Published 11:18 IST, September 9th 2024

China brokerage deal has more bark than bite

In truth, the Guotai-Haitong hybrid will do more for the former goal than the latter.

- Economy

- 3 min read

Big deal. It’s hard to deny the impact of merging $17 billion Guotai Junan Securities with its $14 billion cross-town rival Haitong Securities. The proposed share swap between the two Shanghai-based firms will, if approved, create a financial firm with assets of nearly $230 billion. That will knock Citic Securities from its throne as China’s biggest brokerage. But size isn't everything.

State tabloid Global Times hailed the deal as the first big step to consolidating the sector and furthering Beijing’s efforts to build a “first-class investment bank”. That tracks with comments from securities regulator head Wu Qing, who in March said that China would create around 10 leading securities firms by 2035, including two to three globally competitive investment banks.

In truth, the Guotai-Haitong hybrid will do more for the former goal than the latter. Haitong Securities, once the outperformer of the pair, was a major player in helping Chinese property firms like China Evergrande and HNA raise dollar-denominated debt — until that business collapsed, saddling offshore subsidiary Haitong International with serious losses.

That Hong Kong-listed unit was taken private in January, and Haitong proper reported a 48% year-on-year revenue drop in the first half of 2024. Concerns over the company's operations have mounted after the former co-head of its investment banking division was detained and extradited to China after fleeing to Laos, just days before the merger’s announcement.

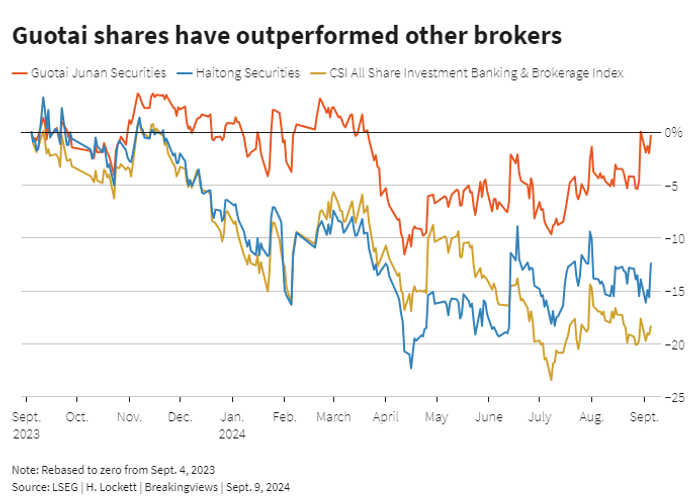

Guotai has fared better, with revenue down just 7% in the six months to the end of June and its Shanghai-listed shares basically flat over the past year, compared to a 12% fall for Haitong. That leaves it relatively well-placed to sort through Haitong’s troubles. As one Guotai insider put it to Breakingviews, though, there was little appetite for the merger “because nobody likes to eat shit”.

Since both Guotai and Haitong ultimately answer to Shanghai’s government, there is little reason to doubt the deal will go through. But in terms of bookrunning prowess, the two brokers together accounted for only about 10% of Chinese equity capital raising by value last year, per Dealogic data. That's well behind Citic at 15%, which along with fellow industry heavyweight CICC also boasts a sizable offshore presence - unlike either of the merging companies.

Such a big tie-up may at the very least cajole some of the country's other 146 brokerages into considering deals of their own. But Wall Street powerhouses like Goldman Sachs and JPMorgan don't need to worry that a new, globally competitive investment bank will enter the fray any time soon.

Context News

Guotai Junan Securities plans to merge with Haitong Securities through a share swap pending shareholder and regulatory approval, per exchange filings on Sept. 5. The combined entity will have assets of about 1.6 trillion yuan ($225 billion), outstripping industry leader Citic Securities. In March, China Securities Regulatory Commission head Wu Qing said China would seek to create around 10 leading firms in the sector by 2035, including two to three globally competitive investment banks.

Updated 11:18 IST, September 9th 2024