Published 18:35 IST, August 26th 2024

KKR bank sale will gauge India’s fee-paying power

SoftBank-backed Indian food delivery giant Swiggy is targeting a valuation of around $15 billion for its upcoming IPO and plans to raise $1 billion.

- Companies

- 3 min read

Banking on it. KKR is gearing up to redeem a nine-year-old bet on India’s capital markets. The U.S. private equity firm is seeking buyers for its 63% stake in Avendus, the homegrown banker of choice for India's technology stars. The upstart firm has probably won a spot on Swiggy's up to $1.2 billion initial public offering, which would be one of its highest-profile yet. That makes it a good time for the buyout barons to offload the business after an earlier attempt to sell it stalled.

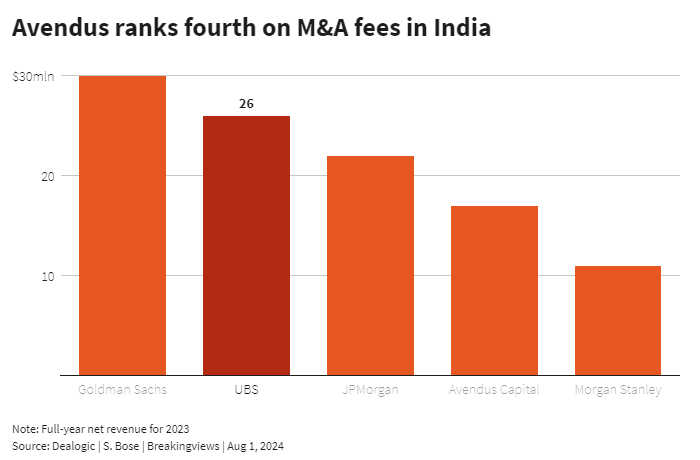

Founded in 1999 by CEO Gaurav Deepak with colleagues Ranu Vohra and Kaushal Aggarwal, Avendus focuses on deals worth up to $2 billion across public and private markets and also houses wealth, asset management, credit and institutional broking businesses. Avendus was the only Indian name among the top five fee earners from M&A in 2023, ranked fourth behind Goldman Sachs, UBS and JPMorgan, per Dealogic.

After a series of flops, India is enjoying a string of successful technology capital-markets deals. The resurgence of excitement about the sector ought to support Avendus' valuation, which could be as high as $450 million, Hindu Business Line reported in April, citing sources, adding that potential bidders include Japan's Mizuho Bank and Dubai-based NBD Emirates. Local sponsors are also circling, a person close to the situation told Reuters Breakingviews.

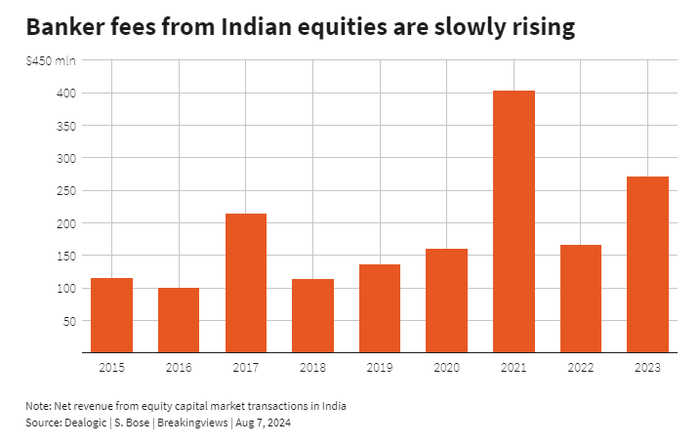

Any sale will test the punchiness of that possible price tag, which would be more than twice the valuation KKR paid in 2015. While Indian fees for investment banking have grown 35% to $650 million since the acquisition, according to Dealogic, and look poised to rise as private equity activity picks up, there are some 30 banks fighting for the spoils. What's more, while individual parts of Avendus' business, partly built up via acquisitions, look appealing, it's unclear if there is a single buyer for the whole thing.

For their part, global banks are unsure if improving fee trends will sustain and are opting to fly in executives from less busy locations like Hong Kong and Singapore to support the uptick in activity rather than raising local headcount. A rich valuation for Avendus would imply a more lucrative future for its peers too.

Context News

SoftBank-backed Indian food delivery giant Swiggy is targeting a valuation of around $15 billion for its upcoming initial public offering and plans to raise between $1 billion and $1.2 billion, Reuters reported on Aug. 23 citing three people familiar with the matter. Japan’s Mizuho Bank and Dubai-based NBD Emirates are likely to bid for KKR’s 63% stake in Avendus Capital, the Hindu Business Line newspaper reported in April, citing unnamed sources. A deal could value Avendus at up to $450 million, the report added. Avendus is a an Indian financial services boutique founded in 1999 by CEO Gaurav Deepak with colleagues Ranu Vohra and Kaushal Aggarwal. It houses investment banking, wealth, asset management, credit and institutional equities businesses.

Updated 18:35 IST, August 26th 2024