Published 13:54 IST, October 28th 2024

India’s microfinance trouble goes mainstream

IndusInd Bank on Oct. 24 reported a 39.5% year-on-year fall in net profit to $158 million for the three months to the end of September.

- Economy

- 3 min read

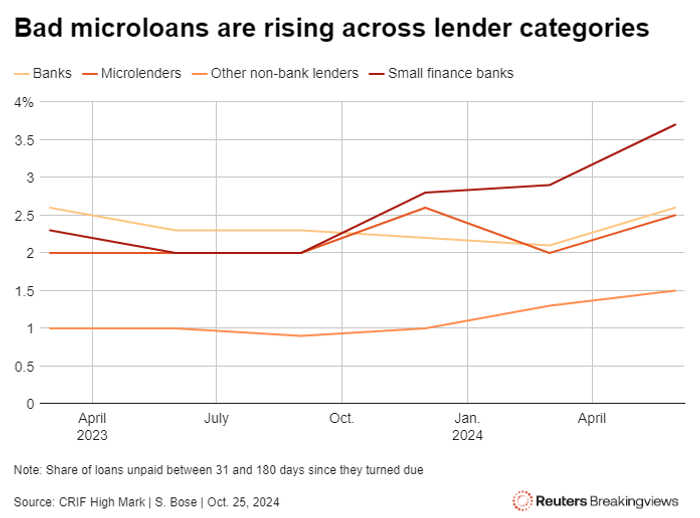

No credit. Loans to the poor are turning sour fast in India. Shares of $11 billion IndusInd Bank crashed 19% on Friday after it reported a spike in microloan delinquencies; days earlier two of its peers, $42 billion Kotak Mahindra Bank and RBL Bank, reported similar bad numbers. Investors are pricing in a throwback to the 2010 crisis that roiled this niche corner of the credit market.

IndusInd’s net profit for the three months to the end of September fell 40% year-on-year to $158 million, dragged down by a near-doubling in provisions for bad loans. The worst-hit category was microfinance, where gross non-performing assets rose by more than a percentage point to 6.54%. The reaction, a $2.3 billion plunge in IndusInd’s market capitalisation, is equivalent to 59% of the bank’s entire microfinance book and nearly as much as it paid in 2017 to acquire Bharat Financial Inclusion, a deal that brought this small part of the industry deeper into India's mainstream lenders.

IndusInd’s microloan book is faring only slightly worse than the 6% bad-loan ratio Bharat Financial had at the time of the acquisition nearly a decade ago. But repayments are overdue for loans equalling another 4% of the portfolio, most of which will turn bad over the next six months, analysts at Jefferies estimate. On top of that is an ever-present worry that politicians could make things worse.

Local leaders periodically grant debt waivers to low-income borrowers to ease the strain on household incomes and to boost their own popularity, as northeastern Assam state did last year. Such waivers hit a crescendo in 2010 when a spate of borrower suicides in southern Andhra Pradesh nearly wiped out an earlier incarnation of Bharat Financial .

IndusInd acquired the company at a time when lenders hoped digitisation would help them to better assess credit risk. That hope is now getting a reality check. The Reserve Bank of India has sprung into action, raising capital requirements and earlier this month it halted lending at four shadow banks it accused of "usurious" pricing and big markups over their funding costs.

Those moves are meant to put the industry on its guard. IndusInd told Breakingviews it expects heightened caution, a recovery in rural incomes and receding heatwaves and floods to support the sector. But growth in India's $4 trillion economy is slowing, and investors, unsurprisingly, are in no mood to deal out credit upfront.

Context News

IndusInd Bank on Oct. 24 reported a 39.5% year-on-year fall in net profit to $158 million for the three months to the end of September, sharply below analysts' expectations of $263 billion as per data compiled by LSEG. The gross non-performing asset ratio in its microfinance book worsened to 6.54% as of Sept. 30 from 5.16% as of June 30.

Updated 13:54 IST, October 28th 2024