Published 11:05 IST, October 16th 2024

EU champions’ hope will slam into hard M&A reality

European Commission President Ursula von der Leyen wants her new antitrust chief Teresa Ribera to review the bloc’s merger guidelines.

- Economy

- 6 min read

Return to scale. Brussels wants European companies to join together and compete with U.S. and Chinese rivals. In many cases, however, national politicians and investors may have different ideas. Unless European Commission President Ursula von der Leyen can resolve that tension, she won’t get the European corporate champions that she and her colleagues desire.

For investment bankers with long memories, it’s ironic that the historically deal-sceptic Commission is now concerned about a lack of corporate heft. Outgoing antitrust boss Margrethe Vestager and her predecessors blocked deals ranging from the planned merger of Alstom and Siemens’ train unit in 2019, Deutsche Börse’s acquisition of exchange rival NYSE Euronext in 2012, and Schneider Electric’s 6.4-billion-euro purchase of rival Legrand in 2001. Those deals, the Commission argued, could have created companies with too much market influence and the power to hike prices for customers.

Times have changed, however, and Brussels bigwigs now seem more worried about the puny size of their domestic companies. In a September “mission letter” to new competition chief Teresa Ribera, who takes over later this year, von der Leyen asked for a review of Europe’s merger guidelines, focusing on the need for greater “resilience, efficiency and innovation”. That’s antitrust code for “we want consolidation”. A few days later, Ribera promised that the rules would “evolve” to help European companies bulk up. The bloc is not alone: the new UK Labour government will ask its competition authority to prioritise growth, investment and innovation as part of a wider war on so-called “red tape”, Sky News reported on Monday.

The change of heart reflects a realisation that the European Union’s often subscale private sector may struggle to cope with capital-intensive trends like rising defence needs, the shift to a green economy and artificial intelligence. A recent report by former European Central Bank boss Mario Draghi estimated that the energy transition, digital investment and necessary extra military spending could require up to 800 billion euros of annual investment across both the public and private sector.

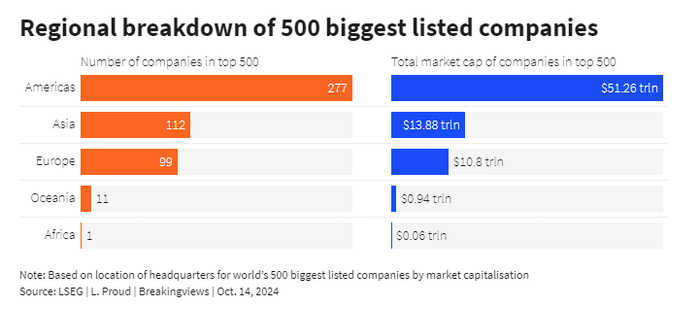

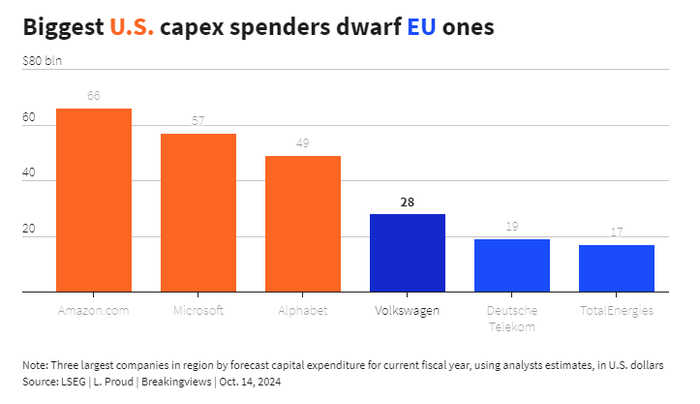

Europe’s relatively puny companies may struggle to muster those kinds of resources. The region is home to just 99 of the world’s 500 largest public companies by market capitalisation, LSEG data shows, compared with 112 for Asia and 277 for the Americas. Amazon.com alone will invest about $66 billion through capital expenditures this year, according to analysts’ estimates gathered by LSEG. That’s more than the three biggest EU-based spenders combined: Volkswagen, Deutsche Telekom and TotalEnergies. The aggregate market capitalisation of five large U.S. technology companies – Apple , Nvidia, Microsoft, Alphabet and Amazon – just about exceeds the value of the entire STOXX Europe 600 Index, which also includes UK-listed groups.

