frictionless transmission of energy. No doubt that’s a touch of hype. Stablecoins have had their niggles too. Tether, the largest of today’s providers, was fined $42 million in 2021 by the U.S. Commodity Futures Trading Commission for inaccurately representing the collateral it held.

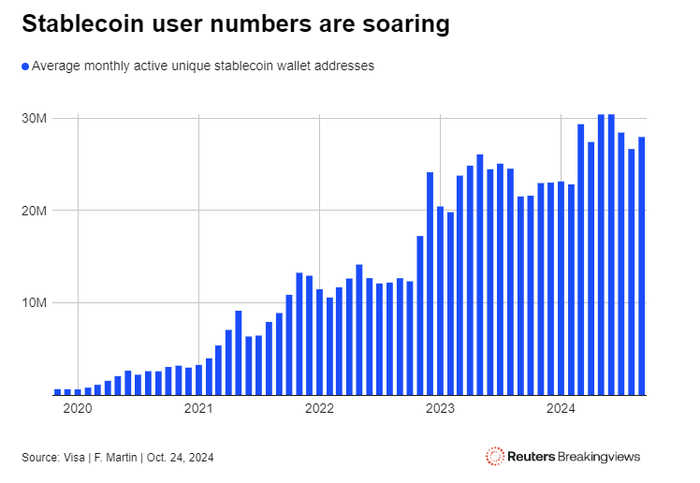

Still, customers like the concept. In stark contrast to the own-standard crypto complex, the number of active stablecoin users has roughly tripled in two and a half years. Stablecoins, it seems, give the people what they want: constant, real-time access to a globally usable, digital dollar.

For decades, even the United States’ allies have chuntered about its unfair dominance of the international monetary system. The digitisation of finance is certainly changing the rules of the game. Yet even if Russia’s BRICS Bridge eventually catches on, it’s unlikely to extinguish the “exorbitant privilege” of which then French Finance Minister Valéry Giscard-d’Estaing famously accused the United States as far back as 1965. Far more probable is that Stripe-Bridge reinforces former U.S. Treasury Secretary John Connally’s equally notorious retort: “It’s our currency, but your problem.”

Updated 13:25 IST, October 25th 2024