Published 14:20 IST, October 22nd 2024

India’s lenders face the end of lazy banking

A shift in consumer habits is changing the market and forcing banks to find new ways to turn a profit.

- Companies

- 3 min read

Crunch time. The days of lazy banking in India may be coming to an end. The country's lenders have historically made a larger chunk of their money from interest income than some other markets – just 30% came from other sources as of 2021, versus 40% for banks in the U.S. A deep pool of cheap deposits helped. But a shift in consumer habits is changing the market and forcing banks to find new ways to turn a profit.

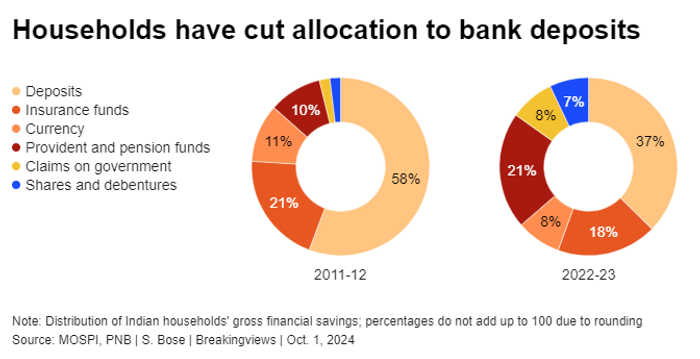

Indians, especially those under the age of 30 who make up two-fifths of equity investors, are putting more of their money into assets that can, when markets fare well, yield more than a savings account. Since the pandemic, physical assets like real estate and gold have become more popular. Financial holdings as a share of total household savings fell to 28.5% from 40% during the three years to end March 2023, according to an analysis of official data by state-backed Punjab National Bank.

The booming stock market is another lure: between June 2020 and March 2023, the share of the country's $3 trillion or so of household financial assets held in mutual funds rose from 6.6% to 8%; bank deposits' share, meanwhile, fell from 49% to 45%.

Granted, banks are still adding deposits at a decent clip of 12% year-on-year as of October, Reserve Bank of India data show. But that's also one percentage point lower than their loan growth. As a result, Indian banks' aggregate loan-to-deposit ratio touched a two-decade high of 80% in December, and was even above 100% for a handful of lenders including HDFC Bank during the three months to the end of June, per S&P Global.

But the change is starting to hit earnings in a number of ways. The reduction in financial firepower is contributing to a drop in loan growth, which declined to 13% in October from 20% in January, per source. Last month HDFC even sold $717 million-worth of mortgages, Bloomberg reported citing unnamed sources. That helped cut its loan-to-deposit ratio to 100% for the quarter ended September.

Some lenders are having to make more use of the wholesale markets to fund new loans - certificates of deposit issued this year up to Sept. 20 stood at $98 billion, 67% higher than the comparable period of 2023, per RBI data. Another response has been to offer higher interest rates to try to keep savers from pulling out more money.

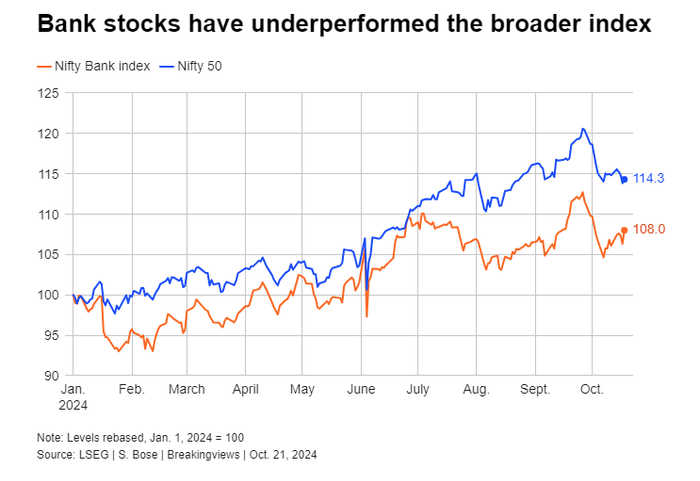

That all hurts banks' net interest margins. At top lender State Bank of India, that metric declined by 11 basis points to 3.22% in the 12 months to the end of June. HDFC Bank 's NIM is 64 basis points lower than when it merged with its parent last year.

Longer term, the answer is to adapt the business model. Making loan sales, whether into the securitisation market or directly to investors, a core part of the business could generate some extra fees. Bulking up in other ways of managing people's savings could provide more juice, from cross-selling insurance and mutual funds to building wealth management businesses. Kotak Mahindra , for instance, now caters to more than half of India’s top 100 rich families.

It'll require shaking up how banks do business. But the alternative is to watch earnings shrink while hoping for a stock market crash that persuades everyone to put their money back into deposits.

Updated 14:20 IST, October 22nd 2024