Published 15:10 IST, August 21st 2024

Luxury’s legal pain is new threat to valuations

Europe’s Amundi and other investors in LVMH want the French luxury giant to take more aggressive steps to monitor its suppliers’ treatment of workers.

- Companies

- 4 min read

Hell for leather. Not many products get more attractive when you know how the sausage is made. That may particularly be the case for Italian-made luxury goodies. Successive Milanese court rulings on troubled supply chains are a problem for a sector built on prestige and enigma – and may imply further hits to valuations.

A Milan court document in June asserted that subsidiaries of LVMH’s Christian Dior arm had subjected workers, some of whom were illegal immigrants, to excessively long hours. It also said that safety devices were removed from machinery to speed up operations. Meanwhile, prosecutors are investigating the supply chains of a dozen unnamed luxury brands.

Dior says it has cut ties with the suppliers in question. And while the court alleges that contractors charged the group as little as 53 euros ($57) for producing a handbag that would then go on to retail for 2,600 euros, it’s hardly news that luxury’s high-end brands command high-end prices. That’s one reason why LVMH made a 70% margin after deducting the cost of manufacturing in 2023.

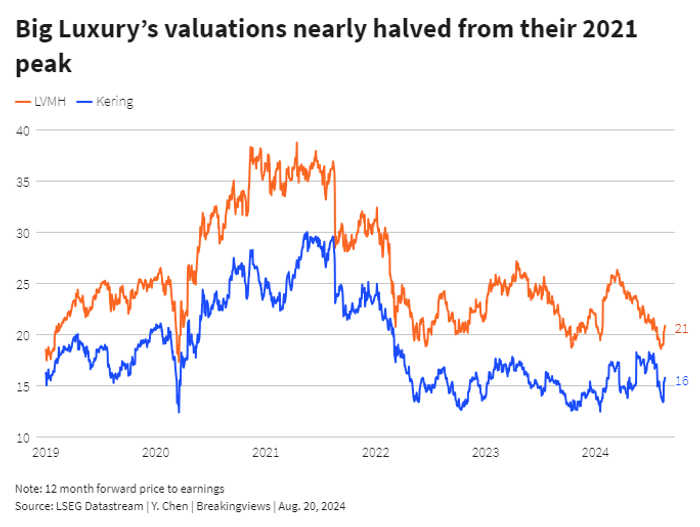

Still, luxury is in a tight spot. Struggling Chinese demand has seen the earnings multiples of LVMH and rival Kering fall sharply since 2021, and investors may increasingly wonder why barely more than 10% of major fashion brands even disclose their production volumes. This year’s Italian court rulings, which mean both Dior and Armani have had to see companies they own temporarily run by a court-appointed administrator, suggest a further headache: higher costs.

With prices for personal luxury goods in Europe up 50% since 2019, according to HSBC analysts, the average consumer might assume their product is made by well-paid experts in agreeable conditions. Yet the rise of fashion’s “see-now-buy-now” model, which demands shorter delivery between collections, rubs against this. It has arguably incentivised key players to cut production costs too far.

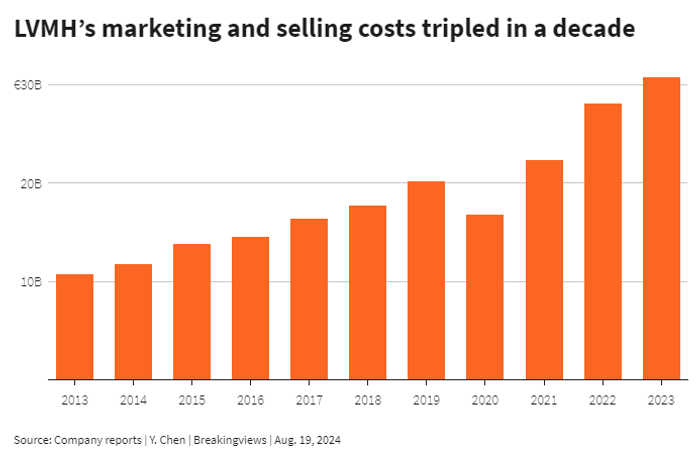

Many brands now roll out up to eight collections a year, compared to just two traditionally. Meanwhile, LVMH and Kering spend around 40% of their revenues on marketing to enhance brand visibility, via buying and renting prime real estate and paying influencers. The sector generally makes 40% of its products with suppliers it directly owns or controls, while another 30% comes via long-term partners that are deemed relatively “safe”. The remainder is where cost pressures may have encouraged some to turn a blind eye, according to one industry expert.

The saga is unlikely to see rich consumers ditch their fancy bags and garb any time soon. But if the negative legal rulings continue, LVMH and rivals will increasingly face a choice. They can invest more in their supply chains by getting more agreeable contractors and doing more unannounced audits, which will hit their margins. Or they can slow the conveyor belt of collections. Neither sounds great for their bottom lines – or their valuations.

Context News

Europe’s top asset manager Amundi and other investors in LVMH want the French luxury giant to take more aggressive steps to monitor its suppliers’ treatment of workers, after Italian prosecutors found sweatshop-like conditions at subcontractors for Christian Dior, one of the flagship brands within the LVMH group, Reuters reported on July 23. Italy’s Competition Authority (AGCM) said on July 17 it had started another investigation into fashion groups Armani and Dior over the alleged exploitation of workers at its suppliers. An Italian court in June had placed under judicial administration a company owned by the Italian unit of French fashion group Dior for subcontracting its production to Chinese companies that exploited workers. The court in Milan ordered a one-year administration for Manufacturers Dior Srl, according to the ruling seen by Reuters. Italian prosecutors said Dior paid Italian subcontractors as little as 53 euros ($57) per Dior bag assembled, selling the same style bag in shops for 2,600 euros while failing to implement basic safety requirements, according to court documents reviewed by Reuters. Dior said it has cut ties with the suppliers in question, that they were only partially assembling leather products and that reports of bags produced at “ridiculously low” costs were among “entirely false” information relayed by the media.

Updated 15:10 IST, August 21st 2024