Published 16:48 IST, November 16th 2024

Charlie Ergen drowns in two kinds of debt

DirecTV said on Nov. 12 it would terminate its merger with rival satellite pay-TV provider EchoStar’s Dish by a Nov. 22 deadline.

- Companies

- 3 min read

Bond villain. Charlie Ergen has thrown too many sharp elbows. The founder of satellite and pay-TV company EchoStar risks losing a deal to merge subsidiary Dish with rival DirecTV after bondholders balked at measly terms. Aside from his steep financial debt, years of wheeling and dealing bring the burden of exhausting creditors’ patience. It’s time to come to the table.

The transaction to offload TV provider Dish is messy. DirecTV agreed in September to buy its challenged peer for all of $1, as well taking on about $10 billion in debt. Catch is, even that’s too expensive. The deal requires Dish creditors to collectively accept a 15% haircut on the assumed bonds. On Tuesday, that gambit failed.

The clock is now ticking. DirecTV has a window lasting until Nov. 22 to terminate the deal. The company backed by buyout shop TPG says it stands ready to do so.

This isn’t Ergen’s first creditor fight. Bondholders in April sued over a series of actions tied to the 2023 merger of Dish and EchoStar, claiming that the companies shifted assets worth some $9 billion from Dish to a subsidiary beyond lenders’ grasp, among other moves. It’s all ultimately the consequence of Ergen using his businesses to fund a high-stakes gamble. Staring down traditional television’s inevitable decline, he went on a multi-year spending spree, forking over roughly $25 billion to accrue wireless airwaves. Now, he’s trying to use them to become a cellphone carrier.

This wildly expensive ploy has vexed shareholders and creditors alike. The group of bondholders fighting the DirecTV deal are calling time. Should the merger fail, they say the blame lies with Ergen.

He does, in fact, have options to appease them. Under the merger, EchoStar should glean $1.5 billion of cashflow from Dish through 2025, part of which could be forked over. Alternatively, he could offer a secure claim on his airwaves.

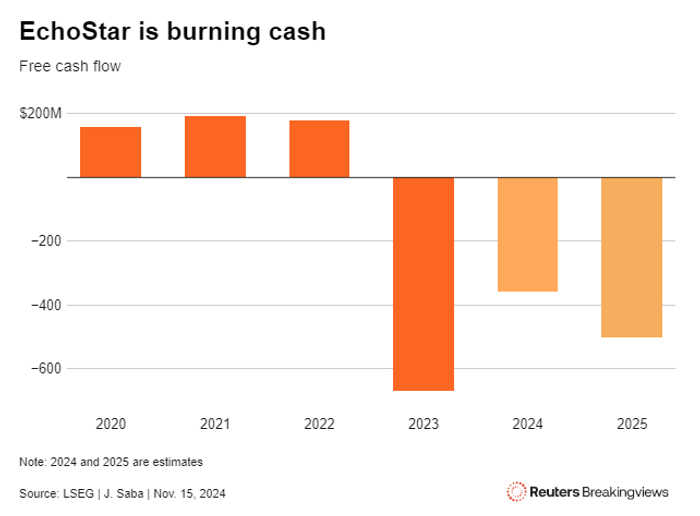

Of course, the temptation might be to just keep biding time. TPG agreed to float EchoStar a $2.5 billion loan to pay off debts due in November, staving off total collapse. Yet the company is simply over-levered. Its debt stood at nearly $22 billion prior to the deal’s unveiling, some 12 times estimated 2024 EBITDA, according to LSEG. There is other financial juggling happening that could provide some breathing room, but the company also faces regulatory deadlines for its capital-intensive wireless buildout. Ergen has kept ahead of his financial debts thus far. It’s the karmic debt he’s built up with creditors that could haunt him.

Context News

DirecTV said on Nov. 12 it would terminate its merger with rival satellite pay-TV provider EchoStar’s Dish by a Nov. 22 deadline after a group of bondholders failed to agree to the deal earlier in the week.

Under the terms of the agreement announced on Sept. 30, DirecTV will buy EchoStar’s TV assets for $1 plus the assumption of Dish’s net debt. As part of the transaction, Dish and DirecTV have commenced an exchange offer for $9.75 billion of debt. The deal is contingent on holders of that debt accepting a haircut of roughly $1.5 billion on their principal.

Updated 16:48 IST, November 16th 2024