Published 14:01 IST, November 28th 2024

Starbucks coffee in China is better served to-go

Starbucks said on Nov. 21 that it was open to exploring strategic partnerships for its operations in China.

- Companies

- 3 min read

Double shot. Starbucks boss Brian Niccol faces conflicting challenges at opposite ends of the planet. Chinese consumers want a steady flow of new beverages, an approach that has caused trouble at U.S. stores. Focusing on the company’s home market and spinning off its second-biggest business would be the smart approach.

The newly installed chief executive’s cup runneth over with problems. Starbucks shares are down about 2% over the year, lagging the 32% gain in the S&P 500 Index. U.S. sales for the quarter ending Sept. 29 decreased 6% and the rate of decline was twice as fast in China. Niccol yanked the $115 billion coffee chain’s forecast for 2025 and vowed to get back to basics, a plan that includes reducing wait times for customers and trimming the mind-boggling menu of caffeinated and sugary concoctions.

China poses different questions. Consumer spending has weakened even as coffee became the country’s fastest-growing food and drink category. Java servings per capita increased by a multiple of 14 between 2008 to 2022, Bernstein analysts estimate.

As a result, competition boomed in the time since Starbucks opened its first store in Beijing 25 years ago. Local brewers including Luckin Coffee and Cotti Coffee are gathering steam, partly by catering to consumers who crave new flavors. Luckin, which has rebounded from a 2020 accounting scandal, touted 28 new drinks in the third quarter alone. Starbucks can’t keep up; its market share tumbled to 19% in 2023 from 39% in 2014, per research outfit Euromonitor.

Niccol comes from Chipotle Mexican Grill, the burrito maker with no business in China. Moreover, Starbucks badly missed its 2019 target of tripling revenue in the Middle Kingdom by 2024. So far, sales there are up just 5% despite having opened 84% more locations, to nearly 7,600, over the same span. The company says it’s considering strategic options for its China operation, including finding a local partner. Going further makes more sense.

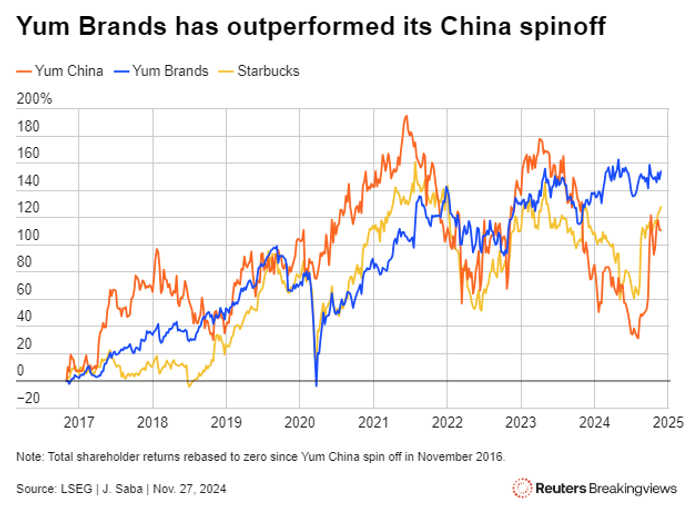

Yum Brands, owner of Pizza Hut and KFC chains, spun off its China division in 2016, a move that helped buoy the former parent’s shares. Assume the $3 billion of Starbucks China revenue in the year ending Sept. 29 generated an operating margin on par with its international division’s 14%, and it would mean $420 million of earnings before income and taxes. Using Yum China’s 2024 multiple of 16 times, per Visible Alpha, implies an enterprise value of nearly $7 billion. It’s an espresso-sized serving better sold to-go.

Context News

Starbucks said on Nov. 21 that it was open to exploring strategic partnerships for its operations in China, after Bloomberg had reported on Nov. 20 that the coffee chain was considering selling a stake in the business.

Updated 14:01 IST, November 28th 2024