Published 11:54 IST, September 2nd 2024

India’s food inflation debate will get spicier

The challenge is that food accounts for nearly half of India's CPI index and is frequently the deciding factor at policy meetings.

- Economy

- 3 min read

Food for thought.. Governor Shaktikanta Das recently shot down a proposal to strip out food prices from the Reserve Bank of India's inflation target. Ignoring the item would allow the institution to trim interest rates. With the economy slowing - data released on Friday showed GDP growth hit 6.7% for the three months to the end of June, a five-quarter low - the pressure to bend is building.

Das last month rebuffed the idea outlined in an annual survey led by the government's Chief Economic Advisor V. Anantha Nageswaran. It called for excluding prices of all edibles, from pulses to vegetables, from the RBI's 4% consumer price inflation target. The cost of food, the survey argues, is subject to supply-side pressures which central banks cannot influence effectively.

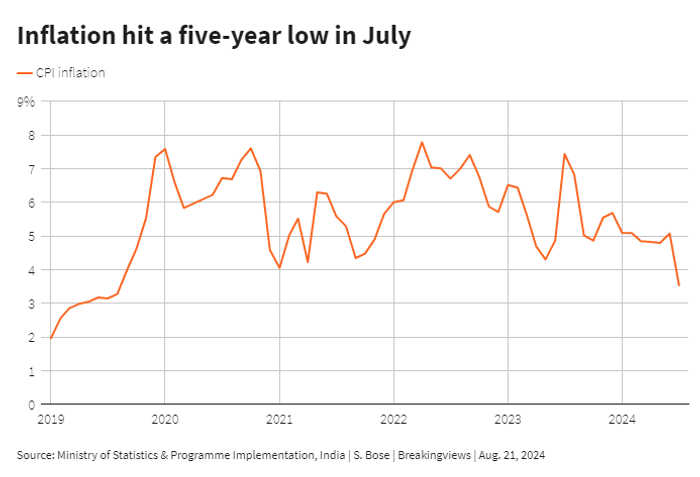

The challenge is that food accounts for nearly half of India's CPI index and is frequently the deciding factor at policy meetings. Though the measure fell below 4% in July, Das says one-off readings will not drive policy decisions. As a result, the RBI has kept interest rates unchanged at 6.5% since February 2023, and borrowing costs for big businesses remain high.

Modifying the composition of the inflation target would ignore the role of demand in shaping prices of items like meat. It would also give the RBI fewer opportunities to flag food-related risks, an important proxy for climate change. Finally, as Das notes, most people in India understand inflation through grocery bills which, if elevated for too long, can feed into other costs.

A better alternative is to cut the weight of food to align to current consumption trends. Official data for the year ended March 2023 shows food makes up 39% of city-dwelling Indians’ monthly per capita spends, although it still bites out nearly half of wallets for the majority of Indians who live in rural areas.

The current inflation-targeting framework was adopted less than a decade ago, and shifting the goalposts as growth moderates would be a bad look. The RBI has a tolerance band of plus or minus two percentage points around its existing target that allows it to use its judgment to look through wild price swings, as it did during the Covid-19 pandemic. Das, a long-serving governor, has made his views clear, but as inequality rises his eventual successor will face the same unpalatable pressure.

Context News

India’s retail inflation needs to fall durably for its central bank to cut its key lending rate, Reserve Bank of India Governor Shaktikanta Das said in an interview with television channel NDTV Profit on Aug. 20. A dip below the 4% target in July is not enough for the RBI to move, he added. Retail inflation fell to a near five-year low of 3.54% year-on-year in July, as the effect of a high base helped ease food price rises, official data released on Aug. 12 showed. The country’s monetary policy committee cannot afford to look through food inflation in an environment of persistent high prices, Das said after a policy meeting on Aug. 8. Rate setters should not become complacent about easing core inflation because “the public at large understands inflation more in terms of food inflation than the other components of headline inflation,” he added.

Updated 11:54 IST, September 2nd 2024