The question is whether looser competition policy alone can solve this. Draghi’s report mentions the need for consolidation in his chapters on telecoms, semiconductors and defence. With good reason: all three sectors are geopolitically important and also of paltry size compared with their Chinese and United States-based counterparts. The problem is that M&A isn’t obviously the right solution.

Start with telecoms. Most countries have a handful of mobile and broadband operators, with the largest market share typically held by a former state telephone monopoly like Telecom Italia and Madrid-based Telefónica. Within-market deals can help save costs: France’s Orange, for example, plans to generate 490 million euros of annual synergies by combing its Spanish unit with local player MásMóvil. Yet consolidation inside countries won’t create U.S.-style giants. Even if all the main markets went from the typical four-player structure down to three, Europe would still have a patchwork of local players rather than cross-border champions.

Meanwhile, the deals that would generate meaningful scale make little financial sense. A Deutsche Telekom-Orange merger, for example, would create a 160-billion-euro broadband and mobile champion with 156 billion euros of revenue this year – more than U.S. heavyweight Verizon, according to analyst estimates gathered by LSEG. Beyond sheer size, though, it’s hard to see the industrial logic. Cross-border synergies are lacking in Europe’s fragmented and highly politicised telecom markets, bankers and analysts say. And operators with a global sprawl tend to incur a share-price penalty. Britain’s Vodafone, for example, has been breaking itself up after failing to convince shareholders of the merits of a business model spanning many different European countries.

Semiconductors are another case in point. Netherlands-based 300-billion-euro equipment manufacturer ASML is the only European company in the sector with a 12-digit market capitalisation. Two of the other large regional chipmakers, Germany’s 40-billion-euro Infineon and Franco-Italian 23-billion-euro STMicroelectronics, on paper look like possible candidates for a scale-building merger. Yet the logic for investors would probably be limited to having a more diversified set of customers, analysts told Breakingviews, which might not be enough to offset the political controversy of such a project. Countries tend to jealously guard local chip investments, meaning cost savings could be minimal.

There’s a similar risk in the defence industry, where combinations involving national players like France’s Thales, Italy’s Leonardo and Germany’s Rheinmetall would only work with the aid of national political backing. That’s so far lacking, and it’s not clear that von der Leyen has the heft to change it.

The common theme, then, is that cross-border deals in strategically key sectors are either financially or politically tricky – and often both. Nor does it help that investors often seem allergic to the idea of ambitious dealmaking. Shares in Norwegian oil group Equinor dropped 4% immediately after it unveiled a 10% stake in Danish wind-power group Orsted last week. Back in 2019, when Infineon announced a $10 billion transatlantic acquisition, its shares sold off by 5% in the morning, and trailed STM’s over the ensuing months. Understandably, shareholders are generally suspicious of expansionist projects that add risk and complexity to a company’s equity story.

That’s not to say that von der Leyen and Ribera’s efforts will be worthless. Permitting local telco rollups would relieve pressure on the operators’ investment budgets, potentially boosting fibre broadband investment. And in situations where national capitals get behind a deal, as was the case with Siemens-Alstom, it seems likely that the Commission will no longer be an obstacle. Yet instances where politicians, CEOs and investors all agree on a cross-border merger are relatively rare. There’s only so much that von der Leyen and Ribera can do alone.

Context News

European Commission President Ursula von der Leyen wants her new antitrust chief Teresa Ribera to review the bloc’s merger guidelines, with a view to giving more weight to “resilience, efficiency and innovation”, according to a Sept. 17 mission letter. Ribera told the Financial Times in a Sept. 19 interview that Europe’s competition rules would “evolve” to help European Union companies build the scale needed to take on U.S. and Chinese rivals. The new UK Labour government will ask the country’s Competition and Markets Authority to prioritise growth, investment and innovation, Sky News reported on Oct. 14.

Updated 11:05 IST, October 16th 2024