Published 11:00 IST, January 5th 2025

Margin Pressures May Intensify; Slow Growth: Nomura Lists 10 Stocks For FY26

As per the report, the demand is expected to remain subdued, which will make it difficult for the companies to pass through the high commodity prices

- Economy

- 2 min read

Global rating agency Nomura anticipates margin pressures to intensify in FY26 owing to slower demand and increased competition which is likely to put strain on corporate profitability.

"Most companies could pass on commodity costs post-COVID until 2025 due to high demand for their products; however, we believe, given slow demand, the tide has turned,” the Nomura report notes.

As per the report, the demand is expected to remain subdued, which will make it difficult for the companies to pass through the high commodity prices making it even more challenging for businesses to safeguard their margins in a low-growth environment.

Slower Economic Growth Outlook

India's economic growth is expected to slow down in the coming years. According to Nomura's Economic team, GDP growth will decelerate to 6.0 percent in FY25 from 8.2 percent in FY24 and stabilize at 5.9 percent in FY26.

"Macroeconomic indicators point to an overall slowdown," the report underlines, signaling a shift in the country's economic momentum. In addition to this slowdown in growth, inflation is expected to ease, with CPI inflation forecast to decline from 5.4 per cent in FY24 to 4.9 per cent in FY25 and then to 4.3 per cent in FY26. With global growth remaining weak and commodity prices subdued, some sectors still have inflationary pressures.

Rural Demand May Offset Slowing Growth

On the bright side, demand in the rural segment seems to be a silver lining in the economy. Favorable rainfall and higher crop prices could help lift the economic slowdown. According to the report, "some green shoots visible in rural demand given good rainfall overall and higher crop prices and potential cuts in interest rates," which will help to moderate the broader slowdown and support general economic activity.

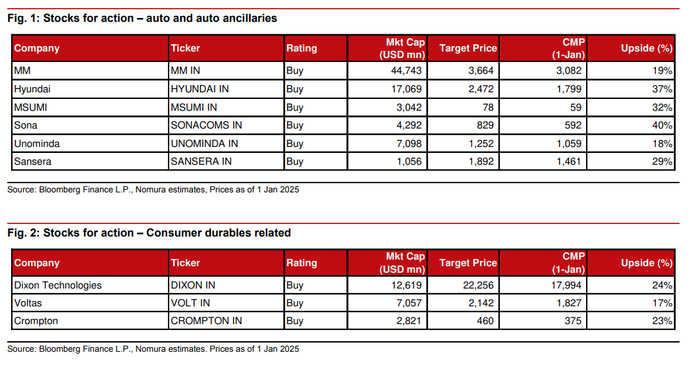

Here is the list of stocks mentioned by Nomura with stock action:-

Updated 12:10 IST, January 5th 2025