Published 17:22 IST, July 31st 2024

HSBC’s growth engine has insufficient horsepower

HSBC announced a $3 billion share buyback on July 31. The London-listed bank also said that its return on tangible equity would be in the “mid-teens” in 2025.

- Companies

- 3 min read

Flat fee. Noel Quinn, the outgoing boss of $167 billion HSBC, has spent the last five years focusing on supposedly growthy businesses like Asian wealth management. Yet half-year results show a bank struggling with falling net interest income. For incoming CEO Georges Elhedery, the solution requires luck and investor patience.

HSBC’s top line is full of noise, such as the effects of marking to market the many securities it carries at fair value. But one number stands out from the half-year statement, released on Wednesday. Net interest income, or the money the lender gets from bonds and loans minus the cost of liabilities like deposits, fell to $16.9 billion compared with $18.3 billion in the first six months of 2023. Disposals are one reason, but HSBC is also paying away more of the benefits from higher rates to customers. The risk is that falling rates add another problem later this year, by denting the bank’s income from holding government bonds and central-bank reserves.

Elhedery, who takes over in September, can hedge this risk. HSBC has used derivatives to lock in yields and reduce the hit from falling rates. As of June 30, a 1 percentage point fall across the curve would reduce net interest income by $2.7 billion, it says, compared with $3.4 billion on Dec. 31. But hedging doesn’t change the group’s fundamental growth prospects.

For that, Elhedery will look to wealth management and wholesale transaction banking. The wealth unit had some good news on Wednesday: revenue from private banking, asset management, life insurance and selling investment products rose 9% year-on-year in the second quarter, creating extra income of almost $200 million.

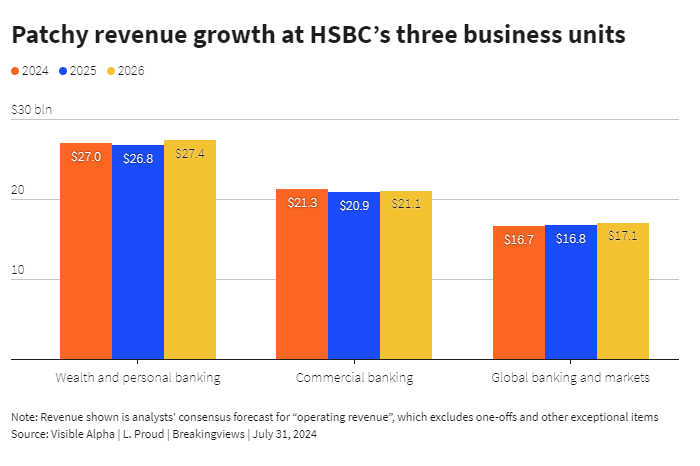

But that was more than offset by a fall in retail banking, a much bigger component of HSBC’s wealth and personal banking arm. Falling net interest income meant the retail bit saw revenue fall by over $400 million year-on-year in the most recent quarter. Currency swings and other one-offs may have hurt, but it’s clear that the division that houses HSBC’s wealth unit is not shooting the lights out. Nor is transaction banking, which includes payments services and foreign exchange, which barely grew in the first half.

Elhedery can juice his wealth contribution by investing more in advisers and buying rivals. He could also fund the unit with more equity capital, of which HSBC has plenty, allowing his private bankers to win clients by boosting lending. But a Chinese economic funk and high Western rates, which encourage rich customers to hold cash rather than invest, have restricted wealth growth. As long as those trends persist, it’s hard to see HSBC having a convincing growth story — or trading much above tangible book value.

Context News

HSBC announced a $3 billion share buyback on July 31. The London-listed bank also said that its return on tangible equity would be in the “mid-teens” in 2025, matching its estimate for 2024. The lender’s shares were up 3.5% to 701 pence as of 0804 GMT on July 31.

Updated 17:22 IST, July 31st 2024