Published 16:26 IST, November 17th 2024

ASML’s sunny AI destination has a cloudy roadmap

Computer chip equipment maker ASML on Nov. 14 said the company’s sales growth would average 8% to 14% over the coming five years.

- Companies

- 3 min read

Short circuit. ASML is a major beneficiary of the artificial intelligence-driven boom. After all, the $270 billion Dutch group makes machines producing advanced chips which power everything from Apple’s smartphones to Nvidia’s graphics processing units. But geopolitics, problems with its chip manufacturer customers and weak smartphone demand make the journey towards reaping the rewards as complicated as its machines.

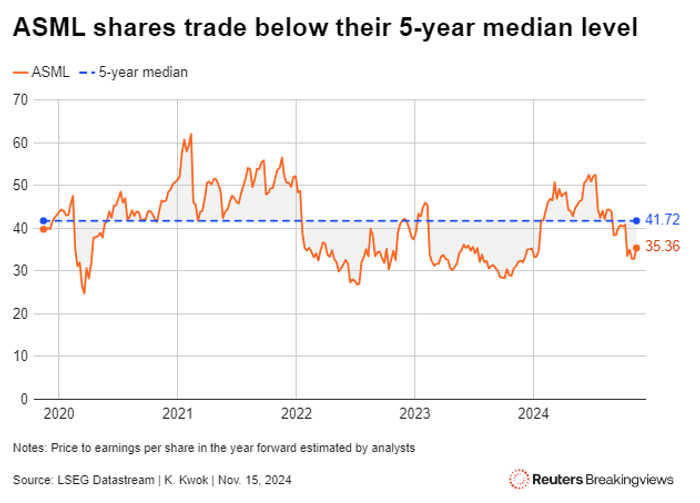

ASML boss Christophe Fouquet has had a bumpy 2024. The group’s shares are trading 5% below their level at the start of the year, following a disappointing set of third-quarter results in October. Investors saw the company cut 2025 revenue guidance because consumers are buying fewer smartphones and computers, and chip customers like U.S. group Intel have hit trouble. ASML now trades at 35 times its next year earnings expected by analysts using LSEG data, versus the stock’s five-year median of 42 times.

Fouquet’s sunny outlook at Thursday’s investor day eases some of these concerns. He said growing AI demand for data centres would help boost global chip sales to over $1 trillion by 2030, which represents an annual 9% growth rate in the semiconductor market. As a result, he projected that ASML sales in 2030 would range from 44 billion euros to 60 billion euros, in line with a previous forecast set in 2022. The company also forecast a gross margin of between approximately 56% and 60% in 2030, up from the 50.6% estimated for this year.

The catch is that Fouquet gave no details about near-term performance up to 2026. Investors may be able to continue betting on AI-driven demand expectations for servers, data centres and storage semiconductors, which should boost the use of ASML’s highest-tech extreme ultraviolet (EUV) lithography machines. But ASML also raised concern that the lack of efficient energy to train the next AI models could set a ceiling on the current AI boom. The company lowered its expectations of demand in smartphones and consumer electronics, dampening predictions that AI can power the growth of smartphones by 2030.

Donald Trump’s election as U.S. president adds further uncertainty to the mix. China may speed up purchases of ASML’s lower-tech machines in the short term to guard against the Trump administration imposing tighter restrictions on exports of U.S. components. It’s even possible that the U.S. strong-arms ASML into a block on selling machines to China completely. Given Intel and Korean chip player Samsung’s troubles mean they’re unlikely to pick up any slack, ASML’s near-term future remains cloudy – however sunny the picture looks further out.

Context News

Computer chip equipment maker ASML on Nov. 14 said the company’s sales growth would average 8% to 14% over the coming five years.

The company forecast revenue of 44 billion euros to 60 billion euros ($46 billion to $63 billion) by 2030, and gross margins of between 56% and 60%, unchanged from previous long-term guidance issued in 2022.

The company also expects the global chip market will grow 9% annually from 2025, passing the $1 trillion mark around 2030, with AI chips growing rapidly to make up 40% of the total.

In ASML’s third-quarter earnings on Oct. 15, the company forecast lower 2025 sales and bookings due to sustained weakness in parts of the semiconductor market, pushing the group’s shares down 16%, their biggest one-day drop since 1998.

ASML’s shares dropped 2.4% to 655.30 euros at 0844 GMT in Amsterdam on Nov. 15.

Updated 16:26 IST, November 17th 2024