Published 18:37 IST, November 6th 2024

Burberry buyer would need steel-plated trench coat

Fashion website Miss Tweed reported on Nov. 3 that Italy’s Moncler was considering a bid for Burberry, citing unnamed sources.

- Companies

- 3 min read

Heavy weather. As one of the few global luxury groups without a controlling family shareholder, it’s little surprise that Britain’s 3-billion-pound ($3.9 billion) Burberry is perennially the subject of takeover talk. A sliding share price and CEO change this year adds to the M&A case. Would-be buyers, however, will require deep pockets and buckets of patience.

Shares in the trench coat maker rose 5% on Monday after an independent luxury-news website reported that Italy’s Moncler was eyeing a bid, citing unnamed industry sources. The purveyor of posh puffer jackets, which is backed by French behemoth LVMH, said it would not comment on “unsubstantiated rumours”. By Tuesday, Burberry shares had lost all the previous day’s gains.

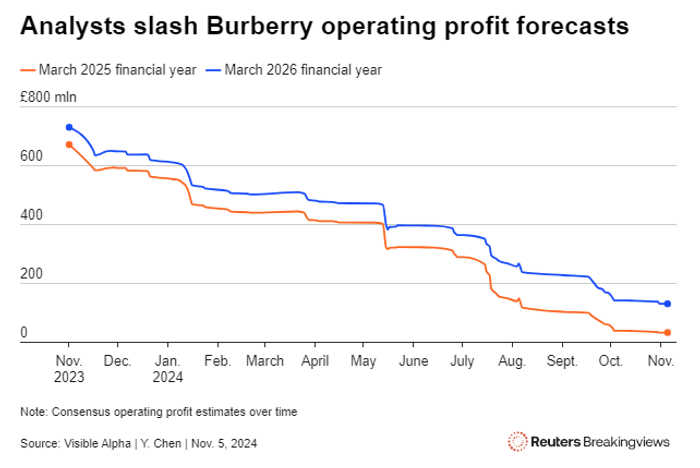

One problem for possible suitors like Moncler, LVMH, Coach owner Tapestry or Switzerland’s Richemont is the target’s sliding operating profit, which implies a poor return on invested capital. Assume that any buyer paid a 30% equity premium. The overall outlay, including debt, would be 5 billion pounds. In return, the new owner would get Burberry’s forecast operating profit of 262 million pounds after three years, using Visible Alpha consensus data.

If the buyer could also slash a quarter of the UK group’s sales and distribution costs, which is the standard for industry M&A according to one analyst, the cost savings would be 282 million pounds. Added to the operating profit, and taxed at 28%, the overall reward would be 391 million pounds in the financial year ending in March 2028, implying an 8% return. The industry’s weighted average cost of capital is more like 9.5%, Barclays analysts reckon.

Those calculations assume that new CEO Joshua Schulman can live up to analysts’ expectations, which is hardly a given since brokers have continually had to slash their forecasts over the past year. The former Michael Kors and Coach executive faces the Herculean task of turning around a once aspirational brand that is now increasingly associated with knockdown prices. The company has two sorts of stores: around 400 flagship sites selling products like 2,000-pound trench coats at full value, and over 50 outlets that traditionally hawk older designs at a discount. The latter type, which appeal to the mass market and account for 30% of sales according to HSBC estimates, bring in extra revenue but arguably dilute the brand’s exclusivity over time.

Any new owner may therefore have to invest in marketing and new designs to regain some cachet. That’s risky and time consuming, especially in a sector downturn. Based on analysts’ current operating profit forecasts, using Visible Alpha data, the return on investment would only surpass Burberry’s 9.5% cost of capital in 2030, assuming the same 282 million pounds of M&A cost savings. In other words, there’s an argument to be made for buying Burberry, but the payback would take a long time.

Context News

Fashion website Miss Tweed reported on Nov. 3 that Italy’s Moncler was considering a bid for Burberry, citing unnamed sources. Moncler, known for its puffer jackets, said it would not comment on “unsubstantiated rumours” of a possible deal between the two luxury brands. Burberry told Reuters it does not comment on speculation. Burberry shares closed 4.8% higher on Nov. 4, but slipped back subsequently. As of 0849 GMT on Nov. 6, they traded 2.7% above the Nov. 1 closing level.

Updated 18:37 IST, November 6th 2024