Published 22:00 IST, July 1st 2024

Anglo American’s revamp has an inauspicious start

The $41 billion company’s Australian coking coal unit was supposed to be the easiest unit to offload as part of an overhaul.

- Economy

- 2 min read

Baptism of fire. Anglo American's seven-week-old restructuring plan has just been dealt a severe blow. The $41 billion company’s Australian coking coal unit was supposed to be the easiest unit to offload as part of an overhaul quickly pulled together in response to rival BHP’s takeover attempt. A methane fire at its most profitable pit, though, makes a swift sale at a decent price much less likely. That will increase the pressure on CEO Duncan Wanblad.

The stars appeared to be aligned for finding a buyer for the business. Several similar deals have already been struck, including Glencore’s impending purchase of 77% of Teck Resources’ coking coal division valuing it at $9 billion. And much of what Anglo’s asset digs up is the highest-quality variety of the rock used in steelmaking. All else being equal, it could be worth at least $5 billion, or 4 times 2025 EBITDA, Breakingviews calculates. A successful deal would bolster Anglo and Wanblad ahead of trickier transactions for its South African platinum operations or De Beers, its struggling diamonds business.

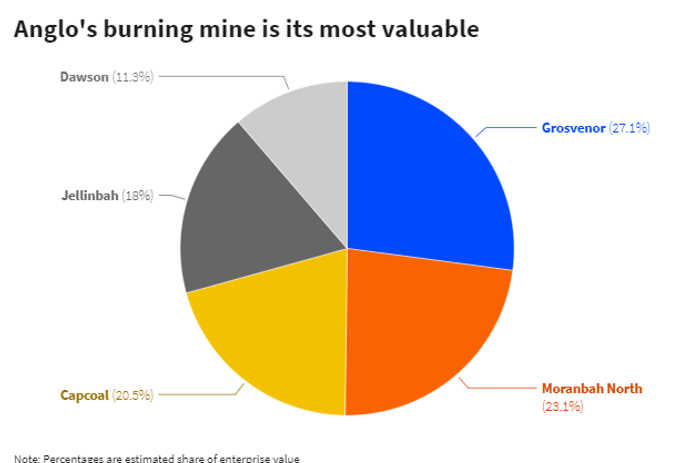

Trouble is, the Grosvenor mine where the fired started on Saturday is the jewel of the coking coal business, accounting for almost a third of its overall value, per Jefferies. It is likely to be closed for months once the flames are extinguished, Anglo has warned. That may be optimistic: it was offline for almost two years after a similar incident in 2020.

That wouldn’t close off all M&A options. Anglo could sell the remaining mines piecemeal, for instance. That would probably suit smaller local players like Whitehaven Coal and Stanmore Resources that might baulk at buying all of them. Or it could sell the whole caboodle to, say, BHP at a lower price but perhaps with some schmuck insurance in case operations pick up quicker than expected.

Neither is ideal for Wanblad, though. He needs to extract as much value from hiving off parts of Anglo, as soon as possible, to demonstrate that his overhaul could be better for shareholders than selling the entire company to BHP. If Plan A doesn’t work, he may have to consider alternative ways to demonstrate value, such as selling a stake in the group’s prized base metals business. Grosvenor’s underground conflagration is an inauspicious start, and makes future Plan Bs more likely.

Updated 22:00 IST, July 1st 2024