Published 16:01 IST, August 22nd 2024

Pity the Paramount common shareholder

Media executive Edgar Bronfman Jr. has submitted a bid for National Amusements, the Redstone family investment vehicle that controls U.S. Paramount.

- Companies

- 3 min read

What else is on?. Paramount Global investors might have a chance to change the channel. Seagram liquor scion Edgar Bronfman Jr. has emerged to upstage technology heir David Ellison’s $8 billion bid for the U.S. media group. The key to victory is winning over controlling shareholder Shari Redstone - though other owners of voting shares may make their voices heard. Lost in the mix is the grim reality for investors without a vote.

Bronfman’s gate-crashing is the latest twist in a long saga. After potential deal partners like Warner Bros Discovery or buyout shop Apollo Global Management retreated, Ellison’s Skydance Media sealed a two-step merger in July. The transaction will see Skydance acquire Redstone’s National Amusements, which holds voting control, then merge with Paramount, which comprises a movie studio, broadcaster CBS, and cable networks like MTV.

That agreement included a “go-shop” provision, allowing other would-be buyers to engage. Bronfman has submitted an offer valuing NAI’s equity at $1.75 billion, matching Skydance. Like Ellison, he plans to pump $1.5 billion into Paramount’s balance sheet, perhaps in return for more equity. Behind him is a group of investors including “Superbabies” movie producer Steven Paul and “Mighty Ducks” actor Brock Pierce, now chairman of the Bitcoin Foundation.

This is likely just an opening gesture for Bronfman, who may raise his bid later. For now, though, his selling point is simplicity: his deal leaves Paramount as-is. That could pluck a fly from the ointment. After subbing out paid-off debt, both offers imply a per-share value of $27.55 for Redstone’s voting- and non-voting stock, ignoring a small theater chain NAI owns. Under Ellison’s bid, other holders of governance-entitled class A shares get $23 a piece. Investors like Mario Gabelli have blasted the discrepancy, and could push the matter into court.

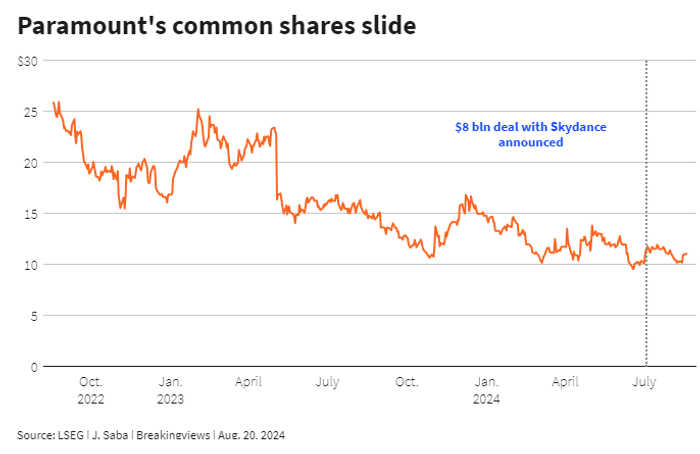

For holders of voiceless class B shares, the picture is mixed. Skydance offered $15 in cash - though only for roughly half their shares. To get it, Paramount will acquire Skydance at a whopping 13.9 times 2025 EBITDA, even after promised cost savings, more than double Paramount’s current multiple. There's no clear reason why the combined company would suddenly garner a generous valuation. Class B shares traded at around $11 before news of Bronfman’s bid broke.

They have fallen again, slightly, since then, after plummeting by a quarter since the start of the year and throughout various deal machinations as strategic challenges mount. For investors stuck in Paramount’s common shares, M&A channel-surfing can only do so much to solve them.

Context News

Media executive Edgar Bronfman Jr. has submitted a bid for National Amusements, the Redstone family investment vehicle that controls U.S. entertainment group Paramount Global, according to a Wall Street Journal report citing people familiar with the matter on Aug. 19. Bronfman, whose family once owned the Seagram liquor empire, is partnering with high-net-worth individuals including movie producer Steven Paul. NAI and Paramount had previously agreed to a deal with technology scion David Ellison and his film production firm Skydance Media. The $8 billion transaction struck in July includes merging Skydance with Paramount, the owner of broadcaster CBS, cable channels including MTV and movie studio Paramount Pictures, as well as acquiring NAI. That agreement contained a 45-day “go-shop,” during which the seller may engage other suitors, that ends on Aug. 21.

Updated 16:09 IST, August 22nd 2024